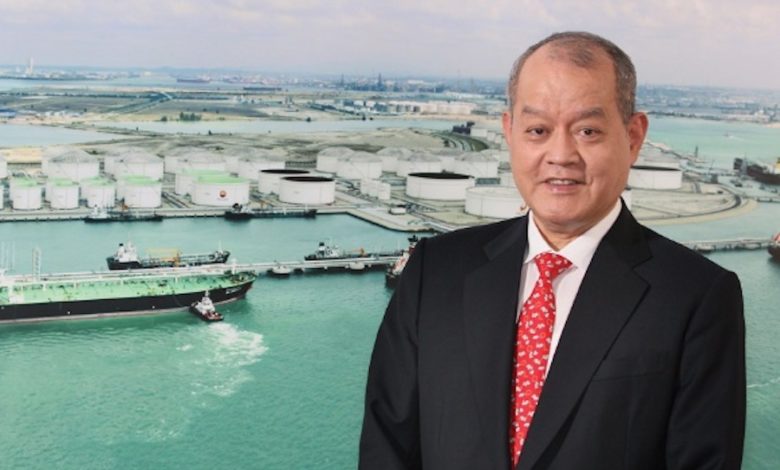

Prosecutors are due to charge O K Lim, 78, with another 23 charges of forgery-related offences in the ongoing Singapore court proceedings against the founder of Hin Leong Trading.

Lim was charged with two counts of abetment of forgery for the purpose of cheating in August and September last year as Southeast Asia’s largest bankruptcy of 2020 unfolded.

Separately, a High Court hearing is scheduled on April 5 of an application by judicial manager PricewaterhouseCoopers to freeze the assets, shares and funds held by the Lim family in a bid to recoup $3.5bn of debt from the collapsed oil trader.

The decline and fall of Hin Leong – as well as many subsidiaries including Ocean Tankers – ranks among the largest corporate collapses seen in Southeast Asia over the last decade.

According to court documents the alleged fraudulent activity included “the creation of fictitious gains to conceal accumulated trading and other losses, the forgery of documents, the manipulation of Hin Leong’s accounts through irregular accounting entries, the overstatement of Hin Leong’s inventory and the obtaining of financing through improper means”.

Lim has admitted Hin Leong hid some $800m in losses incurred from futures trading over a 10-year period.