Exposed carriers struggling to pay sky-high charter rates

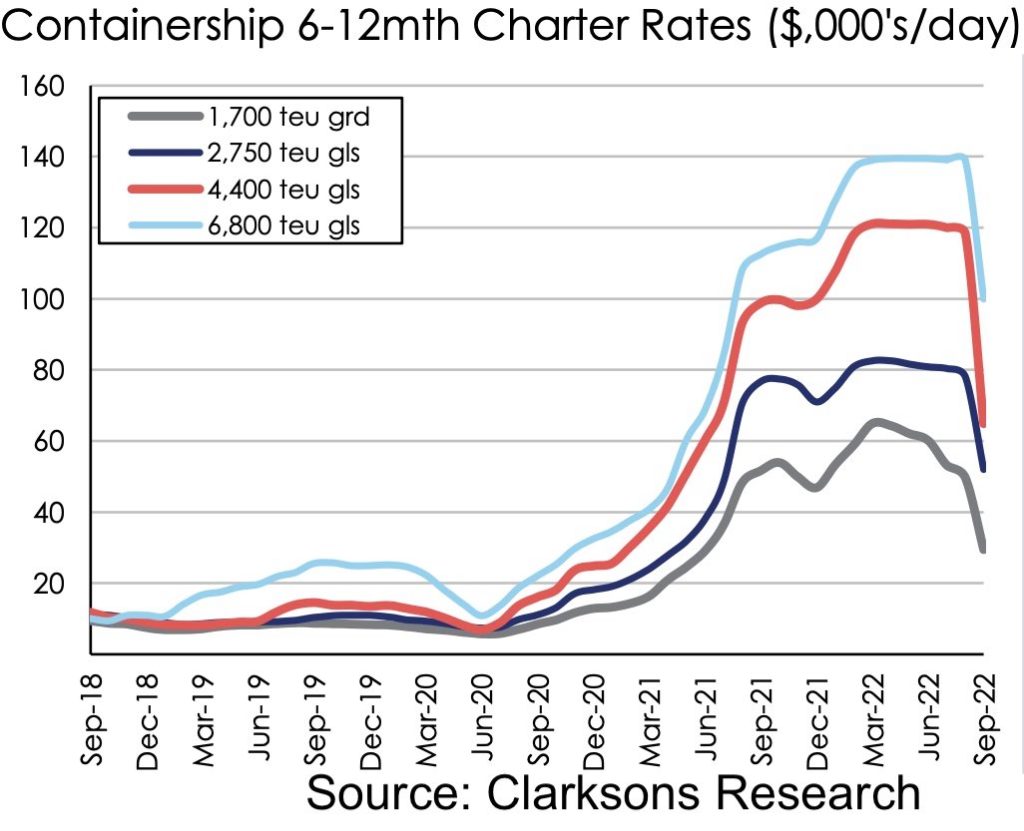

The abrupt plummet in boxship charter rates is making plenty of headlines, with warnings that some carriers are struggling to keep up with their rental payments for ships signed earlier at sky-high prices.

