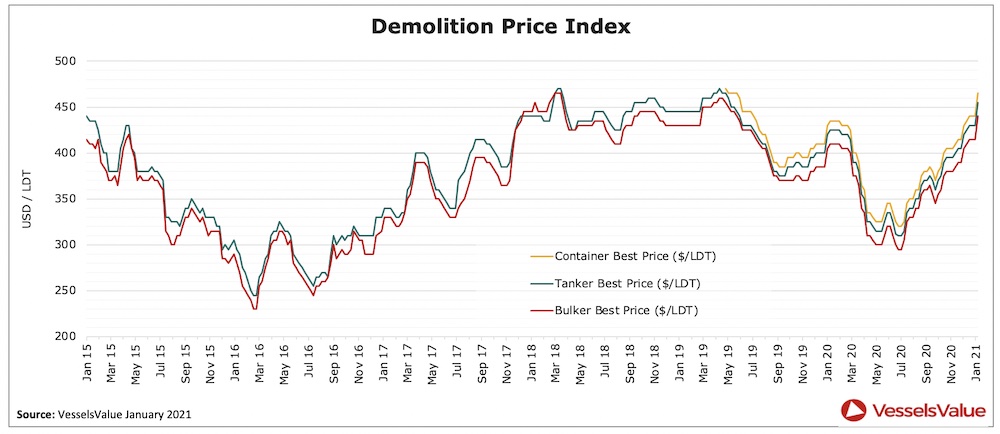

Ship demo rates close in on the $500 mark for the first time since 2014

Ship demo rates are roaring ahead with the $500 per ldt mark on course to be broached for the first time since November 2014.

A busy start to the year, led principally by eager Bangladeshi yards, has seen prices jump above $450 per ldt with many owners now actively rethinking recycling plans to take advantage of the strong prices on offer.

“Now it seems a question of when not if we break through the $500 / ldt in the coming weeks,” brokers Thurlestone noted in a report to clients this week.

Clarksons Research suggested several factors appear to have led to this fresh enthusiasm, with spare capacity at recycling yards generating new demand for ships, supported by demand for steel from local mills. This is being driven by rallying global steel markets, which some industry stakeholders believe could help support the recycling industry for some time.

Many owners with costly surveys or repairs on the horizon will be tempted to scrap at these rarely achievable rates

Current scrap price levels will likely become attractive for owners as they increase relative to secondhand rates, Clarksons Research suggested in a recent report.

“Scrapping activity is also likely to be driven this year by the accelerating ‘green transition’, with owners potentially encouraged to recycle vessels by the costs of complying with environmental regulation,” Clarksons stated.

Jon Chaplin, marine business development manager at UK-based consultancy Lucion Marine, told Splash today: “Many owners with costly surveys or repairs on the horizon will be tempted to scrap at these rarely achievable rates.”

Cash buyer Best Oasis described the opening days of 2021 in the ship demo market as a “total frenzy”.

Among this year’s ships sent for scrap are three VLCCs, triple the number scrapped last year.

Alphatanker noted in its most recent weekly report: “Demolition interest is expected to be sustained over the next few months from the combination of tanker markets remaining depressed, a sustained rebound in scrap prices in line with rising global steel prices and as secondhand tanker prices continue to steadily weaken.”