Exclusive data reveals Suez diversions by shipping segment

A US-listed bulk carrier was hit yesterday by the Houthis in the Gulf of Aden with the American military replying in kind, as the full scale of shipping’s Red Sea exodus becomes more clear.

Yesterday also marked the first time this century that no single LNG carrier was present in the Red Sea, a remarkable sign of how rapidly and tremendously the global seaborne map has changed in the three months since the Houthis from Yemen – backed by Iranian intelligence and weaponry – came out in support of Hamas in the ongoing war with Israel.

The Marshall Islands-flagged Genco Picardy bulk carrier, belonging to Genco Shipping & Trading, became the third ship in four days to be targeted by Houthis yesterday evening, hit by a drone on its port side and gangway (pictured).

The ship sustained minor damage with no crew injured and it was able to continue on its journey assisted by a nearby Indian naval vessel.

In response, US ships and submarines fired at Houthi positions in Yemen. Fourteen missile sites were targeted at around 11.59pm local time on Wednesday, said US Central Command.

The US on Wednesday put Yemen’s Houthis rebels back on its list of specially designated global terrorists, putting financial sanctions in place.

The scale of the shipping pullback from the region is gigantic as detailed in new, exclusive data from maritime trade analytics specialist Sea detailed below.

Three of the world’s largest shipping companies, Nippon Yusen Kaisha (NYK), Mitsui OSK Lines (MOL) and Kawasaki Kisen Kaisha (K Line), all three from Japan and with a combined fleet of more than 1,800 ships, have become the latest big names to suspend navigation through the Red Sea, while Vincent Clerc, the CEO of Danish liner giant Maersk, warned yesterday while attending the World Economic Forum in Davos that the disruption would continue for months.

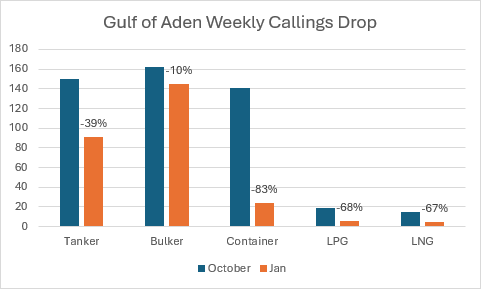

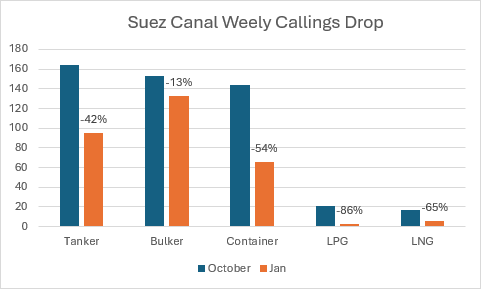

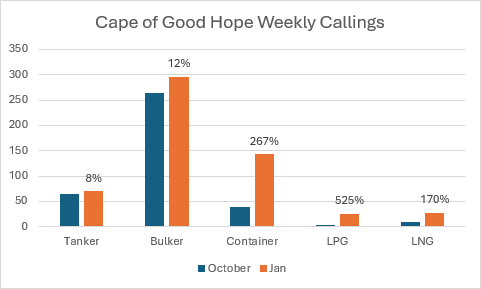

While most headlines have focused on the disruption wrought to the liner trades, all shipping segments have been pulling back from Suez transits, with record maritime traffic being witnessed outside of Cape Town.

Brokers Braemar have picked up on data from AXS ship tracking data which reveals a tangible reduction in tanker transit patterns, for instance. In December, an average of 26 oil and chemical tankers above 25,000 dwt per day transited the Bab el-Mandab strait at the southern entrance to the Red Sea. However, in the first half of January, this figure dropped by 38% to an average of 16 tankers, according to new analysis from Braemar.

Exclusive data compiled by Sea for Splash today comparing the second week of October to the second week of January shows both the significant drops in maritime traffic at the both the Suez and the Gulf of Aden across multiple shipping segments as well as a 53% increase across all vessels passing the Cape of Good Hope.

bulk carrier, belonging to Genco Shipping & Trading, became the third ship in four days to be targeted by Houthis yesterday evening, hit by a drone on its port side and gangway (pictured).

bulk carrier, belonging to Genco Shipping & Trading, became the third ship in four days to be targeted by Houthis yesterday evening, hit by a drone on its port side and gangway (pictured).