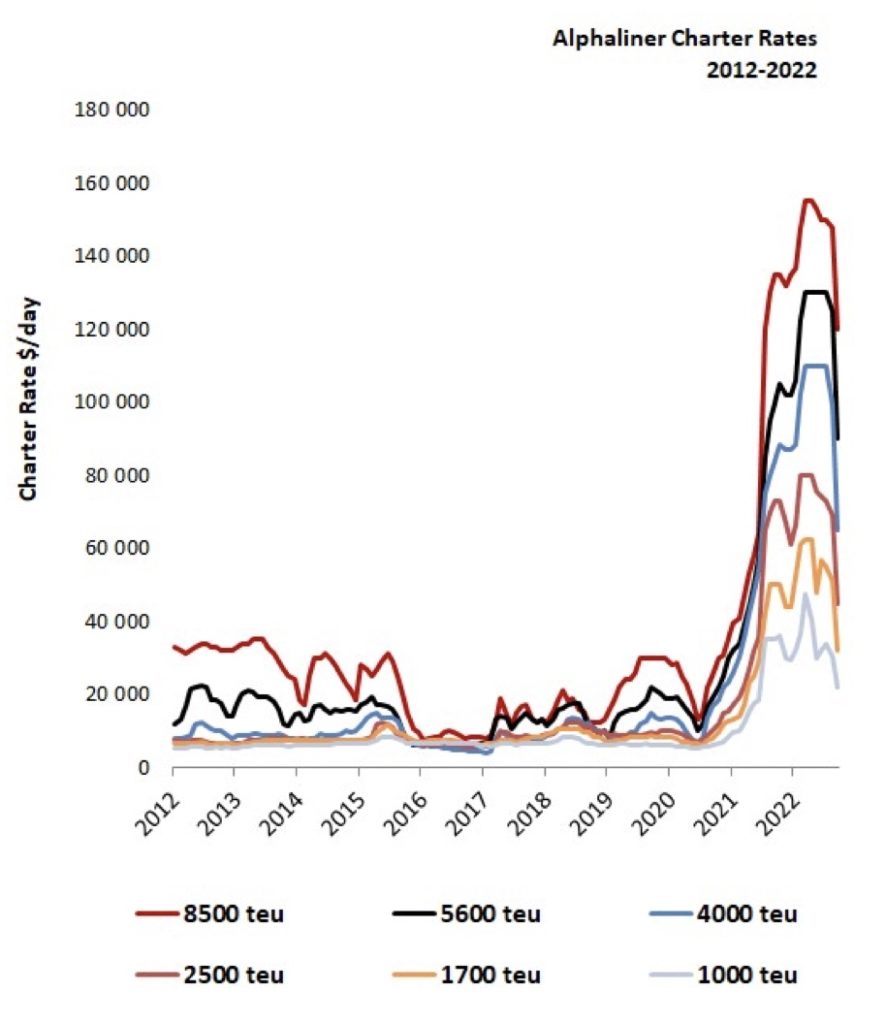

Classic panamax tonnage has been fixed in recent days at rates of $40,000 and $50,000 for periods of six months, according to Alphaliner, roughly half what such a vessel size could have obtained only a few weeks ago for the same durations.

Carriers with a strong spot cargo exposure are already struggling to honour expensive charter commitments

The steep drop is evidenced in multiple charter indices around the world. Braemar’s BOXi index has slumped 45% over the past six weeks, dropping by 30% last week alone. Clarksons’ charter index dropped 26% last week as charter rates come into sync with the rapidly declining spot freight rate environment.

Ships in the 1,700 teu range are now being fixed for 12 months at around $35,000 per day, down from $50,000 six weeks ago, according to data from Alphaliner.

“These fixtures will inevitably influence other size segments, which are likely to see significantly weaker charter deals concluded in the next few weeks,” Alphaliner stated in its latest weekly report, warning that carriers with a strong spot cargo exposure are already struggling to honour expensive charter commitments.

Many within the liner community have been speculating over the past month that the swift change in fortunes, especially on the transpacific, has been engineered by some of the largest liners in order to expose, and whittle away the presence of new entrants on the key tradelane.

