Supramaxes crowned king of dry bulk

The supramax market is now earning a premium over all of the other bulk carrier classes assessed by the Baltic Exchange. These ships have surged by 138% year-to-date to around $27,000 per day, the greatest year-to-date percentage gain of all the dry segments, new research from Braemar ACM shows.

The booming steel trade has bolstered supras as have some of the less glamorous commodities such as cement and aggregates.

Indian iron ore exports on supras have boomed this year and there has also been a noticeable uptick from other producers such as Liberia and Norway, and from distribution hubs such as Bahrain.

Supramaxes have also seen a 20% year-on-year increase in copper concentrate shipments so far this year while trade of manganese ore, a key steelmaking ingredient, has also jumped 14%.

Supramax shipments of cement so far this year are up by 30% year-on-year, while aggregates moved by supras had grown 11% year-on-year in 2021 so far.

Over the first five months of the year, agribulk trade on supras has grown by 10% year-on-year.

“The bottom line is that the geared fleet is well placed to supply re-opening economies with the wide variety of raw materials needed to get growth back on track,” a report from Braemar ACM, published yesterday, stated.

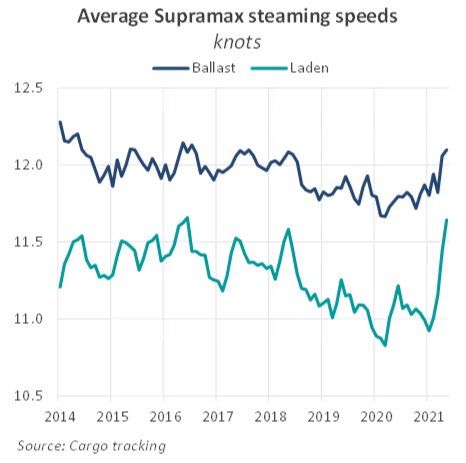

This is also evident in rapidly rising vessel speeds. Average laden speeds for supras jumped to 11.6 kts in May, up by 6% from 2020’s average, while ballast speeds have increased by 3% to 12.1 kts, despite bunker prices also being on the rise.

The speed increase loaded and in ballast is to be expected. BUT has port productivity kept up or have ships raced to wait with higher demurrage rates not pushing port productivity up? Any data?