Pace of boxport capacity expansion forecast to contract at least 40% in the wake of coronavirus

The pace of container port capacity expansion is forecast to contract at least 40% over the next five years in the wake of the Covid-19 induced slowdown in port throughput, according to the latest Global Container Terminal Operators Annual Review and Forecast report published by consultancy Drewry.

Global container terminal capacity is projected to grow at an average annual rate of 2.1% over the next five years, equating to an additional 25m teu a year. This is well below the capacity growth seen over the past decade, when the average annual increase was more than 40m teu a year.

Port throughput is projected to grow at an average annual rate of 3.5% over this period from 801m teu in 2019 to reach 951m teu by 2024. But risks remain to this outlook should a resurgence in Covid-19 cases cause further widespread economic lockdowns over the forecast period.

Our five-year forecast for global container port handling has been cut back drastically due to the Covid-19 pandemic, and the risks remain heavily weighted to the downside

Eleanor Hadland, author of the report and Drewry’s senior analyst for ports and terminals, said: “Our five-year forecast for global container port handling has been cut back drastically due to the Covid-19 pandemic, and the risks remain heavily weighted to the downside.”

As a result of the pandemic operators and port authorities are actively reviewing delivery of planned projects in the light of the drastic slowdown in economic growth and uncertain short-to-medium-term outlook.

“Major expansion projects and greenfield projects that are already under construction and due for commissioning in 2020 and 2021 may face minor delays due to interruptions to global supply chains during H120,” added Hadland. “However, for projects which are currently at an earlier stage of planning, particularly where construction contracts and equipment orders have not yet been tendered, suspension or cancellation is more likely if market conditions remain poor.”

In recent years global operators had already scaled back investment plans, with only limited greenfield projects in the pipeline. However, leading operators look set to continue to lead the way in terms of terminal automation.

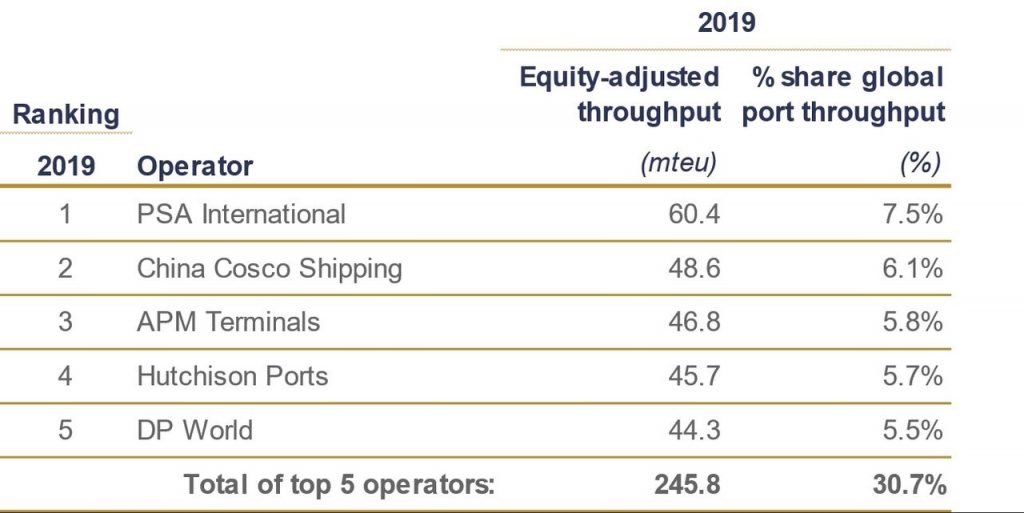

The report also contains a review of which companies are the top terminal operators in the world. Singapore’s PSA International tops the list, while former number one, Hutchison Ports has slipped to fourth place.