Shipowners losing millions by choosing the wrong bunker port

Ishaan Hemnani from BunkerEx has some advice on where to get fuel.

Bunkers are one of the largest costs associated with a voyage, so making the right decisions around it are crucial. Although many shipping companies have dedicated bunker teams, the decision of where to bunker tends to start with the chartering manager during their initial voyage estimation.

Before a vessel becomes open, chartering managers begin to assess multiple voyage options. This typically happens well in advance as an unemployed ship equals unrecoverable earnings (time is a perishable good). For an accurate voyage estimate, chartering managers need to collect information on both the vessel and ports specific to the voyage.

Vessel parameters are often similar for each voyage: max. cargo capacity, bunkers remaining on board [ROB], tank capacities, consumption tables, allowed drafts, planned sailing speeds, etc.

However, voyage parameters are mostly variable and need to be gathered for all voyage options: sea distances, weather forecasts, calling costs, FFA rates and of course, bunker prices.

There are established software solutions for most of the above (e.g. Seametrix or Netpas for sea distances, StormGeo for weather routing, DA Desk or Diabos for calling costs), however bunker prices are more complex as it’s not enough to only check bunkering options at the load and discharge ports.

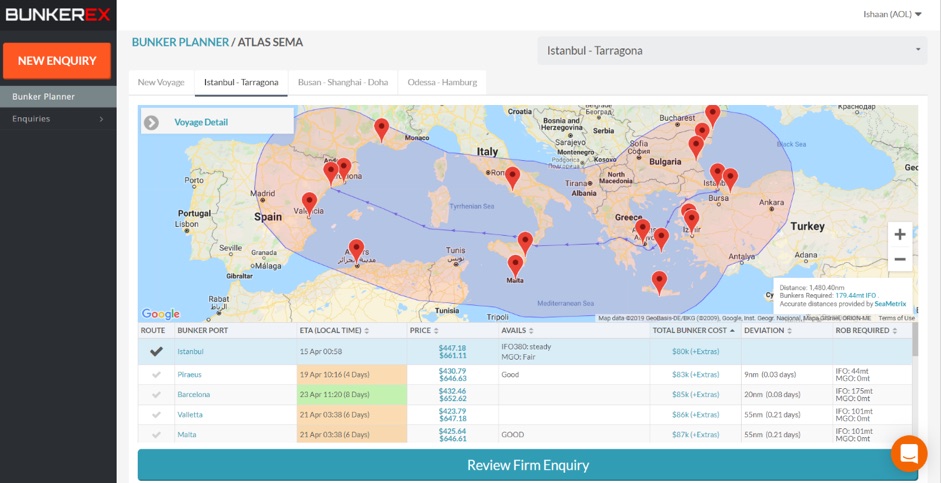

As the screenshot of our new software illustrates, even a short voyage across the Mediterranean has many potential bunkering options:

BunkerEx Planner Screenshot (bubble around voyage denotes max. deviation distance allowed).

For a thorough voyage estimation, commercial operators need to evaluate every port to check:

• Bunkers only call: is it allowed and if so, are there additional calling costs?

• Deviation time: What is the time cost of the deviation?

• Added consumption: How much extra fuel will be consumed on the deviation?

• ROB: Does the vessel have enough fuel on board to reach the port?

• Bunkering time: How long will the bunkering operation take and are weather delays likely?

• Suppliers and specifications: Who are the physical suppliers, are they reliable and do they have the specifications required?

• Market risk: What is the ETA to each port? Is it possible to fix the price now or do I have to wait and risk an upturn in the market?

• Bunker price: Considering all the above, what are current prices and are they low enough to justify stopping there?

Doing this for each bunker option on every potential voyage is not feasible even with a large team, but how much does this really matter?

Hundreds of thousands in lost TC earnings

A common misconception is that there are only a handful of major bunker ports in the world and that these are always the cheapest options. For example, many owners will repeatedly bunker in one of Singapore, Rotterdam, Fujairah, Gibraltar or Houston whenever they sail nearby without evaluating other options. Looking at the data illustrates how expensive this might be.

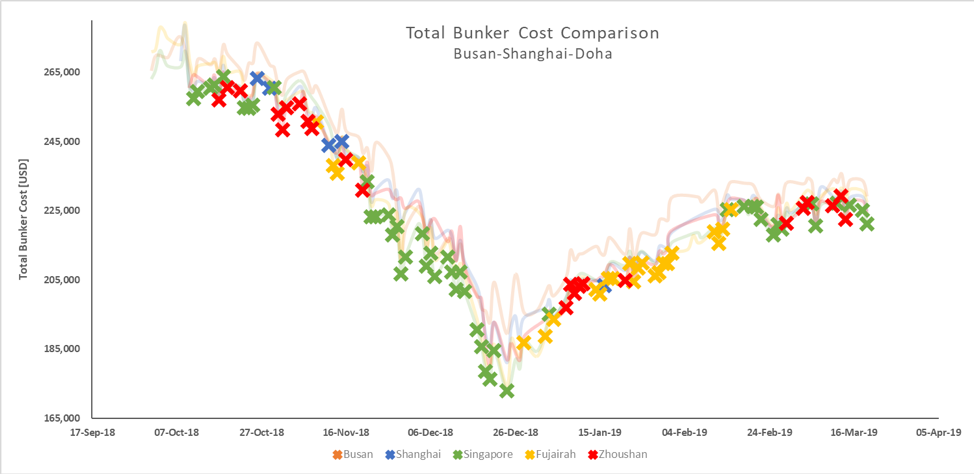

Example Voyage: Busan-Shanghai-Doha

On a single voyage from Busan (Korea) to Shanghai (China) to Doha (Qatar), we found the cheapest bunker port changes every 2.82 days (accounts for deviations, calling costs, barging, extra bunker time, vessel day rate and consumption). This can be seen in the graph below where each coloured cross denotes the cheapest bunker port at that time – and it changes often.

Assumes lifting 500mt of fuel, vessel day rate of $12k, speed of 11 knots, consumption of 32mt/day, bunkering concurrently (free time) at Busan/Shanghai but add 10 hours bunker time and calling costs for bunkers only at Singapore/Fujairah/Zhoushan, includes barging if applicable (e.g. $5/mt at Shanghai, $0 at Singapore as >500mt) and adds extra fuel consumed on deviations.

At some point over the last six months, each one of Singapore, Fujairah, Busan, Shanghai and Zhoushan were the worst of the five bunkering options for this voyage.

Bunkering at these ports during those periods would have cost shipowners an extra +$9.5k, losing $257/day of potential TC earnings on this voyage (averaged and assuming 31 sailing days and 6 days port stay).

Even choosing the second best option averages to +$2.2k, equalling an extra $60/day on this voyage.

As our real-life back tests confirm, multiplying this across an entire fleet means the cost of not choosing the right bunker port can add up to hundreds of thousands of lost TC earnings per year.

Where technology can help

Given the sheer number of moving options to evaluate, it is unrealistic to expect chartering, ops or bunker teams to continually recalculate all possible bunkering options. Dedicated bunker desks are typically charged with managing credit lines, negotiating and fixing firm stems, dealing with claims and now researching 2020 strategies.

Performance optimising technologies are touching many different corners of maritime and the choice of bunker port should be no different. As is plain to see from the data above, spending a few minutes punching in a voyage can reveal drastically cheaper bunkering options. Not doing so can unknowingly cost owners and operators hundreds of dollars per day per vessel.