Near-term uncertainty plagues the OSV market

Limited visibility and volatility have made planning for 2021 difficult and there is little by way of longer term clarity, writes Gregory Brown, associate director – offshore at Maritime Strategies International

The impact of COVID-19 on the oil market will endure well into 2021. Rarely has it been that E&P budgets and plans made on a 12 month view would have been set during period a such high near-term volatility and limited visibility. Recent tendering has suggested something of a pick-up versus the mid-year trough but leading edge day rates are still 10-20% down from 2019 levels. The more production-focussed Platform Supply Vessel market has continued to be slightly more resilient than Anchor Handlers but is by no means immune.

The net result is that expectations for 2021 are muted. E&P budgets suggest that activity cuts will continue to be felt for some time. Outside of particular bright spots such as Qatar and Brazil the industry will have to rely on self-help to survive the downturn.

On a more encouraging note, the limited number of deliveries and continued lack of newbuild contracts has provided some support to our expectation that the marketed fleet of OSVs will continue to fall this year.

That said, while there has been a series of assets sold in the distressed market, there has been (so far) less scrapping activity as logistical constraints and a heavily depressed scrap value have served to undermine the market. Tidewater, Bourbon, Vroon, Maersk and DOF are amongst those attempting to right-size their fleets – but with the exception of Maersk, all of the above have done so under the banner of a restructuring process.

More owners will have to take a similar approach before the market balances and the mechanisms to drive such fleet rationalisation are unclear. A surer path to recovery may well be based on tightening oil company standards around maximum ages, which will gradually act on the supply side, but the impact of such tightening will take time to be felt.

Demand improving

On the plus side, the gradual recovery in oil demand seen since Spring looks set to continue, led by strengthening demand in Asia. This is reflected in recent earnings season commentary where consensus appeared to be that the sector was past the worst and most immediate impacts of the downturn.

The IEA continues to estimate oil demand increasing by around 5.7m b/d in 2021 as economies open up. However, that positive forecast, and much of the more constructive commentary emanating from the industry comes with the significant caveat that the recovery is fragile and could be easily derailed by the second (and potentially third) wave of the pandemic.

Against that backdrop, management teams in oil companies and the service industry will have put budget and planning documents together. Such plans are often constructed on a five year view, and while the longer-term forecasts are often treated as wish lists, rarely has it been that there is so much near-term uncertainty.

In light of this, the industry will be forced to control what it can. The sector can not control commodity price fluctuations or government-led restrictions on movement but it can control its response to both the pandemic and the broader implications of the energy transition. The latter has come into sharp focus and will eventually offer opportunities for the supply chain.

Loss of confidence

As anyone with a passing acquaintance with the oil industry will have seen, the COVID-19 pandemic and the response thereto has served to decimate industry confidence. The offshore industry has been at the sharp end of this reduction and the pipeline of new projects has weakened.

Although award momentum improved somewhat with the lifting of restrictions through Q3, supported by tax relief packages in Norway and opportunistic contracting elsewhere, the growing fears of rising cases of COVID-19 across Europe and North America means that the industry exited 2020 under a cloud.

Despite that, two regions – Brazil and Norway – stand out in terms of offering some respite from the wider market duress. Petrobras has continued to advance exploration and development drilling in the Santos and Campos basins, and has awarded firm contracts for a series of large scale FPSOs. In Norway, Equinor has moved the Breidablikk project forward, and is likely to see make progress on NOAKA in the short-to-medium term. These projects, along with electrification plans at Sleipner and Gina Krog will provide material opportunities for the Norwegian supply chain.

Bright spots

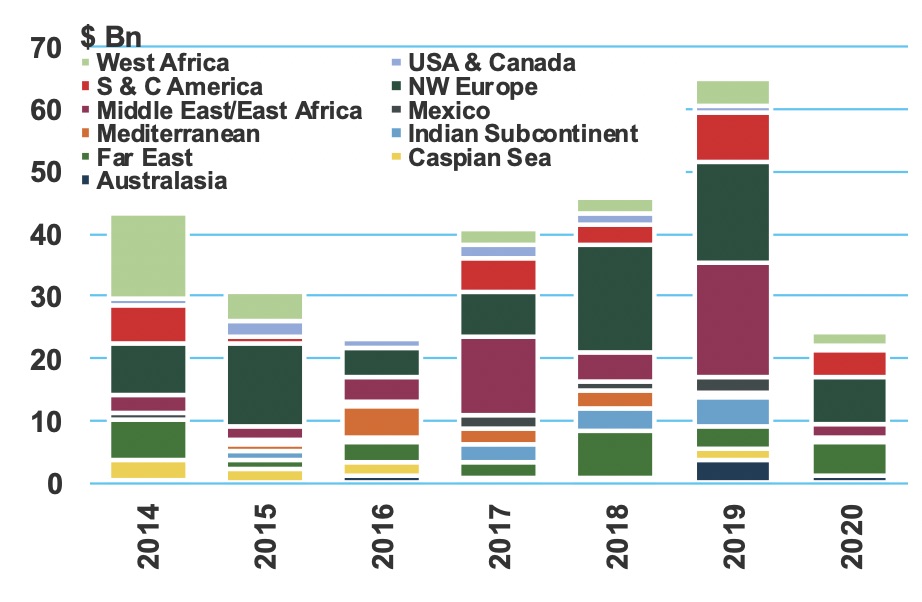

Within Q4’s $86bn bidding pipeline (up $1bn since Q3) are a raft of subsea tieback and step-out developments that can be bought on-stream in less than 18 months. Tendering levels have improved, but it remains to be seen how many enquiries will convert into awards.

The move towards shorter-cycle work at the expense of long-term hub developments reflects the stricter hurdle rates that are being adopted by E&P companies. These go beyond a simple oil price calculation – BP is amongst those to look for a payback of less than 10 years for all investment in upstream oil and 15 years for upstream gas.

Others including Equinor are increasingly shifting towards developments that utilise power from shore to limit at-wellhead emissions. For the bidding pipeline, this has seen a material increase in the number of power lines within the project hopper and an increase in cylindrical FPSO hull designs.

Those projects are unlikely to make material progress until the latter parts of 2021. In the nearer term, we expect to see a series of smaller brownfield packages awarded in the Middle East and Far East as well as the development of the Spruance discovery in the US Gulf. In terms of greenfield work, we expect activity in both Qatar and Brazil to remain relatively healthy, but we are far less optimistic about the $16 bn of live tenders off Africa where bidding deadlines continue to shift right.

The OSV sector will likely remain under a cloud for much of the year. The absence of certainty regarding energy demand serves to disincentivise project development for all but the most strategic of prospects. We do not believe that activity levels will retreat back to the trough of mid-2020, but hopes for a recovery will have to wait for now.