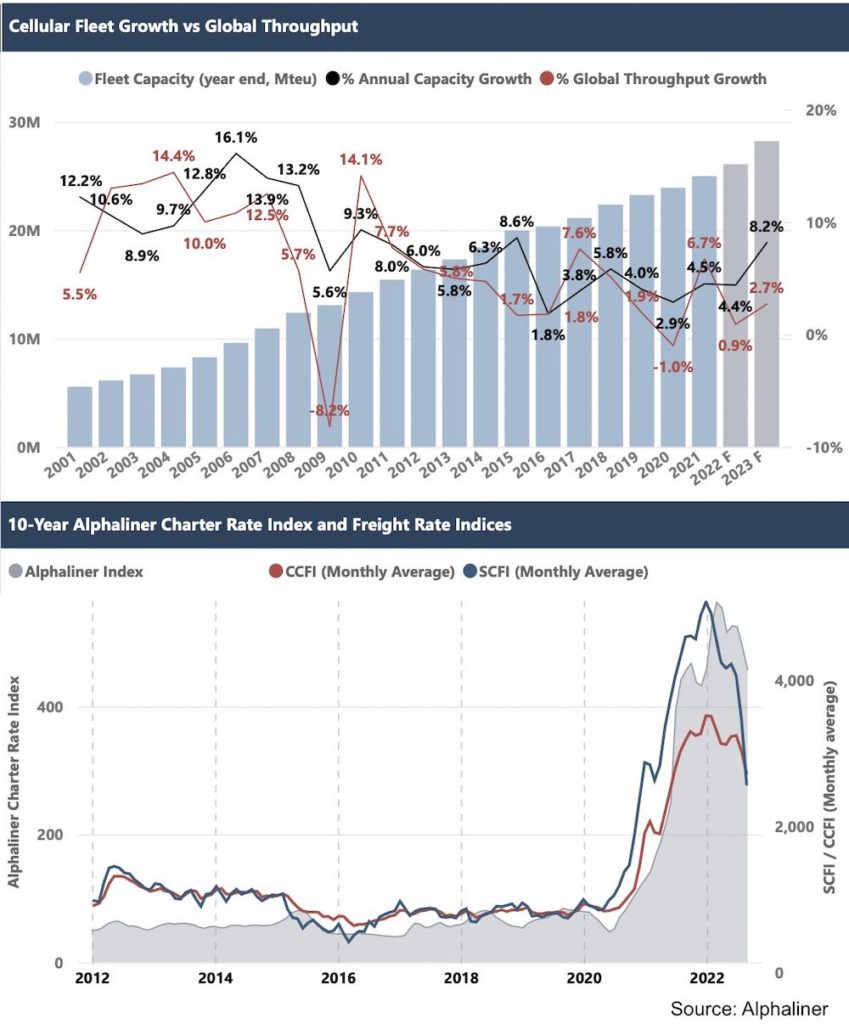

“As cargo volumes and freight rates continue to fall across the board, supply rises, congestion slowly eases and high risks of recession around the world persist, the current drop in charter rates is probably more than a simple market correction, and is likely to worsen,” Alphaliner predicted, adding that overcapacity would become apparent from the second half of next year.

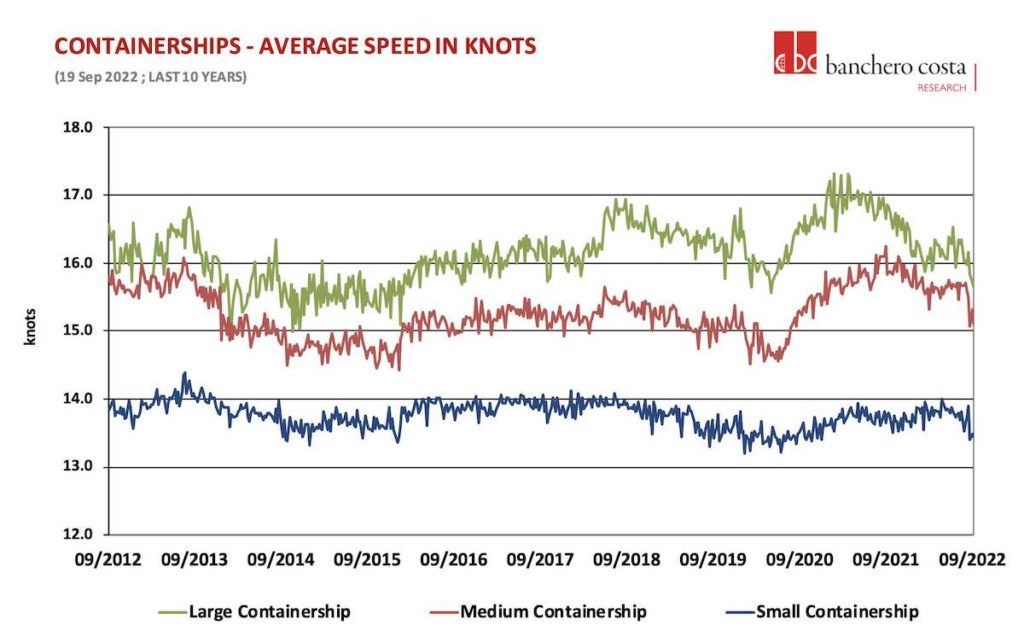

The swiftly changing market fundamentals have also muted the secondhand containership sale and purchase market this month, while the global boxship fleet has notably slowed down in recent weeks. In response to easing demand and falling rates, carriers are cancelling more and more sailings through October.

Analysts at Sea-Intelligence have warned carriers to brace for further falls.

“[T]he renormalisation the rate levels are currently undergoing will also see a hard landing, in the sense that we should expect freight rates to drop lower than the longer-term normal, followed by a distinct rebound,” Sea-Intelligence forecast in its latest weekly report.

On the newbuild front, the first signs of a falling market are surfacing with Splash reporting last week of Seaspan’s decision to cancel four 7,700 teu newbuilds it had contracted K Shipbuilding in South Korea to construct.