Dry bulk owners pop the bubbly but will the bubble burst in 2024?

The market has surprised to the upside with technical factors to the fore, but fleet supply and a gloomy macro outlook are on the horizon, writes Plamen Natzkoff, head of dry bulk freight and commodities research at MSI.

‘Tis the season for good cheer in the dry bulk market, as entrenched disappointment over lacklustre earnings has finally given way to a far more positive mood. The month of November saw sharp improvements in freight markets, led by the Baltic Capesize Index which almost trebled over the month and accelerated to a peak of close to $55,000/day in mid-December, a level not seen since October 2021.

Other dry bulk freight market benchmarks have also strengthened; the Baltic Panamax Index ultimately reached a peak of $22,000/day in mid-December, whilst the Baltic Supramax and Handysize Indices reached $17,000/day and $16,000/day respectively.

While current spot markets are certainly delighting owners, in the year to November average Capesize rates are still tracking 8% lower than the average for 2022, while Panamax rates are running at 40% below last year’s levels. The pervading sentiment remains largely one of dashed hopes for a better year for bulker earnings.

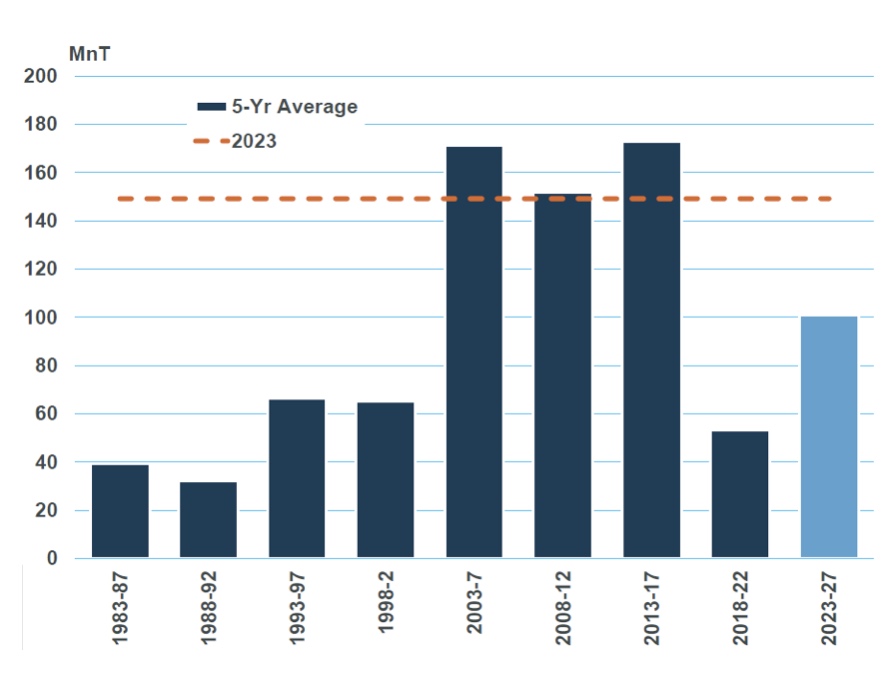

The sense of disappointment may be especially poignant as the year has proved to be one of robust growth in trade volumes, including a massive acceleration in Chinese coal imports. In aggregate, MSI estimates that dry bulk trade will expand by just under 150m tonnes this year, on par with the average growth during the post-2000 boom years (see chart).

One factor suppressing the upside potential for earnings has been supply growth. MSI now estimates that 32.7m dwt will be delivered in 2023, but just 7.9 Mn Dwt scrapped, equivalent to an increment in the fleet capacity over the year of almost 25 Mn Dwt (2.6% year-on-year).

A key factor behind disappointing freight rates – as highlighted in recent reports by MSI – has been the evolution of fleet trading efficiencies. It was sharply rising inefficiencies that drove strong freight markets in 2021/22, and the near-normalisation of these factors in 2023 has weighed on market balances.

Nonetheless, developments towards the end of this year have demonstrated that issues affecting the trading efficiency of the fleet can still have a significant impact on freight markets, with notable disruptions including rising congestion and an effective closure of the Panama Canal to bulkers.

Recent weeks have seen a very significant jump in the amount of shipping capacity tied up at ports globally, and in particular in the Panamax market. In contrast to the 2021 period when congestion was largely concentrated at China’s ports, vessels are currently being delayed predominantly at loading ports, notably in Brazil and Indonesia and to a smaller extend East Coast Australia.

While providing a very significant boost to current market rates, in contrast with the persistent and rolling restrictions in place at the time of COVID, we can expect that this time round congestion will ease quickly as we roll down the other side of the seasonal peak in coal, grain and iron ore exports.

On the other hand, disruptions to the fleet’s trading patterns associated with restrictions at the Panama Canal are likely to persist for longer. As authorities restrict transit capacity at the canal due to prolonged drought, the implications for the dry bulk market are considerable – exports from the US Gulf and other Caribbean origins to Asia would now need to sail either through the Suez Canal or via the Cape of Good Hope. Considering the additional requirements for longer ballast distances, the effective capacity of the fleet serving the US Gulf to Asia trade would be reduced by approximately 30%. It is yet to be seen whether rising tensions in the Red Sea will result in bulkers avoiding the Suez Canal but this is certainly another source of near-term upside risk related to the fleet trading efficiency.

Typically, an increase in freight rates provides a strong signal for owners and charterers to increase sailing speeds in order to maximise trade opportunities. Interestingly, speeds have not responded to the recent uptick. It is natural to question whether speed clauses in charter agreements are having an impact as we approach the end of CII’s first year of measurement, although there is little evidence to demonstrate this yet.

Alternatively, the fact that vessels are increasingly fitted with EPL systems may be placing a technical limit to the ability of operators to adjust speeds in response to market rates. If this is indeed a limiting factor which constrains owners’ ability to respond to market conditions, it may have significant structural implications for more volatile freight rates going forward.

An expectation that freight markets will be continue to be volatile certainly chimes with analysts, owners and charterers alike. It is not difficult to justify this qualitatively, citing geopolitical issues, new regulations, economic issues (particularly in China), recurring congestion, and to some degree the existing presence of volatility at the back end of 2023. Whilst some of these drivers are awkward to capture, MSI also subscribes to this view, that volatility could return without much notice next year.