American port congestion shows no sign of easing

There’s no let up in the port congestion plaguing American gateway ports.

Changed buying patterns brought about by the pandemic have brought extreme consumer demand into North America. This combined with Covid outbreaks at local dockworking forces and a shortage of container equipment have created what many liner executives have described as the perfect storm in recent weeks.

Splash has surveyed the 10 largest container ports in North America today using vessel tracking site MarineTraffic and picked out the three ports with the biggest vessel backlogs.

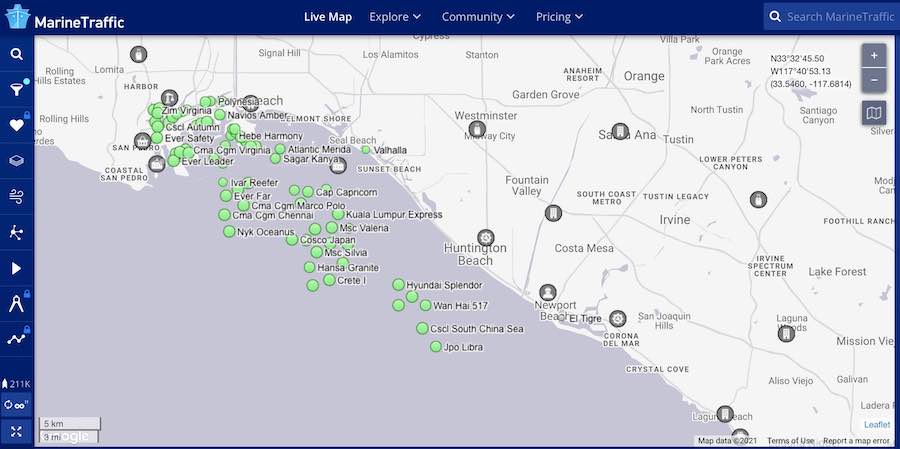

More than 30 ships are anchored in San Pedro Bay (see map below left), waiting to berth at Los Angeles and Long Beach, the queue stretching 20 km down the coastline.

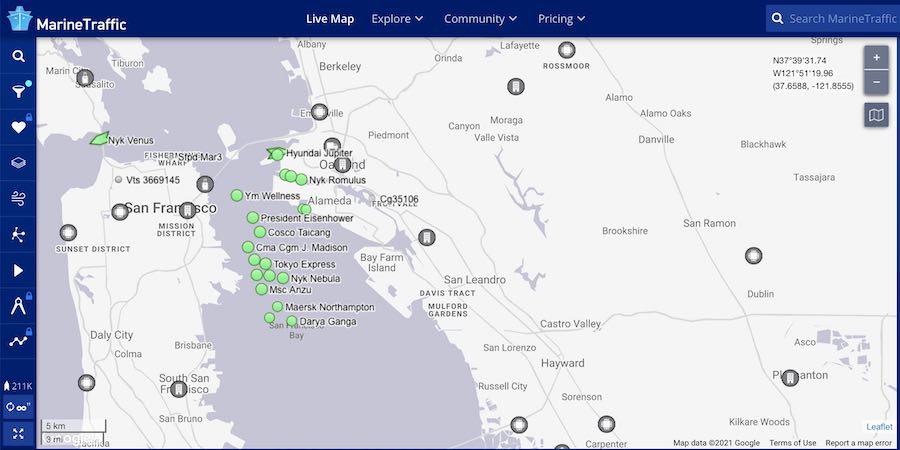

Further north in California, 12 ships are waiting in Oakland (see map above right).

