MSC launches $700m takeover bid for Gram Car Carriers

Liner giant Mediterranean Shipping Co (MSC) has moved to take over Gram Car Carriers (GCC) in a potential deal that values the world’s third-largest car carrier tonnage provider at about NOK7.6bn ($700m).

The offer of NOK263.69 per share in cash has been made via MSC subsidiary Shipping Agencies Services (SAS) and represents a premium of 28.3% to GCC’s stock price on April 23.

The board of the Oslo-listed GCC, which reported a revenue backlog of $794m at the end of the first quarter, has unanimously resolved to recommend the shareholders to accept the offer.

Shareholders, including members of the board and the executive management, who collectively own about 55.85% of the company’s issued and outstanding share capital, have on certain terms and conditions undertaken to accept the offer.

Gram’s largest shareholders F. Laeisz, AL Maritime, Glenrinnes Farms, HM Gram Investment and HM Gram Enterprises, which in aggregate hold around 54.54% of the shares, have given irrevocable undertakings to accept the deal.

“Today’s voluntary offer by one of the world’s leading maritime groups, is a validation of the unique position GCC has built as a leading car shipping tonnage provider and the long-term commitment put in by the entire team. The board is satisfied that the offer represents a fair valuation of GCC, as is also reflected in the recommendation to shareholders to accept the offer,” said GCC chairman Ivar Myklebust.

The acceptance period will start at the latest on May 31 and remain open for no less than 20 days. The deal is expected to close during the third quarter or, at the latest in the fourth quarter of 2024.

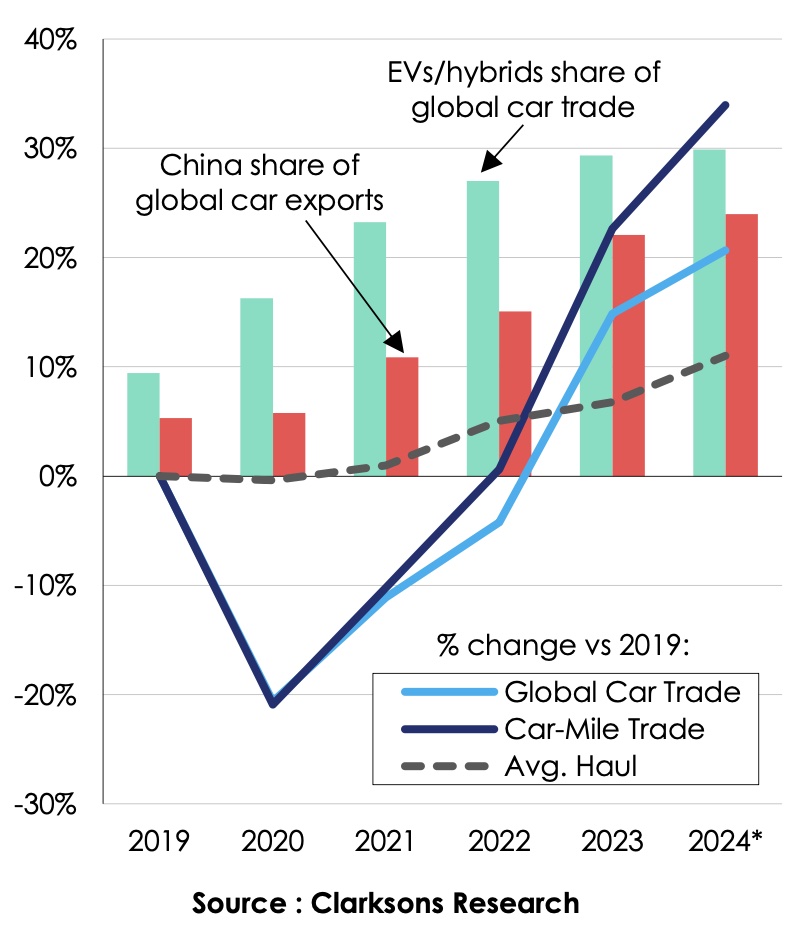

“Car carriers have been amongst shipping’s hottest sectors in recent years,” stated a recent report from Clarksons Research.

Seaborne car trade has been on a remarkable run in recent years, rebounding by 38% across 2021-23 after a 20% Covid-driven decline in 2020. 2023’s estimated deep sea trade total of 24.2m cars stood 15% above pre-covid levels, well ahead of total global seaborne trade more broadly (+2.3%).

The move by the world’s largest containerline on Gram’s fleet of 18 owned car carriers presents business elements that are familiar to the MSC Group, which already has two 6,700 ceu ships and transports regularly an important volume of cars in containers, the Oslo filing explaining the offer said.

“GCC…and its management and operational know-how will be of great value to the MSC Group going forward, while, at the same time, the contemplated transaction will enable the Group and its customers to benefit from the global logistics expertise and footprint of the MSC Group.”

Other global liners such as CMA CGM and HMM have also moved to expand their offerings in the car carrier trades via either chartered in or new tonnage.

Cash-rich MSC has invested in many industries outside of its core businesses of cruise and containers in the last couple of years including in aviation, rail, media and logistics.