Tanker fundamentals see investors pile in

Of golden ages and structural bull markets, shipping analysts are falling over themselves to extend hyperboles for tanker prospects.

The latest bullish report comes from Castor Group in the US, who forecasts vessel supply destruction for large crude tankers to be among the largest ever recorded in the coming few years, second only to the period following the re-opening of the Suez Canal in 1976.

“Obsolete tonnage will not be replaced in the foreseeable future by new buildings as the last few years’ skyrocketing costs and the lack of feasible alternative fuel technologies have caused the longest hiatus of newbuilding orders in almost 40 years,” Castor analysts noted.

A structural bull market lasts for a long time and provides for a time tested and profitable investment strategy

Castor data suggests that at the end of 2025, almost 25% of current aframax supply will be lost. Moreover, in only one year’s time, the VLCC sector is expected to shed 6% of its vessel supply, while the Suezmax sector will lose almost 9% of its tonnage capacity.

The Ukrainian war has caused significant changes in trade patterns in all three crude sectors, resulting in large increases in vessel demand. Since early June, volumes in the VLCC sector are ahead 33.3% and actual vessel demand has risen 30%, according to Castor. The fleet has also become significantly more geographically fractured which in conjunction with higher vessel demand, have pushed earnings almost $35,000 per day higher. During the same time, global suezmax vessel demand has jumped 20% with increases recorded in most export regions. Geographical fragmentation of the fleet has also provided support for higher earnings. Aframax vessel demand rose almost 24% during the same time with the vast majority of increases recorded in the West.

Tankers, Castor argued, are in the early stages of a structural bull market.

“While no bull market follows a straight linear path higher, a structural bull market lasts for a long time and provides for a time tested and profitable investment strategy; buy dips,” Castor advised.

In a widely read recent report entitled ‘Medium-term tanker fleet fundamentals to support a golden age’, brokers BRS looked at the low tanker orderbook, something it said was down to a combination of a tanker market in the doldrums, technological uncertainty and high shipbuilding prices.

“It is becoming extremely difficult for an owner to today place a tanker order at a shipyard with a proven track record for building tankers, for delivery before 4Q25,” BRS stated, predicting that this should see the VLCC fleet contract by 1-2% per annum over 2024-26.

Joakim Hannisdahl, who oversees the Cleaves Shipping Fund, wrote earlier this week of the start of the long-awaited cyclical expansion in oil tankers.

“We now see a dual positive effect on tanker demand due to implications from the invasion and from a general improvement in global oil supply,” Hannisdahl wrote, going on to discuss the very low orderbook.

Norwegian bank DNB has also turned bullish. In a report issued at the end of last month, DNB stated it saw considerable upside potential for many of the tanker stocks it covers.

“As the earnings inflection point appears to be nearing, we have upgraded most of them to buy,” DNB stated.

“We find all-time low orderbook-to-fleet ratios of 5.1% for crude tankers and 4.7% for product tankers, versus high average fleet ages of 11.3 years and 12.1 years, respectively. Against a tightening regulatory backdrop and higher fuel costs, this should offset part of the already limited deliveries and we forecast 2.9% average supply growth for crude tankers and 3.1% for product for 2022–2025e,” the DNB report forecasted.

DNB’s rate forecasts have been substantially upgraded and now stand at $41,400 a day for 2023, $54,400 a day for 2024 and $60,700 a day for 2025 for VLCCs and $23,600 a day, $26,500 a day and $26,800 a day for modern MRs, respectively.

Based on these rate estimates, DNB sees a 13% upside potential to average secondhand VLCC values one year forward, with a five-year old VLCC valued at $93m versus today’s quote of $82m. For MRs, DNB sees 18% upside potential on average, and values a five-year old at $40m one year forward – 20% above the $33.5m current broker quote.

VLCC newbuilding prices have increased from $88.4m in January 2021, to $119m, an increase of 35%, according to the New York-based tanker broker Poten & Partners. Secondhand prices have shown a similar trend. The last time asset prices increased like that was during the tanker supercycle from 2004 to 2008.

So far, newbuilding prices have increased faster than secondhand values in the current cycle. However, Poten argued in its most recent weekly report that this will likely change if rates continue to recover.

Talking changing tanker prospects yesterday was Hugo De Stoop, the boss of Euronav, one of the world’s largest tanker players. Unveiling Q2 results, De Stoop discussed the ongoing counter-seasonal recovery in the markets

“Recent trading data points – such as China’s return to crude procurement, vessel supply metrics and improved oil supply – have underpinned a recovery in the freight markets which is unusual for the season. Euronav is ideally placed to benefit from the shorter-term cyclical recovery but also the robust medium-term fundamentals of our market,” De Stoop said.

The counter-seasonal run comes despite falling demand in key market, the US.

“Demand destruction is by now a reality in much of the Western world, most visibly witnessed in the US with the Energy Information Administration releasing figures showing implied demand for gasoline plunging by 7% last week to just over 8.5m barrels per day, around 11% under the five-year average for this time of the year, even as prices at the pump are coming off fast,” a markets update from Norwegian broker Lorentzen & Co today stated.

However, there are wide differences between the Western Hemisphere and the European continent, propping up the tanker markets, both for crude and products.

“While the US is seeing plenty of extra crude as a result of refineries accepting lesser volumes amidst higher domestic production and releases of the Strategic Petroleum Reserves, Europe is more hungry than ever for supplies, not only for crude but also for distillates,” analysts at Lorentzen & Co pointed out.

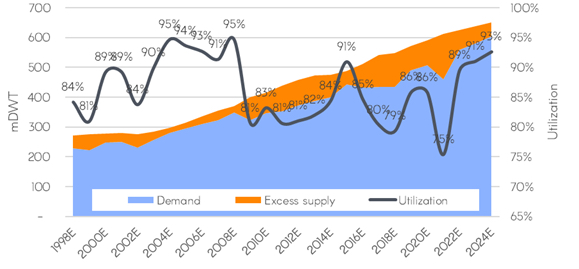

Oil tanker supply/demand and fleet utilisation