Offshore rebound spurs OSV fleet reactivation, demand for modern tonnage

Growing investment in offshore exploration and production and a rising rig count will increase demand for offshore support vessels (OSVs) over the next two years, according to joint research from Braemar ACM Shipbroking and Westwood.

Contracted jackups are at a six-year high, with effective utilisation at 82%. Meanwhile, global drillship effective utilisation reached 79%, its highest level since 2014.

Vessel owners have been reactivating their fleet to take advantage of the increased levels of offshore activity. By the end of the first quarter, the total layup fleet fell by 32%, the lowest since 2016, with 321 vessels either reactivated, scrapped or written off.

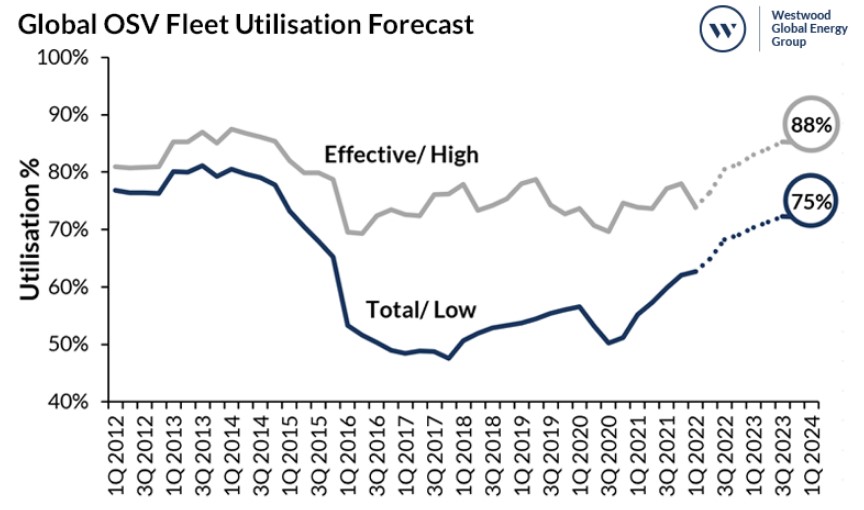

Total utilisation for the global OSV fleet currently stands at around 63%, which is a 7% increase from 2021. With the anticipated rise in rig demand, utilisation is expected to increase even further over the year.

However, only 33% of the current global laid-up fleet consists of what analysts described as premium vessels, or those less than 15 years old. “OSVs over 15 years old and stacked for longer than three years are deemed highly unlikely to re-enter service,” Braemar and Westwood said.

The report found that assuming no further scrapping, improved demand alone would increase utilisation to 75% by 2024. Meanwhile, utilisation could reach 84% if ships older than 15 years are scrapped and up to 88% should the entire laid-up fleet be removed from the market.

It also stressed that complying with local content, age restrictions and low emission requirements from operators will put increasing pressure on owners with ageing fleets. Analysis showed that over the next two years, 430 vessels will pass the 15-year age mark and be considered non-premium.

The total orderbook of registered International Maritime Organization (IMO) newbuilds now stands at 215. However, only 67 are considered Tier 1 vessels and are likely to be delivered in the next 12 to 24 months.

“It wasn’t all that long ago there was a heavy oversupply issue in the OSV market, however, the issue facing owners today is not the sheer number of OSVs but the age and quality of available tonnage and whether owners can raise the capital to invest in newer, cleaner vessels for future offshore operations as E&Ps continue to focus on age restrictions and lowering their overall emissions,” analysts concluded in their report.