Massive boxship orderbook delivering into record ageing fleet

Container shipping is entering a once in a generation fleet renewal with a record orderbook delivering into a fleet that is now primed for much demolition with shipping organisation BIMCO reporting today boxships now have reached the highest average age on record.

“Container ships have reached their highest average age yet at 14.2 years, the highest average age of the three main shipping sectors. The dry bulk fleet has an average age of 11.9 years whereas tankers on average are 12.8 years old,” commented Niels Rasmussen, chief shipping analyst at BIMCO.

Currently, 21% of ships in the container fleet are now older than 20 years and thereby prime candidates for recycling in the coming years, according to BIMCO. Of the ships older than 20 years, the size segments 0-2,999 teu and 3,000-5,999 teu contribute 76% and 16% respectively, highlighting that fleet renewal in the past years has been focused on the post-panamax segments.

“Perhaps more importantly, nearly 70% of all containerships are over 10 years old. All ships built according to slow steaming principles so far, have been delivered within the last 10 years, allowing for lower energy consumption per container carried,” said Rasmussen.

Data from Clarksons Research shows there are 902 containerships on order, an all-time high, equivalent to 25% of the extant fleet.

Despite the significant downturn experienced in container freight rates during the past 15 months, recycling of ships during 2023 has remained low compared with the past 10 years. In the first nine months, 57 ships have been recycled compared to 81 on average during the previous 10 years.

The urge to scrap will likely grow as container shipping faces many quarters of red ink coming up and with Clarksons data showing that 2.5% of the fleet today is already above 25 years old.

Container carriers are forecast to report a combined loss of $15bn in 2024, according to the latest Container Market Annual Review and Forecast from UK consultants Drewry.

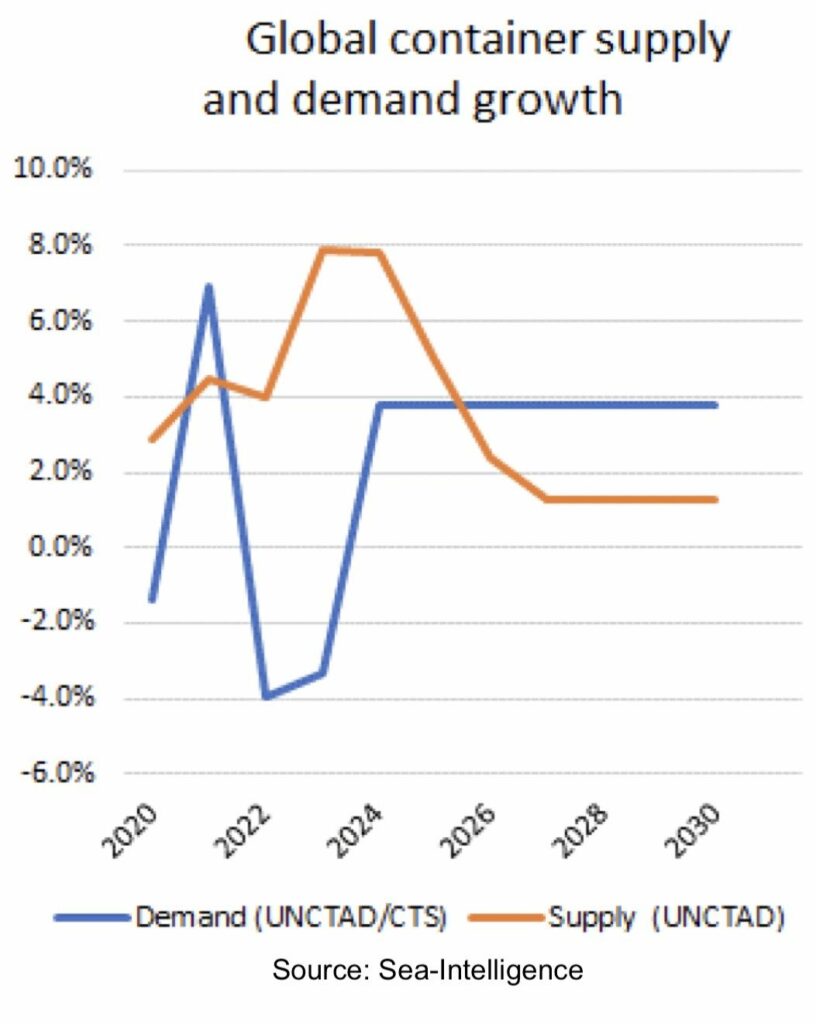

Drewry predicts it will not be until 2026 that fleet and demand growth will be in sync.

“Based on our long-term supply-demand projections, carriers face a relentless challenge to achieve equilibrium over the next few years,” said Simon Heaney, Drewry’s senior manager of container research.

Analysts at Sea-Intelligence, meanwhile, have suggested that 2026 is too optimistic.

The year 2028 is the earliest for overcapacity absorption of all the new capacity flowing out of yards in Asia, according to analysis from Sea-Intelligence, which is in line with the play-out after the global financial crisis.

Describing the current cycle, Sea-Intelligence noted in its latest weekly report: “This would imply an eight-year span, which is in essence the same as the cycle from the financial crisis until balance was again restored in 2017.”