El Niño wreaks havoc on global shipping patterns

Across every continent shipping is having to contend with the fallout from this year’s El Niño, a weather phenomenon that has helped cut drafts along major waterways, slashed agricultural production in key export markets, and could herald a stormy Pacific for vessels to contend with in the coming months.

El Niño is a weather pattern that builds in the Pacific Ocean that can impact weather conditions around the globe.

The good news for shipping is that it tends to mean a lower hurricane season in the Atlantic. The bad news is myriad, however.

Grabbing the most shipping headlines from the weather pattern has been the Panama Canal where the number of daily transits are in the process of being halved while draft restrictions of close to 2 m have been in place along the waterway’s larger neopanamax locks for months. Bulk carriers, large tankers and gas carriers have all made contingencies in recent weeks, avoiding the canal for longer, fleet soaking, voyages around the capes or the Suez.

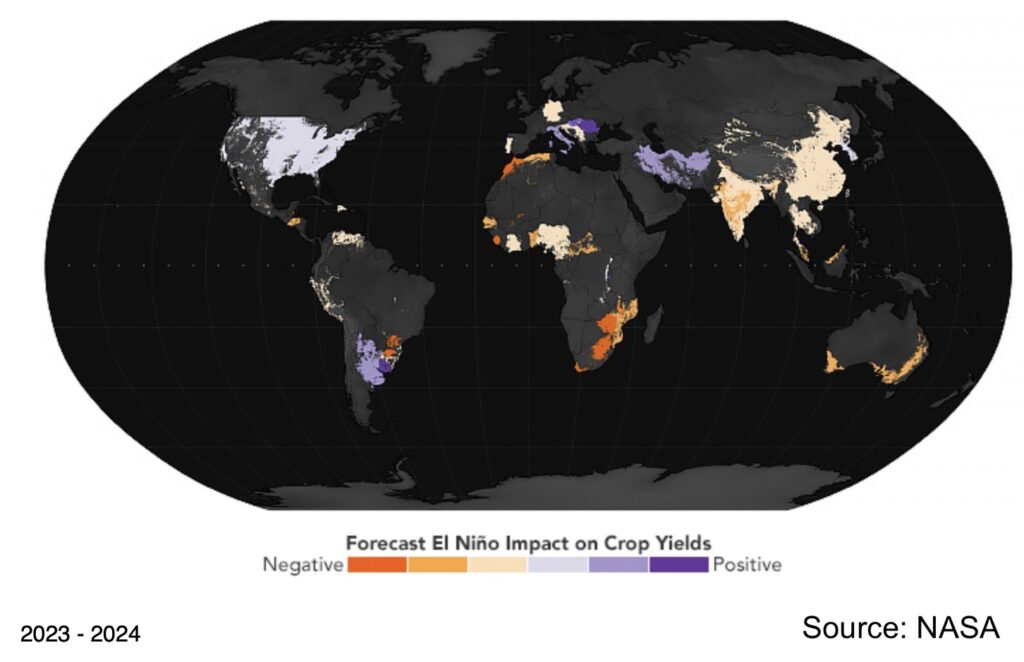

El Niño events are estimated to affect crop yields on at least a quarter of global croplands

“This will result in dramatic changes in seaborne gas and oil trading patterns, stretching the tonne/mile picture in the process,” a new report from Greece’s Xclusiv Shipbrokers.

The water levels are so low along the canal now that the foundations of Tabernilla, a town flooded when Gatun Lake was made, are visible. The Gatun reservoir is crucial for transits along the fresh water canal.

Elsewhere, El Niño, combined with climate change, has curtailed navigation along some of the world’s most important shipping rivers with the likes of the Amazon, the Mississippi and the Rhine in recent months reporting very low levels of water. Likewise, El Niño has been blamed for the near record low levels of water on Lake Titicaca, South America’s largest lake, which straddles the border of Peru and Bolivia.

Turning to agricultural products, although 2022/2023 Brazil’s grain harvests were record breaking, there are now fears about the next crops as harsh weather conditions are disrupting both northern and southern soybean production areas.

“The unusual dry weather in Brazil, experiencing the hottest and driest October in at least a quarter of a century, especially in the Mato Grosso region, has raised concerns that farmers may have to replant soy fields, which could push back second corn planting. Reduced harvest may also affect the dry bulk market, especially in the small/medium sizes,” Xclusiv pointed out.

For palm oil output, researchers at brokers Eastport warned this week that El Nino could reduce rainfall in Southeast Asia, depressing yields and weighing on output from the world’s top two exporters, Indonesia and Malaysia.

This year’s El Niño event, which is forecast to continue gaining strength through the end of 2023 before it dissipates by mid-2024, is expected to contribute to high levels of food insecurity in certain regions.

“El Niño events are estimated to affect crop yields on at least a quarter of global croplands,” said Weston Anderson, an assistant research scientist with the Famine Early Warning Systems Network science team which is predicting El Niño is likely to bring poor maize yields in southern Africa and Central America due to drought. Wheat yields in Australia and rice yields in Southeast Asia are also typically reduced whenever El Niño hits.

In West Africa, meanwhile, concern is growing on a potential shortage of cocoa beans.

Nearly half of the world’s cocoa bean production comes from Ivory Coast. Together with neighbouring Ghana, Cameroon, and Nigeria, the four countries account for three-quarters of the global cocoa bean production. Deterioting weather conditions in recent months have seen authorities in the Ivory Coast warn exports this year could plunge by 25%.

Much of what has been assigned by the Greek broker’s ”report” (presumably written for investors rather than for shipping people who know what is really happening) to an El Nino effect is not due to the specific weather pattern but rather a longer term issue of climate change generally. The Rhine has been suffering from low water problems for many years (lack of snowfall in the Alps) and several of the world’s rivers and lakes are drying up – partly though over-use of local irrigation or because of evaporation and run-off.

Many of the ‘conclusions’ cannot be contextualised by El Nino alone.