San Francisco Bay Blues: Oakland suffering the most from dockworker dispute

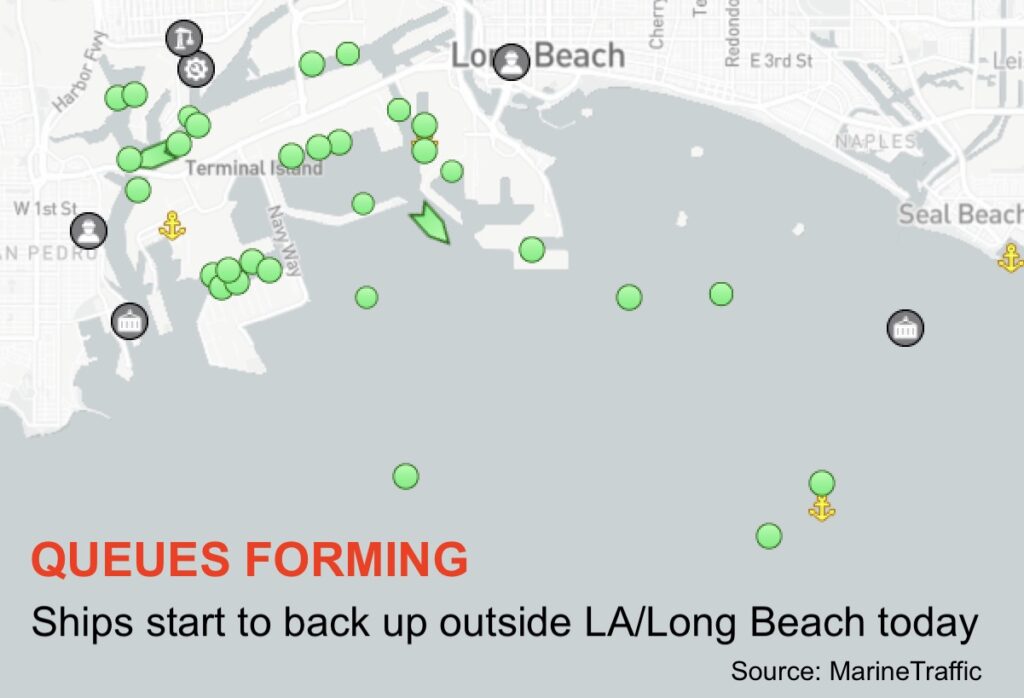

Ships backing up at Californian anchorages are now becoming clear for all supply chain specialists to see as reports grow of boxships suffering delays entering and leaving the ports of Oakland, Long Beach and Los Angeles on the back of industrial action taken by dockworkers over the past week.

The situation is most acute in the waters of San Francisco Bay where the number of containerships queueing up for berths to open at the port of Oakland has now hit double figures.

Some ships moored at the port are taking far longer to leave than in normal operating times. Both the 13,892 teu YM Worth and the 8,000 teu Ever Legend have been at Oakland quaysides since June 2, for instance.

Further south, the situation is also worsening at the San Pedro Ports Complex with many ships delayed from entering and leaving. The 10,020 teu COSCO Oceania, for instance, has been stuck at a terminal in Long Beach since June 1, the COSCO Portugal also marooned nearby since May 31, while the Maersk Evora has been in situ in Los Angeles since May 29, and the YM Unicorn has been parked nearby since May 31.

There is some good news, however, for worried shippers who have recent memories of covid-inspired queues or the backlog of vessels that built in the last major period of dockworker industrial action back in 2015.

Railroad operator Union Pacific has restarted shifting empty boxes from inland locations to Los Angeles and Long Beach, having earlier put such shipments on hold over fears container yards at the ports were getting overrun.

US west coast ports have been suffering sporadic labour walk-outs at terminals up and down the coastline as negotiations with employers over new contracts have taken more than 13 months to conclude. Today and tomorrow will also see union members vote in Canada on whether to push ahead with a 72-hour strike at the ports of Vancouver and Port Rupert.

Latest date from Oslo-based freight rate platform Xeneta shows there has been no discernible uptick in rates from Asia to the US west coast this week leading Peter Sand, the company’s chief analyst, to tell Splash this morning: “This is telling me that while the inbound pressure is on, shippers are currently keeping their cool.”

Drewry’s weekly spot index, published today, showed rates have risen 6.4% on the Shanghai – Los Angeles route to $1,896 per feu, the highest numbers on this tradelane since late March.

In what has been a challenging week for supply chain planners, container terminals at the Port of New York and New Jersey, the busiest port on the US east coast, closed early Wednesday as thick smoke from Canadian wildfires engulfed the region.