Long-term rates propel liners towards historic highs

Further evidence of the record profit year for liner shipping was published today. Hapag-Lloyd’s interims showed a net profit of EUR8.7bn ($8.94bn) for the first six months of the year, more than three times the number a year earlier, as high contract rates more than recompensed for a falling spot market.

Revenues in the January to June period rose 94% to EUR17bn, with average freight rates of $2,855 per teu, up 77% from a year earlier, lending credence to a report from Blue Alpha Capital, covered by Splash yesterday, that is predicting liner shipping as a whole is on course to smash last year’s record collective profits by as much as 73%.

Blue Alpha Capital sees container shipping registering a net profit of $256bn this year, while UK consultancy Drewry has forecast an even higher figure, at $270bn.

Rolf Habben Jansen, CEO of Hapag-Lloyd, commented today: “We are currently seeing the first signs in some trade lanes that spot rates are easing in the market. Nevertheless, we are expecting a strong second half of the year. The currently still strained situation in the global supply chains should improve after this year’s peak season.

The spread between the long- and short-term rates is diminishing and, in some cases, turning negative

Looking at how Hapag-Lloyd, the world’a fifth largest carrier, had registered such a strong growth in average freight rates, Lars Jensen, CEO of consultancy Vespucci Maritime, stated, via LinkedIn, “This is essentially the same as seen with Maersk and shows the impact of the increasing contract rates in 2022 even though spot rates have been declining.”

Maersk, the world’s second largest container line, revealed earlier this month it expects to register a record profit of $31bn for the full year, also citing the strong long-term freight rate environment.

The liner turnaround during the pandemic is unprecedented in the history of shipping with many pointing out that container shipping as a whole is now more profitable than the biggest names in tech. It is also worth bearing in mind that an analysis performed by McKinsey before the pandemic showed that the liner industry as a whole lost some $100bn over a 20-year period.

Looking at liner prospects for the remainder of the year, Hua Joo Tan, who heads up container analysis firm Linerlytica, told Splash: “Earnings will remain strong in the third quarter despite the recent spot rate weakness.”

Tan cautioned he expected a larger correction in the fourth quarter with weaker slack season demand putting further pressure on freight rates.

“The pace of the decline will depend on how quickly carriers can adjust supply to the weaker demand,” Tan said.

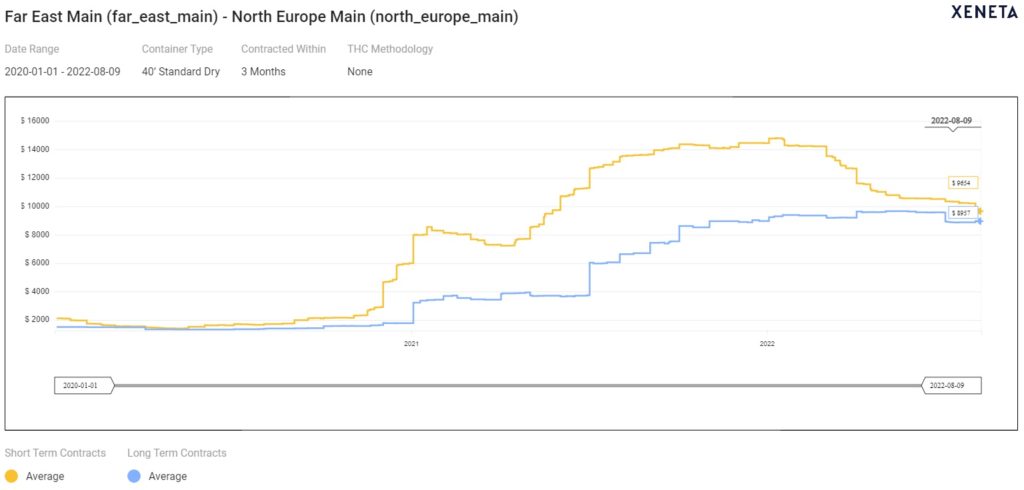

Declining spot rates on the Asia to US west coast and east coast ocean freight trades have converged with historically strong long-term rates, presenting “business opportunities” for both carriers and shippers, a new report from freight rate platform Xeneta suggested today.

According to Xeneta, spot rates to the east coast have now fallen by 26.9% or more than $3,400 per feu this year, while those from Asia to the east coast have slumped by one third or $3,200.

Long-term rates, on the other hand, have “sky-rocketed”, the Xeneta report stated. 2022 has seen long-term contracted prices soar by 103.5% for east coast trades and 96.9% for the west coast.

It’s a development that offers “new strategic openings” for ocean carriers and their customers, according to Peter Sand, chief analyst at Xeneta.

“We’re noticing a similar pattern across a number of key global trade corridors,” Sand said. “The spread between the long- and short-term rates is diminishing and, in some cases, turning negative. This is of interest to both sides in the ocean freight value chain.”

Long-term rates for the trades are, at present, moving sideways according to Xeneta, while spots continue to dip. Short-term rates on the west coast routes are already below long-term prices, with the same negative spread likely to take place later in August on the east coast trade.

Speaking with Splash, Sand agreed with his analyst peers that liner shipping was firmly on course to smash last year’s record results.