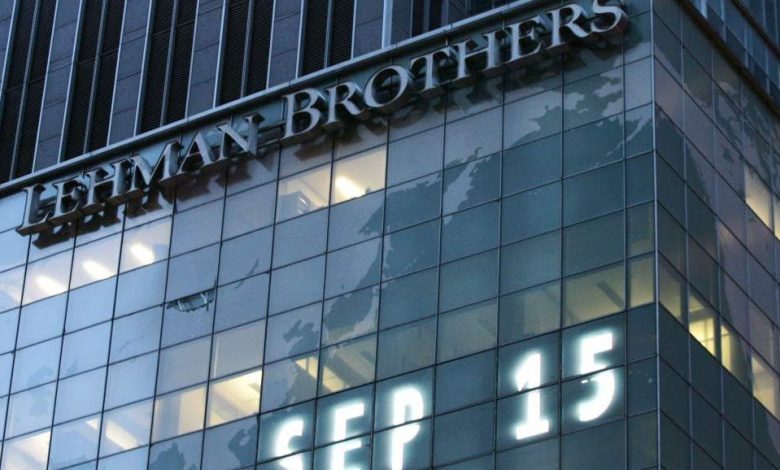

Ship financing now at its lowest levels since the collapse of Lehman Brothers

Ship financing is at its lowest level since the global financial crisis of 2008, according to the latest annual survey from Greece’s Petrofin Bank Research.

The top 40 banks’ lending to shipping now stands at $300.7bn, the lowest level since Petrofin started monitoring the global portfolio in 2008. $44.3bn has been knocked off the portfolios of the top 40 banks over the last year with even the previously fast rising Asian banks registering drops in their portfolios.

“The growth of the global fleet continues to be funded from non-banking sources,” Petrofin noted in a release, citing the continued rise of Chinese leasing companies.

“The decline of Western bank ship finance has assumed dramatic proportions. In just 11 years and despite the rise in the global fleet, about $160bn has been shed via natural repayments, provisions or loan portfolio sales. The trend seems to be continuing, however, the absolute number of candidate banks for exit or reduction has reduced to very few. Those remaining are successfully combining ship lending with other bank services and thus remain in the industry,” Petrofin stated.

Two thirds of Splash readers polled in a recent survey believe ship finance is not becoming more readily available despite increasing rates across many shipping sectors.

Sam, hence my argument for a dedicated Maritime bank – https://splash247.com/time-for-a-dedicated-singapore-maritime-bank/