Who is shipping’s next GameStop?

A new report from US equity research firm Evercore ISI highlights the listed shipping companies most at risk from any further instances of social media short-squeezing.

Global financial markets were rocked recently with the rise of the Reddit retail throng that saw hedge funds lose billions as small investors rallied via social media to short certain stocks, with GameStop (GME) and AMC Entertainment Holdings being the most famous examples of the short-selling phenomenon. Also caught up briefly in the investment storm was Nasdaq-listed Greek bulker owner Castor Maritime. The shipping stock was part of the initial list of restricted stocks on retail-oriented trading apps as the share storm peaked.

Like GameStop, shipping stocks tend to be high short interest, low absolute share prices, and in an out-of-favour sector

Despite many of these amateur investors now enduring significant losses in recent days, Evercore suggested in a note to clients that with more stimulus cheques on the way, free time galore during lockdowns, and the market only really moving in one direction, further instances of social media short-squeezing are likely – with shipping stocks checking many boxes for these amateur investors.

Like GameStop and AMC, shipping stocks tend to be high short interest, low absolute share prices, and in an out-of-favour sector, Evercore pointed out.

Evercore has started to track short interest updates to make sure it isn’t blind-sided by the next GME in shipping, warning yesterday that when these events unfold fundamentals and balance sheets become irrelevant.

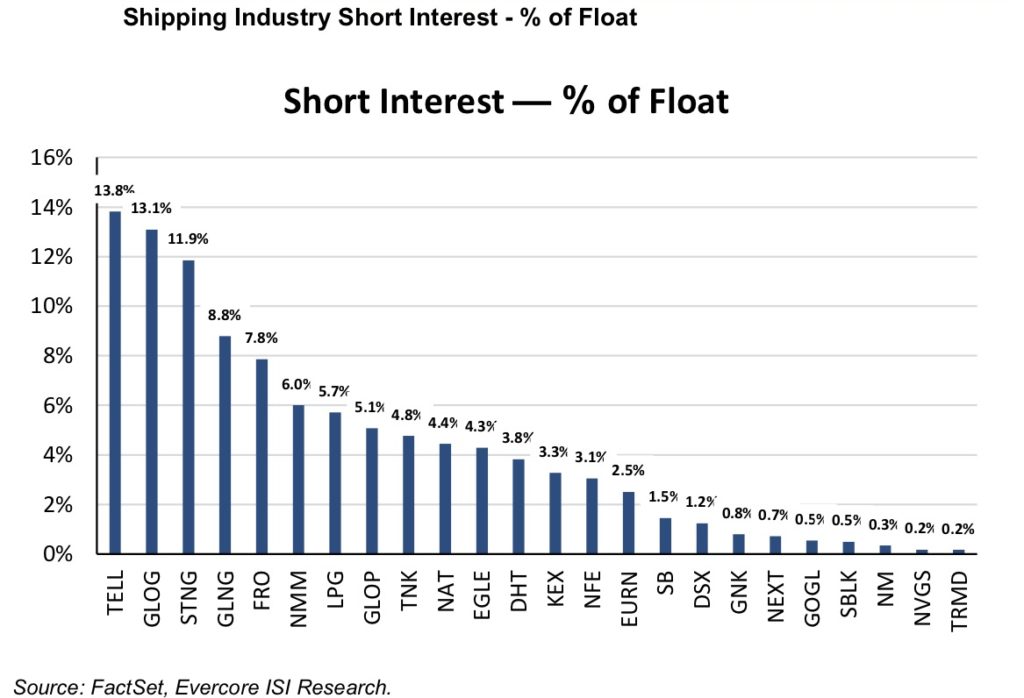

Evercore’s chart of listed shipping companies it tracks (see below) shows none have short interest above the important 20% threshold.

“There is certainly a wide variance across the sector, and a quick check of stock price charts proves that those with the highest short interest figures certainly had greater rises (and falls) than the peers with de minimis short interest,” Evercore observed.