Liner CFOs faced with ‘one of the most unpredictable years in recent times’

Chief financial officers at global liners have had severe difficulties in providing financial forecasts in the 2020s to date, with early annual forecasts often proving to be out by billions of dollars.

Like the pandemic earlier on, the Red Sea shipping crisis is this year’s great unknown for liner fortunes leading to massively divergent earnings before interest and taxes (EBIT) forecasts – stretching to as big as $5bn.

Alphaliner has suggested in its most recent weekly report that 2024 is shaping up as “one of the most unpredictable years in recent times” for the container industry.

Geopolitics introduces considerable uncertainty to our group’s outlook

Available EBIT earnings guidance for 2024 has Maersk forecasting anywhere from a loss of $5bn to break even, Hapag-Lloyd suggesting a 2024 EBIT of anywhere from a $1.1bn loss to a $1.1bn profit, while ZIM has forecast a range from a $300m loss to a $300m profit.

“Forecast ranges remain wide as long as the Red Sea crisis and problems in the Panama Canal continue,” Alphaliner stated with some 90% of all boxships giving the Suez Canal a miss at the moment thanks to the ongoing Houthi attacks on merchant shipping.

“Predicting liner profitability is very challenging in the best of times as it’s dependent on so many moving parts, but when you throw in major disruptive events with no clear timeline, things get even murkier,” commented Simon Heaney, who heads up liner research at UK consultancy Drewry.

Hapag-Lloyd CEO Rolf Habben Jansen said his company currently anticipated a normalisation to the Red Sea shipping crisis some time between end-Q2 and end-Q3. Likwewise, ZIM has predicted a strong first half for the year but a potential return to the weak rate levels of October/November 2023 in the second half.

Robert Mærsk Uggla, chairman of AP Moller-Maersk, speaking at his company’s annual general meeting last week, said: “Geopolitics introduces considerable uncertainty to our group’s outlook.”

Military conflicts, he said, had reached the highest level in decades.

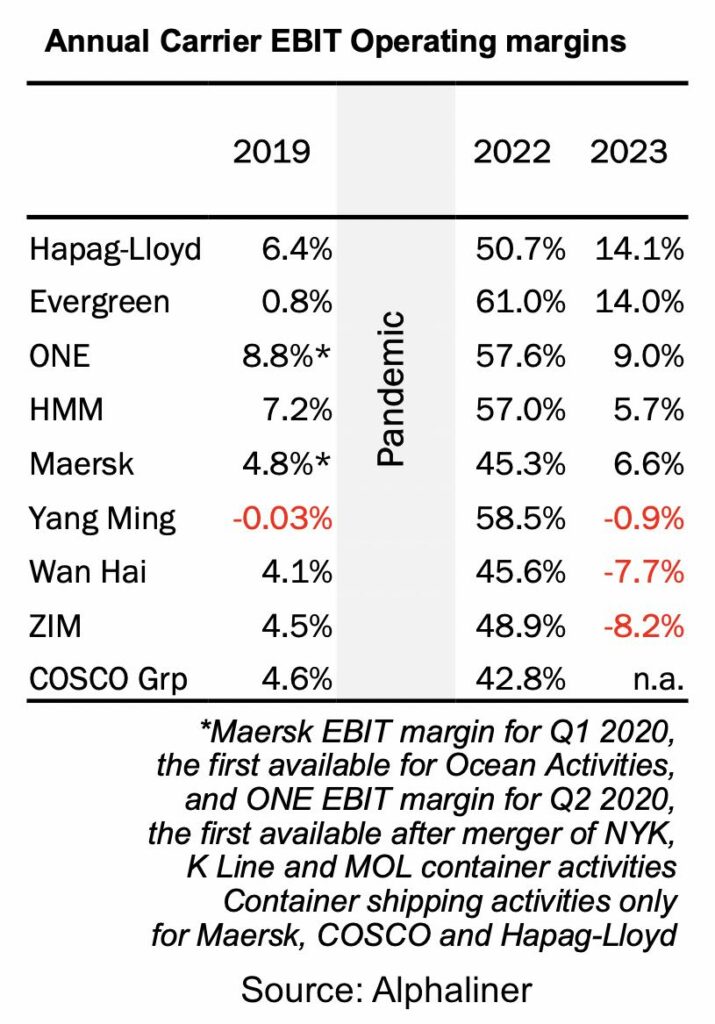

With all global carriers that publish results now having issued their latest quarterlies – bar COSCO – quarterly margins for the period October to December last year went back to levels last seen in early 2018, and below the -0.2% average reported in the decade before covid, according to data from Alphaliner.

“Revenues are also down to pre-pandemic levels, while freight rates are only slightly elevated compared to those years. Volume growth on a global level has been marginal,” analysts at rival organisation Sea-Intelligence noted.

“All liners that provided guidance were unanimous that notwithstanding the Red Sea uplift, the structural overcapacity will drive weaker profitability in 2024 vs 2023,” states a report issued by HSBC earlier this week.

“Their guidance bakes in volume growth of 2.5-4.5% and freight rates rapidly normalising in 2H24 vs 1H24 with the inflow of new tonnage,” HSBC added.

Contract negotiations on the transpacific have been reported as very hard to conclude with shippers and liners finding a huge gap, some $1,000 per feu apart, according to data from Xeneta, a freight rate platform.

Spot freight rates tumbled for the sixth consecutive week as the Shanghai Containerized Freight Index (SCFI) shed a further 6% last week with analysts at Asia-based Linerlytica forecasting more cuts still to come.

“Carriers failed to push through a mid-March rate increase, with hopes for an April rate hike also fading quickly,” Linerlytica noted.

Analysts at Sea-Intelligence predict that in a steady-state situation of keeping a round-Africa routing, spot rates will gradually decline throughout the year, on average, as the industry grapples with record volumes of newbuilds leaving docks at Asian shipyards.

Data from shipowning organisation BIMCO shows 1.31 boxship newbuilds are delivering each day, every day this year.

“Managing global container shipping supply chains today and going forward is very much a matter of managing risk,” commented Peter Sand, lead analyst at Xeneta. “Being better at assessing what might hit you – and having contingency plans in the drawer ready to deploy – is vital. This goes for the carriers, carrier CFOs as well as global shippers.”