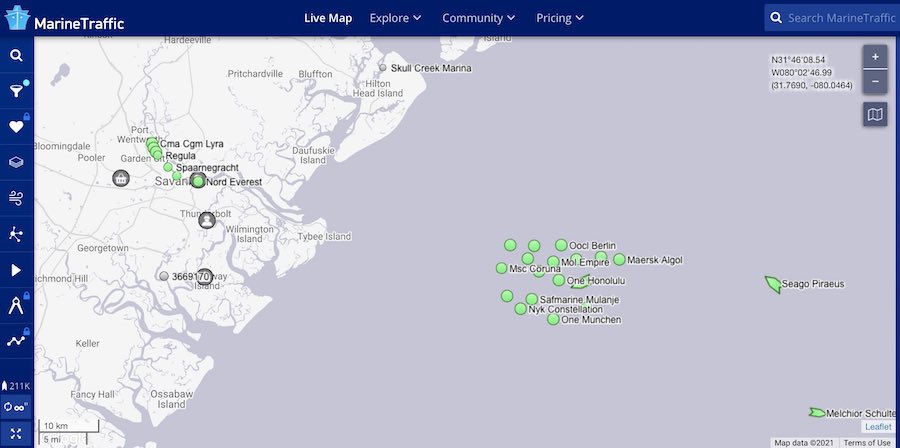

On the east coast congestion is overall far less but there are still pockets of heavy traffic, notably at the port of Savannah (see map above) where 13 vessels are anchored this morning waiting for a slice of quayside to become available.

There is little sign that the congestion easing, with Gene Seroka, the head of the port of Los Angeles, saying recently that it would take a month just to clear all the ships at anchor at his port, let alone all those still inbound from Asia.

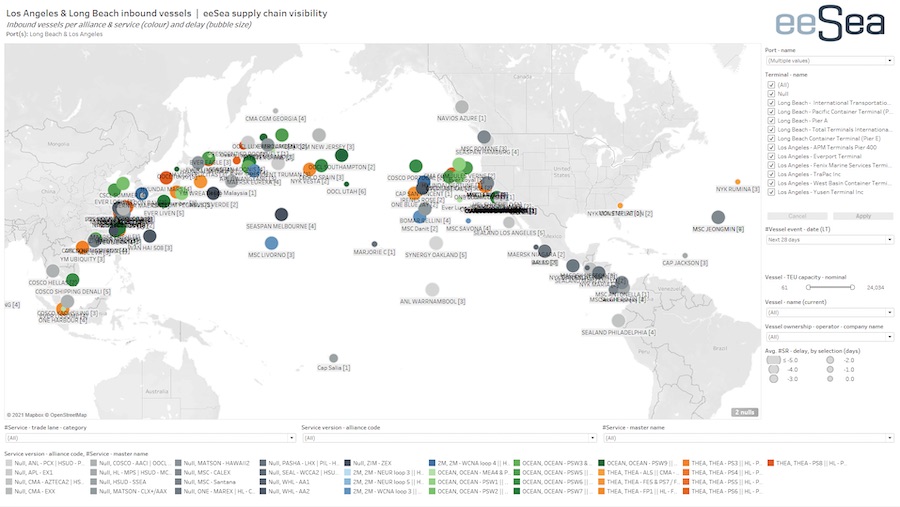

The problem the ports face is there is no let-up in inbound vessels as the below map from eeSea showing all inbound vessels for Los Angeles and Long Beach in the coming 28 days clearly highlights.

The National Retail Federation (NRF) said this week that imports will surge on both coasts. NRF is forecasting what could turn out to be record retail sales growth in 2021.

Liners are taking action to avoid the worst of the congestion. Alphaliner reports this week that heavy port congestion in Los Angeles and Long Beach has prompted Maersk and MSC to decouple the transpacific strings of the two Europe – Asia – US west coast pendulum services in their joint 2M network to reduce the exposure of the Europe – Asia strings to port delays.

Shippers were told at TPM, the world’s top container conference, held earlier this month that they’ll need to wait through to the second half of the year before any semblance of normality returns to container trade flows.

Jeremy Nixon, the CEO of Japanese carrier Ocean Network Express (ONE), said at the event: “Frankly we’ve probably got another three to four months to work this through. Hopefully by the second half of 2021 we should see a more stabilised trade.”

Rolf Habben Jansen, the CEO of Hapag-Lloyd, told TPM delegates that today’s strong volumes would continue for “quite some time”.

“We will get to some kind of normalcy hopefully within one or two quarters,” the Hapag-Lloyd boss said.

The bottlenecks in the container market have now spread from the US to Asia with S&P Global Platts reporting last week that waiting times in Singapore, the world’s top transhipment hub, for boxships with a capacity of 18,000 teu and above are currently five-to-seven days from the normal two-day turnaround, a problem compounded by many feeder lines arriving late as global supply chains struggle to beat today’s container chaos.