Latest China economic data spooks shipping

China’s National Bureau of Statistics (NBS) revealed alarming statistics for April yesterday, with analysts warning similar troubling figures can be expected for May with the country’s aim of an annual 5.5% GDP growth looking very unrealistic. The official data released will spook shipowners who rely on the People’s Republic as the world’s key generator of cargo – both for imports and exports.

Real estate activity collapsed in April, with construction starts falling 44% year-on-year, official data showed.

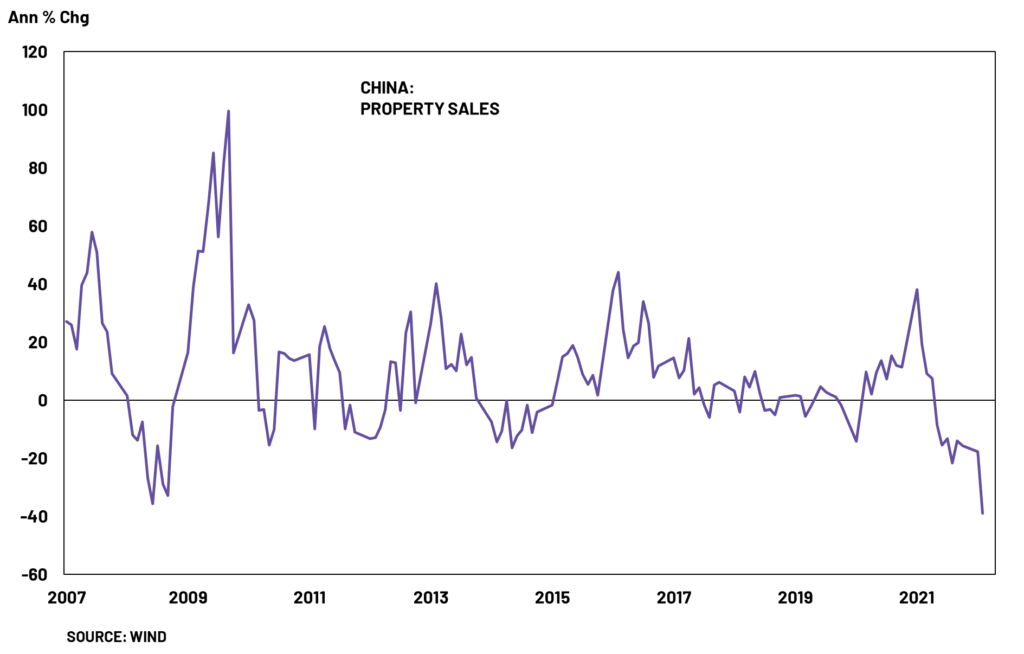

China’s housing market is now in a situation that is worse than the 2008 global financial crisis, new analysis from alternative asset management platform Clocktower Group suggests. The year-on-year growth of property sales has hit a 15-year low, despite all sorts of easing measures implemented by local governments over the past few months.

While the real estate figures showed the largest drops, all the indicators released by the NBS in Beijing yesterday were in the red. Retail sales were down 11.1%, industrial output off by 2.9% and manufacturing output down by 4.6%. The toll taken by Beijing’s zero-covid policy has become clear with up to a third of the Chinese population under some form of lockdown last month. Crude steel output was down by 5.2% last month, while apparent oil demand was also down by 6.7%.

“While the National Bureau of Statistics said in a statement that it expected the Chinese economy to stabilise once the temporary effects of the recent Covid outbreak have passed, significant parts of the headwinds predate the latest round of lockdowns and other restrictions. Hence, there is little to suggest that the Chinese economy will rebound sharply, and the case for additional stimulus measures has strengthened,” an update from commodities shipping platform Shipfix stated yesterday.

The 25-year property boom has run out of steam

Most China economy analysts are now forecasting the world’s most populous nation will suffer a quarterly GDP contraction in Q2.

Official unemployment figures are also a cause for concern, climbing towards the 7% mark in the 31 largest cities with the unemployment rate for those between 16 to 24 years of age rising to 18.2% — the highest ever.

While many shipowners are holding out hope for a sizeable stimulus package from Beijing – something that has bolstered shipping in the past – the fact is China has already spent big this year to keep the economy moving.

Infrastructure approvals by the National Development and Reform Commission (NDRC) are already running at 70% of the full-year total for 2021.

In a recent post, Neil Shearing, group chief economist at London consultancy Capital Economics, suggested that the constraints to any post-omicron covid recovery in China will signal the extent to which the past drivers of China’s growth no longer work.

“The 25-year property boom has run out of steam as urbanisation has slowed to a crawl and the population of young homebuyers has gone into decline. Exports lifted China to becoming the world’s major goods exporter but, outside the extraordinary circumstances of a pandemic, they can’t lift it any higher. Credit-fuelled investment has given China world-beating infrastructure, but increasingly is contributing to financial overhangs that threaten the stability of its banking sector,” Shearing wrote in a widely read article on his company’s website earlier this month.