Iron ore price rollercoaster sends jitters through cape community

The iron ore price rollercoaster combined with a growing amount of the steel-making ingredient commodity piling up at Chinese ports has spooked some shipowners in recent days.

Analysts remain divided on how to read Chinese appetite for iron ore, the dominant buyer of the largest seaborne dry bulk commodity.

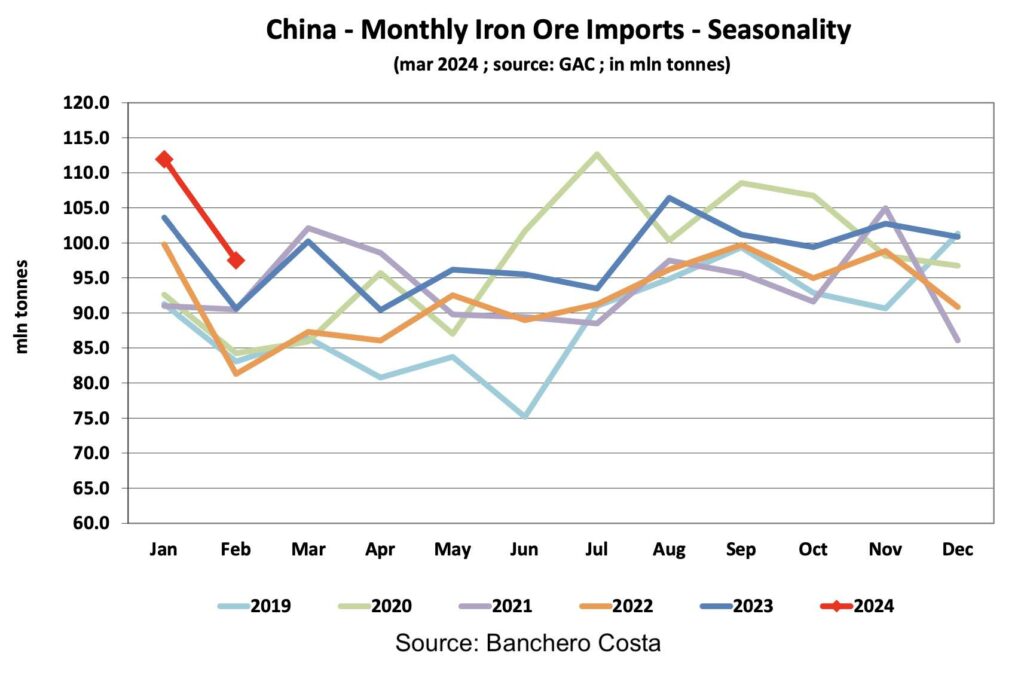

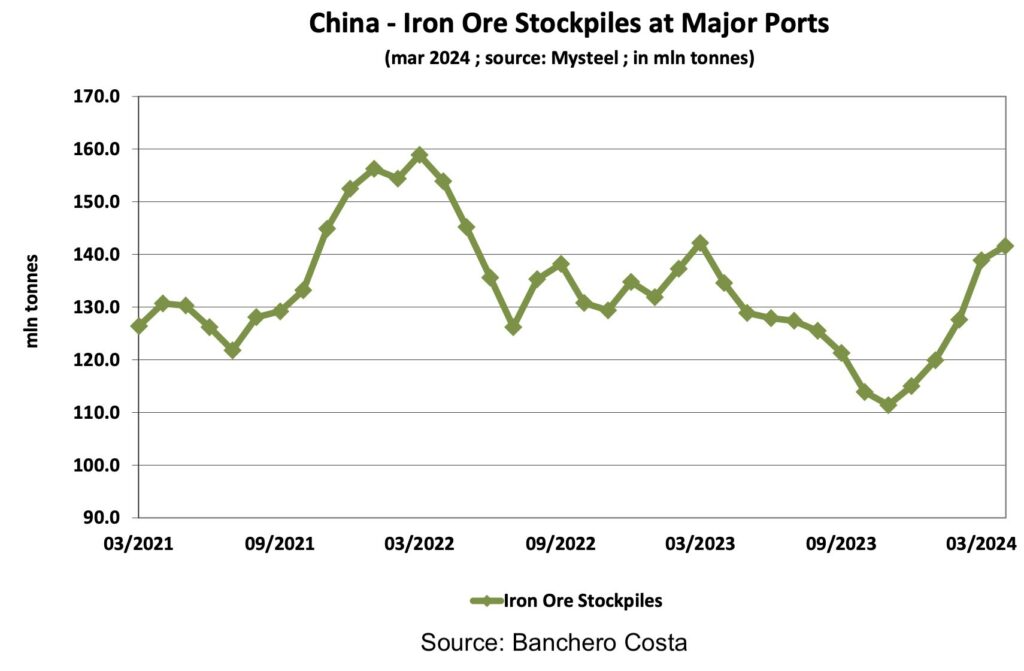

Iron ore prices have swung from above $140 per tonne to below $100 this year, before staging a revival this week to $110. At the same time, iron ore stockpiles at Chinese ports have been climbing, potentially denting previously buoyant capesize rates.

“Looking ahead to the end of March, uncertainties loom, particularly concerning the resilience of the current buoyant sentiment,” states a new report from Greek shipping data platform Signal, listing challenges such as the ongoing struggles of the Chinese economy within its real estate sector and the downward trajectory of iron ore prices as well as the surge in Chinese port inventories, which Signal attributes to waning demand for steelmaking materials.

The “wild” swings in iron ore prices and rising stockpiles have got some owners feeling a “bit jittery” conceded analysts at brokers Arrow in a new research report.

While last week’s iron ore price decline was significant Arrow argues it is not a major cause for concern at present. The primary reason, Arrow argues, for the sharp drop appears to be a surge in supply rather than a huge drop in demand.

Additionally, the decline was exacerbated by souring sentiment, which seems to be improving following the release of better-than-expected data out of China earlier this week as well as the improving global macro outlook.

Arrow also pointed out that with Q2 tending to be peak steak production time in China, stockpiling around this time of the year is common.

Only if prices drop below $90 should alarm bells ring, according to Arrow, something it thinks is unlikely.

“Overall, volatility may persist in the short term, however, the latest data shows that we may have reached a turning point for the global industrial cycle, with bullish implications for industrial commodities,” Arrow concluded.

Jeffrey Landsberg, president of Commodore Research & Consultancy, one of the world’s foremost watchers of Chinese iron ore volumes, had his own take one the recent fluctuations, with a greater focus on the seller side.

China often imports a robust amount of iron ore when stockpiles are rising, and even when steel output is declining, he pointed out in a recent social media posting.

Iron ore port stockpile capacity stands at about 230m tonnes, so with current levels at just over 140m tonnes there is a lot more room to go, he observed.

“The stockpiles on their own are not extremely concerning to us. What is concerning to us, though, is spot iron ore prices,” Landsberg wrote.

China is happy to buy a robust amount of iron ore at lower prices. Commodore’s concern is not that China will pull back on buying but instead that exporters will pull back on selling.

Traditionally, Q1 is considered a quiet period for bulkers due to seasonality and the Lunar New Year celebrations in Asias, which typically led to a temporary pause in market movement. However, this year is an exception with current capesize earnings reaching the highest seasonal levels since 2010, according to data from VesselsValue. Spot rates of around $30,000 a day today are roughly double the levels seen at this time last year.

“The spike can be credited to Chinese trade surpassing expectations, indicating a positive shift in global trade patterns in the first few months of the year,” stated a recent report from VesselsValue.