Thousands of ships targeted for engine retrofits

Engine manufacturers are eyeing a huge slice of new business as owners recognise the possibilities of retrofits.

This week’s news that Maersk will retrofit one of its ships to methanol dual-fuel has got others reassessing their assets.

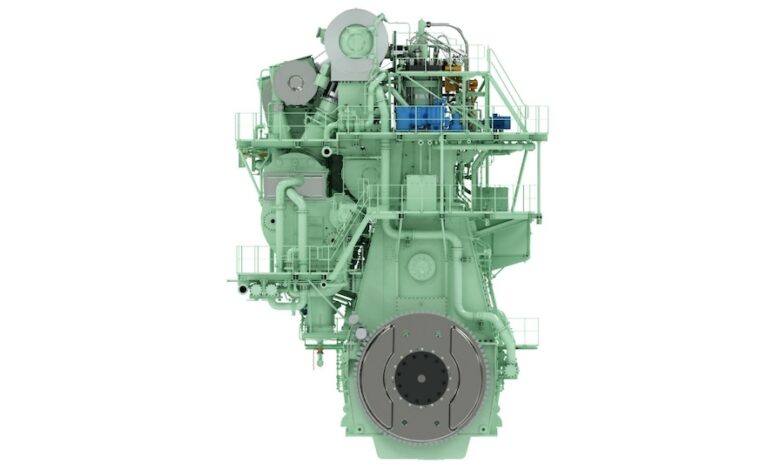

The Copenhagen-based shipping and logistics group has selected German engine maker MAN Energy Solutions for the first engine conversion set to take place in the middle of 2024.

Detailed engineering has already started, and retrofitting the ship will also include, for instance, new fuel tanks, a fuel preparation room, and a fuel supply system.

“With this initiative, we wish to pave the way for future scalable retrofit programs in the industry and thereby accelerate the transition from fossil fuels to green fuels. Ultimately, we want to demonstrate that methanol retrofits can be a viable alternative to newbuildings,” said Leonardo Sonzio, head of fleet management and technology at Maersk.

A spokesperson for MAN told Splash today: “The retrofit market potential is huge.”

MAN estimates that 2,800 vessels with MAN two- and four stroke engines are eligible for conversion today and could save more than 97m tons of carbon dioxide (CO2) emissions annually when run on green fuels.

Contacted by Splash today, Dr Tristan Smith, associate professor in energy and shipping at UCL Energy Institute, argued the potential for engine retrofits among today’s global merchant fleet was “thousands of ships per year”.

Smith and his team have a paper at the International Maritime Organization on the matter discussing the costs involved compared to using more expensive drop-in fuels or scrapping.

“Retrofit is highly attractive,” Smith said, adding that his team tested the shipyard capacity for the rates of retrofit and found there to be no constraints.

Singapore-based owner Berge Bulk recently teamed up with class society ABS to explore the possibility of retrofitting the 300 m-long heavy fuel oil-powered newcastlemax bulker Berge Mauna Kea.

The 210,000 dwt ship is currently under construction at the Nihon Shipyard in Japan, with delivery expected in mid-2024. The joint six-month study will see the duo collaborate on a broad range of subjects from the availability of methanol fuel and practicalities of bunkering to the review of technical and economic aspects of the conversion.

“Existing technologies are available to convert methanol for use in our engines, whilst there are also procedures for bunkering of methanol and its use onboard,” commented Berge Bulk’s CEO James Marshall.

The cost of retrofitting, including the fuel storage and fuel supply system, ranges between $5m and $15m depending on the type of fuel and, as a rule of thumb, this should not exceed 25% of the newbuild cost of a ship to be economically viable, according to advice from DNV.

Pouring some cold water on the potential market for retrofits, DNV’s business development manager Christos Chryssakis has estimated that less than 10% of the existing global merchant fleet are theoretic candidates for retrofitting.

“We don’t see this happening today due to costs and uncertainties but think that this could be achieved over the next five to 10 years, particularly after 2030 when regulations really start biting,” Chryssakis said when interviewed for an article on the DNV website.

Other companies already pursuing engine retrofits include Norwegian shipowner Eidesvik and Japanese giant Nippon Yusen Kaisha.

Analysis from Wärtsilä shows that without modification, more than 80% of the global merchant fleet could fall into the lowest Carbon Intensity Indicator (CII) rating by 2030.