Panama Canal congestion plateaus

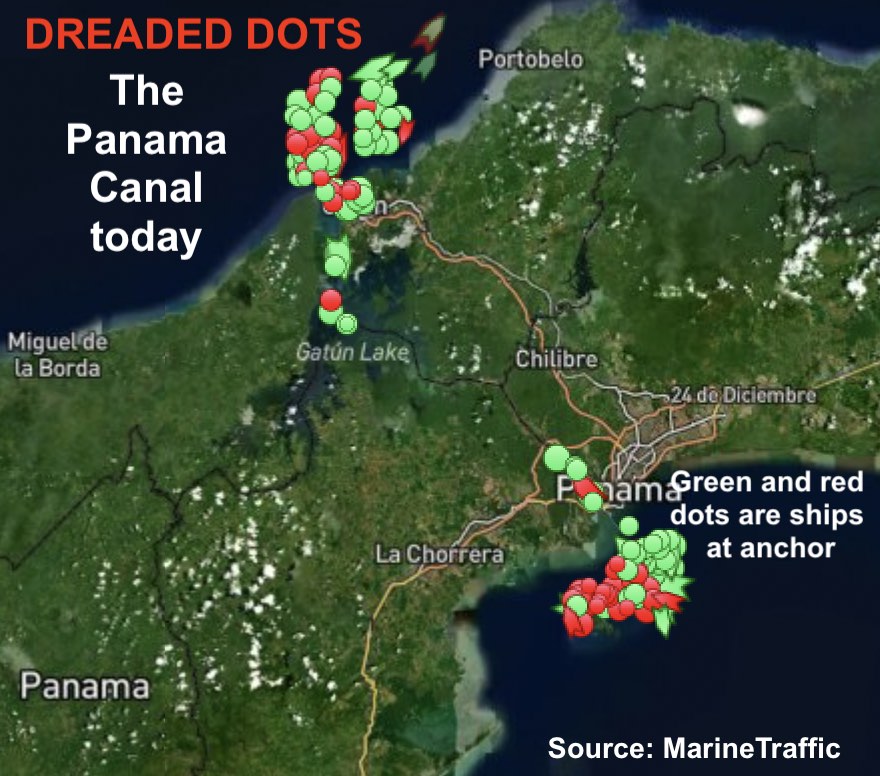

Vessel tracking data shows the worst of the congestion at the Panama Canal has passed for the moment. Nevertheless, it will take weeks to clear out the backlog of vessels waiting at both ends of the waterway, with the authorities also desperately hoping for more rain to avoid any further draft or transit restrictions, which have created enormous logjams in recent weeks.

As it stands there are around 150 ships waiting to transit the canal, a figure that had been climbing steadily since the Panama Canal Authority slashed the number of daily transits by 20% last month in a bid to conserve freshwater in what has been a year of unprecedented drought for the Central American country. Waiting times to transit topped 21 days last week, having started August at an already lengthy 15 days.

While the most attention has been placed on what the delays mean for the container sector, other shipping segments have been badly affected too.

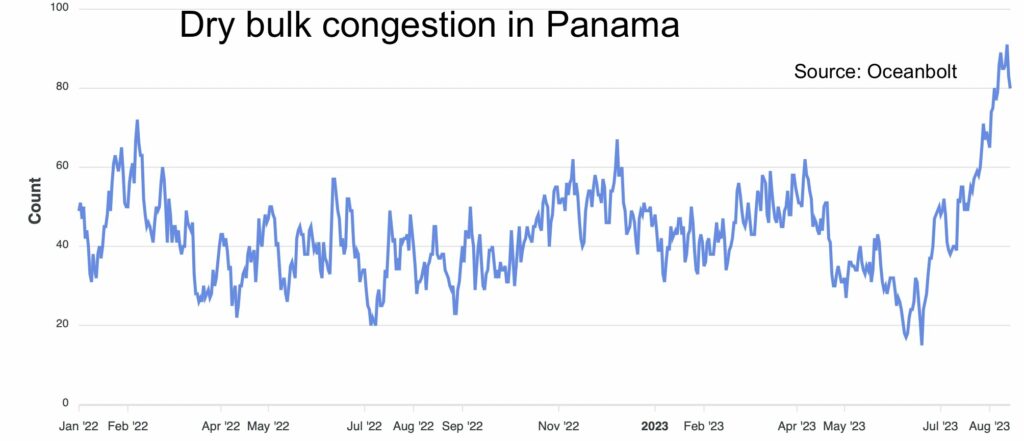

Commodity tracking service Oceanbolt shows dry bulk congestion this month has been the worst in the eight years of data the platform has on its site.

Data from shipping platform Sea shows there are currently 76 bulk carriers in the Panama queue, down from highs of above 80 earlier this month.

“Coal-laden ships out of the Atlantic are deviating from their preferred Panama Canal route due to increasing transit times,” analysts at BRS warned last week. Alternatively, shippers are looking at reducing cargo quantity and employing smaller bulk carriers such as panamaxes and kamsarmaxes.

According to Vortexa data, the number of tankers waiting in west coast Panama to transit reached at least a two-year high at the end of July, and still remains at historical highs. Data from Sea shows a total of 64 tankers waiting to pass through the canal today.

Container carriers have been busy eyeing alternatives as the backlog of ships built up. Andy Lane from Singapore container advisory CTI Consultancy told Splash last week that backhaul container services can go 2,000 nautical miles further through the Suez Canal or 5,000 nautical miles further around Africa. Some headhaul services can likely be switched also to Suez routings, he suggested.

“It just takes a few weeks of lead-time to be able make such network changes. The backlog is going to take months to clear it would seem, so it would be good for the container carriers to start planning now,” Lane urged.

Joe Monaghan, CEO of Worldwide Logistics Group (WWL), a global freight forwarder, told Splash: ”Typically, this situation lasts until rainier months occur. Historically that is October/November with the summer months being the driest. Once draft restrictions are lifted though it may take some time to clear the backlog depending on how acute it becomes. Until this situation resolves itself, we expect more cargo to move trans-Suez, especially from Hong Kong and south of Hong Kong where there would be little or no transit time disadvantage. We also expect to see more interest in intermodal rail and transloading to over the road options via west coast ports.”

While rains have returned to Panama, the authorities are unlikely to make any upwards revision on drafts or the number of transits anytime soon aware of the effects of this year’s El Niño weather phenomenon which tends to bring drier weather to the country later on this year.

Indeed, the canal authority has conceded it could take a hit of up to $200m in earnings for next year if conditions persist.