China on track to smash coal import records

Dry bulk rates might be in the doldrums, but they’d be in a whole lot worse state were it not for the sensational amount of coal China has been importing in recent months, with the People’s Republic now on course to import 400m tonnes this year, smashing last year’s total by 100m, as well as the record set back in 2013 of 327m tonnes.

The full year target figure of 400m has been mentioned by China’s National Coal Association with analysts at broker Braemar saying the coal buying binge comes against a background of more affordable international thermal coal prices, and energy security appears to be the priority in Beijing this year, building stockpiles as the country faces extreme heat with temperatures recorded in excess of 50 degrees Celsius in the west of the country recently.

Total Chinese coal imports for the first half of 2023 were 221.93m tonnes, double the 2022 comparable period, according to analysis from UK consultancy Shipping Strategy.

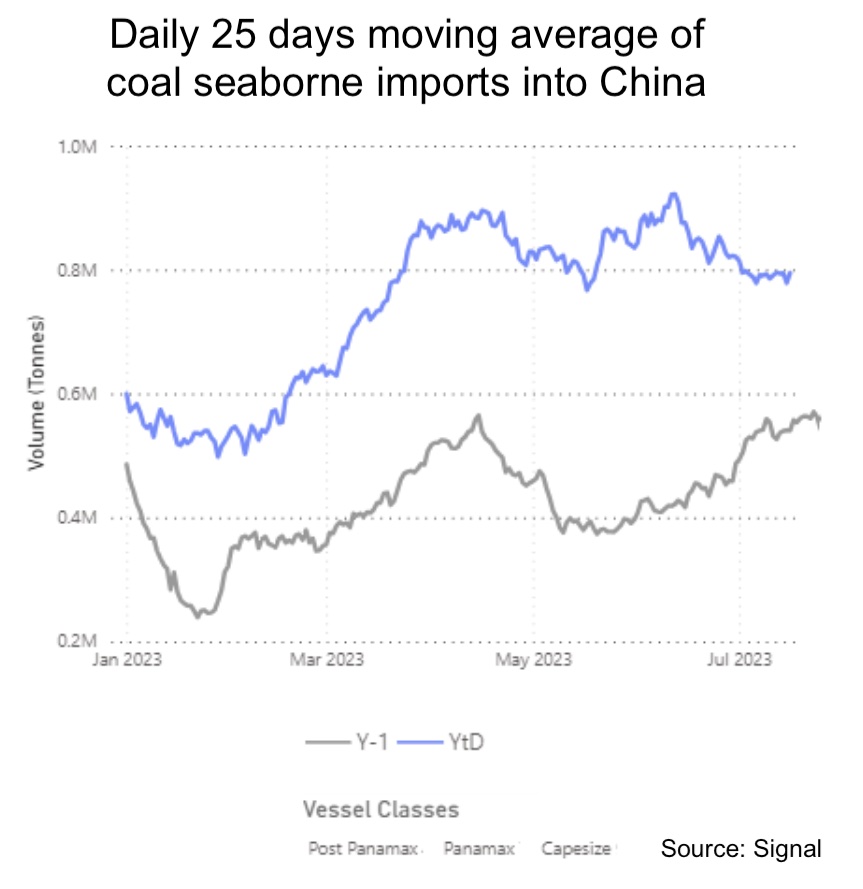

Figures from BIMCO show that in the year to date Chinese seaborne coal imports are up 66% over the same period in 2022.

Ralph Leszczynski, global head of research at Italian broker Banchero Costa, described the coal news coming out of China as “price-driven opportunism”.

Imported coal normally accounts for no more than 10% to 15% of coal consumption in China, with the country being more or less self-sufficient in coal from its own domestic mines, Leszczynski explained.

“Imports tend to spike when imported coal is simply cheaper than what is produced domestically, and tend to fall when international prices – and/or freight – are high,” Leszczynski said.

International coal prices peaked in 2022, and have been on a constant decline over the past six months, falling back to levels last seen in early 2021.

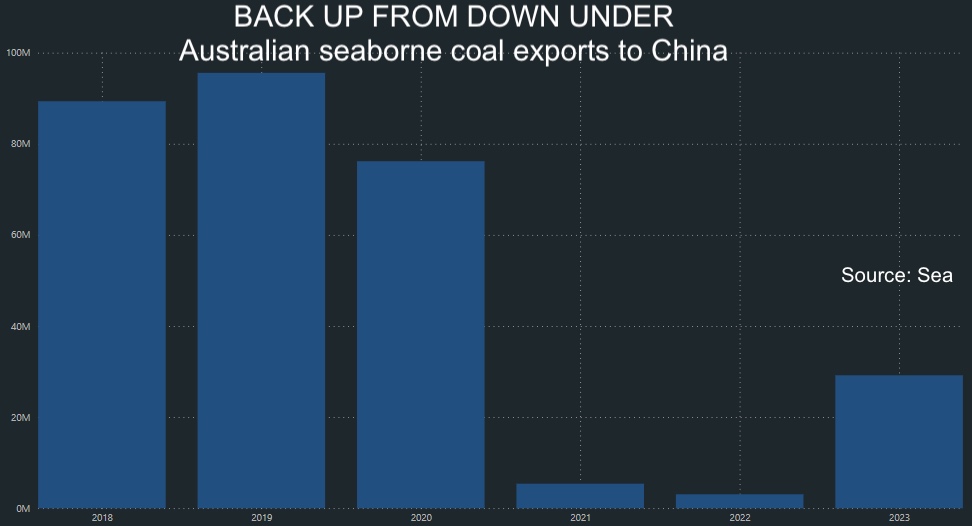

Data from shipping platform Sea shows Indonesia remains the dominant supplier of coal to China, accounting for 54% of the total this year, but the return of Australia into the mix after a couple of years of bans thanks to a spat over the origins of the pandemic is noticeable.

The return of imports from Australia into China helped triple the capesize share of inbound coal shipments in Q2 2023 to 24% from 8% in Q2 2022, according to data from Braemar. However, the doubling in overall imports resulted in higher volumes carried on both panamaxes and geared bulkers—despite the squeezed share of each.

Ulf Bergman, senior economist at chartering platform Shipfix, told Splash that the forward-looking cargo order data also suggests that actual imports will remain high in the coming months.

“Given the time lag between cargo order and actual discharge, the high demand for seaborne transportation of coal to China recorded in March to May should translate into solid import data for the current and coming months,” Bergman said.

Nevertheless, recent weekly data point towards a slowdown in activities, which will likely mean limited downward pressure on official import data towards the end of the third quarter. However, the weekly data remain high in a historical context.

“Without these coal imports the bulk markets would be in the pits,” commented Giuseppe Rosano, founder of UK broker Alibra Shipping, noting how iron ore imports into China have been sluggish due to the weak construction sector.