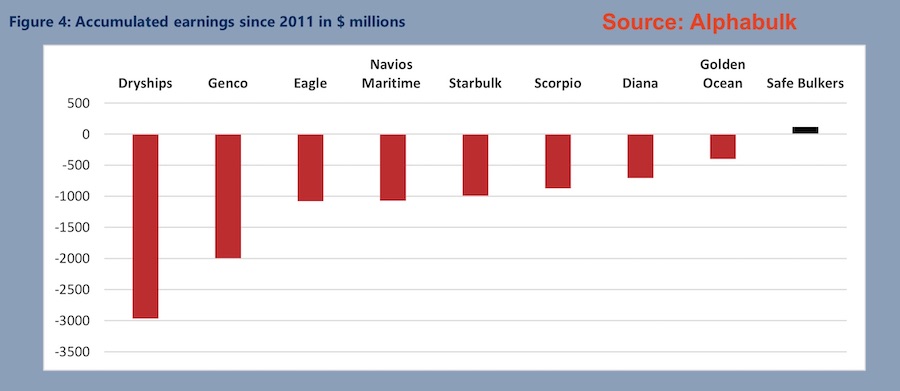

Nine US-listed bulk firms have lost $11.33bn over the past 10 years

Alphabulk, part of AXS Marine, has launched a withering attack on the poor financial performance of US-listed dry bulk companies over the past decade. With most companies still in the red in Q1 and likely for Q2, Alphabulk has run the numbers on nine US-listed dry bulk companies from 2011 to the present day. In total, they have notched up an accumulated loss of $11.33bn in 10 years – an average loss of more than $1bn per company over the period.

The report looked at the losses of Dryships, Genco, Eagle Bulk, Navios Maritime, Starbulk Carriers, Scorpio Bulk, Diana Shipping, Golden Ocean and Safe Bulkers.

The worst performer over the past decade has been Dryships with an accumulated deficit just shy of $3bn. Dryships is followed by Genco, at $2bn.

Only one company has managed to stay in the black, Safe Bulkers, with a $114m profit over the period and just three years in the red.

“If shipping doesn’t belong on the stock exchange, why is it that we have all these listed companies?” Alphabulk mused in its latest weekly report. “The answer to that question is to be found in personal enrichment. Both on the investor and the management side, a listed company can lead to an incredible and perfectly legal accumulation of personal wealth.”