New UCL report claims $850bn of LNG-capable tonnage risks being stranded by 2030

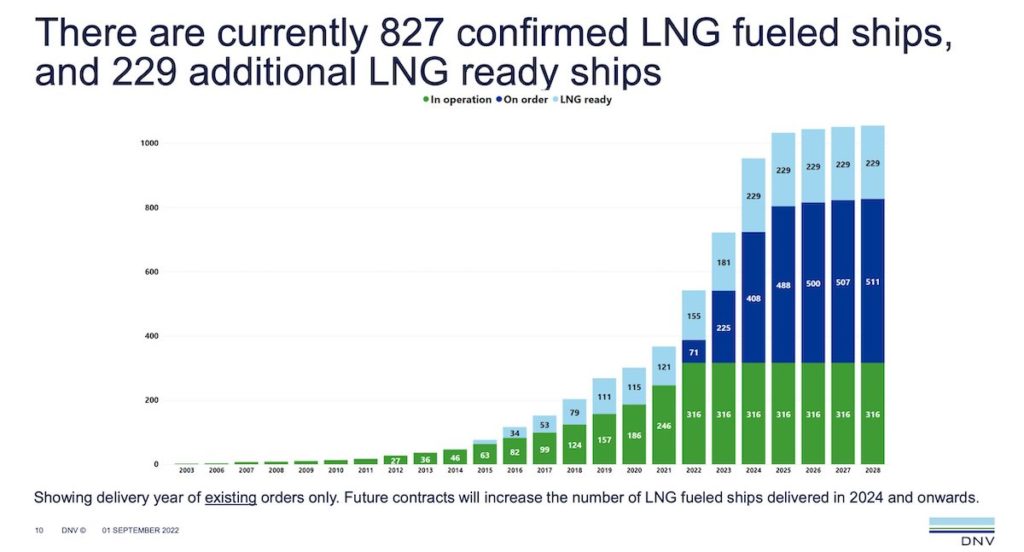

A new report from the influential UCL Energy Institute argues that as much as $850bn of tonnage is at risk of being stranded by 2030 if the shipping sector continues investing in LNG-capable ships as policies that incentivise shipping to decarbonise in line with the Paris Agreement would erode the value of more expensive LNG-capable vessels to be similar to that of lower cost conventional vessels.

The new study, which features well-known green shipping academic Dr Tristan Smith as one of the four co-authors, is the latest in a barrage of attacks on LNG as shipping’s transition fuel.

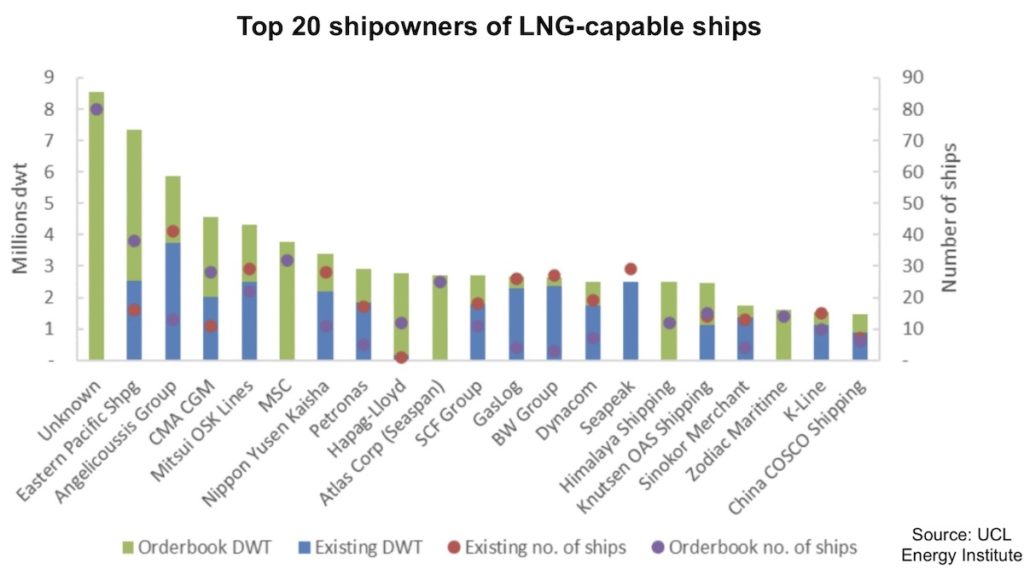

Policies that incentivise shipping to decarbonise in line with the Paris Agreement, if in place by the end of the decade, would bring in zero emissions shipping, against which the existing fleet would be competing, whilst also being incentivised to switch away from the use of fossil fuel, the report suggests. The 45-page study will make for especially tough reading for the likes of CMA CGM and MSC, shipping lines among the most heavily invested in this under-fire transitional fuel.

The longer we leave the LNG transition running and then switch, the more painful it will be

Whilst policy and competition would affect all ships built to use fossil fuels, the analysis suggests that more expensive LNG-capable assets – also known as LNG dual-fuel – would see reductions in their value to match the value of similar aged but lower-cost conventional vessels designed to use fuel oil.

The report titled ‘Exploring methods for understanding stranded value: case study on LNG-capable ships’ finds that the write-down of the full $850bn value at risk is not realised if LNG-capable vessels retrofit to run on scalable zero emission fuels such as hydrogen and ammonia. Under these circumstances, the stranded value is estimated at approximately 15-25% of their value.

LNG has been portrayed as a transitional fuel for the shipping sector, but there is a growing campaign questioning its environmental benefits when considering a full lifecycle analysis of emissions and accounting for greenhouse gases (GHG) emissions as well as methane slip.

The World Bank shocked many in shipping in April last year with the publication of a maritime decarbonisation report in which it specifically recommended countries pull back from investing in further LNG bunkering infrastructure.

Similarly, the Intergovernmental Panel on Climate Change (IPCC) has been highlighting of late in far greater detail the harmful effects methane is having on the planet, something that has given many shipowners pondering LNG-fuelled newbuilds pause for thought.

The least-cost pathway for shipping to meet its required shift away from fossil fuels is to a mix of electrification in short-sea shipping, and use of scalable hydrogen and hydrogen-derived fuels such as ammonia and methanol for deep-sea shipping, the new UCL report urges.

Marie Fricaudet, lead author and PhD student at UCL Energy Institute, said: “The findings highlight that the risk of stranded assets is very material in the shipping sector. The longer we leave the LNG transition running and then switch, the more painful it will be and technology lock-in during this crucial decade will create more resistance to change later.”

Like last year’s headline-grabbing World Bank report, the new UCL study argues that governments should not use public funding to exacerbate the creation of stranded value and identifies methods that investors can use to identify the risks posed by climate change on shipping assets.

“Shipowners and financiers should consider not ordering LNG-capable ships and investing in conventionally fuelled ships which are designed for retrofit to zero-emission fuels,” the report’s authors advise.

For existing LNG-capable ships, they said investors should consider ways to manage the risk of stranded value such as factoring in the cost of retrofit at the point of newbuild or using a steeper than linear depreciation curve.

Faced with repeated criticism, SEA-LNG, shipping’s lobby group in favour of the chilled gas as a transitional fuel, stated in a release yesterday: “Waiting is not an option – LNG as a marine fuel delivers immediate GHG benefits and a lower risk, lower cost, and has an incremental pathway to zero emissions through bioLNG in the near term and e-LNG in the mid to long term.”