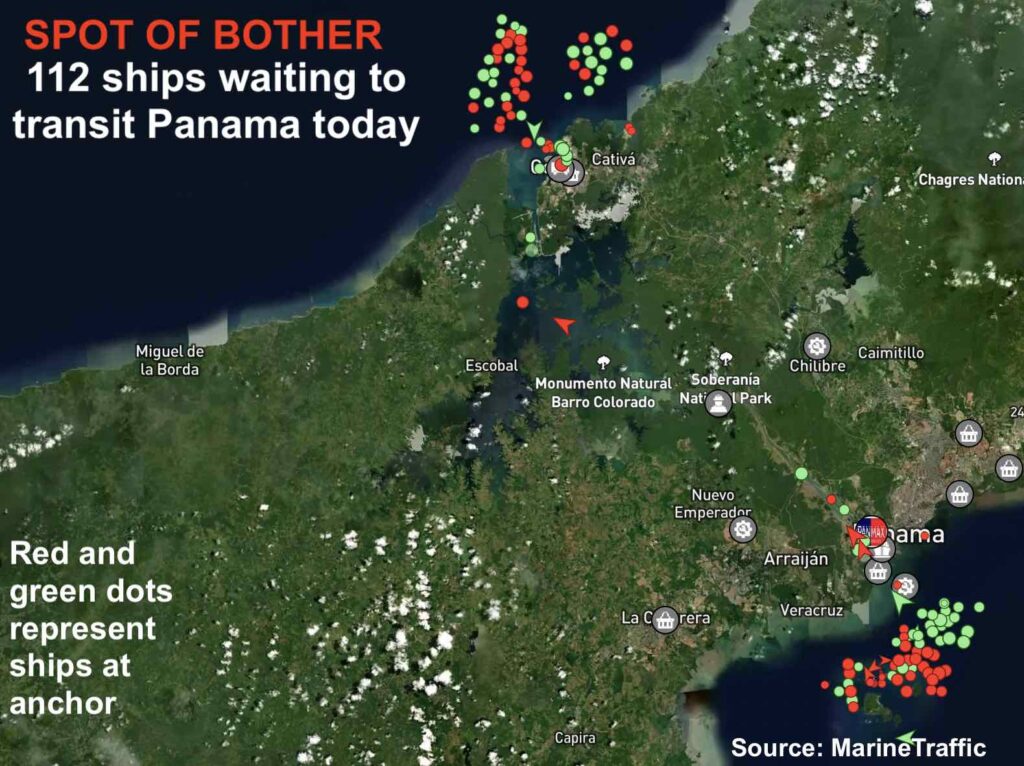

Panama Canal queue grows 13% in the space of 24 hours

The number of ships waiting to transit the Panama Canal has leapt by 13% in the space of just 24 hours as drastic transit cuts kick in at the drought-hit waterway that accounts for 3% of all global maritime trade.

Following the driest year on record, the Panama Canal Authority (ACP) has been cutting both daily transit volumes as well issuing draft restrictions across the canal, a waterway that requires 52m gallons of freshwater on average per vessel transit. Further significant transit cuts were announced last week that will over time see the number of voyages cut to just 18 a day by February, down from a maximum of 40 during normal times.

As of 02.30 am local time this morning, there were 112 ships waiting to transit the canal, up from 99 yesterday, and some 22 above the average 90 vessels recorded over the last seven years. At its worst moment, back in August of this drought-ridden year, the canal had more than 160 ships waiting to cross.

Many shippers and shipowners have decided to take alternative routes, aware of how containerships will gobble up the lion’s share of the limited available slots in the coming months.

“Wait, spend or sail around South America? These are the tough choices currently facing shippers looking to move goods between the US and Asia,” commented Judah Levine, head of research at online box booking platform Freightos.

Panama-based dry bulk operator Sagitta Marine warned that the ACP’s slot booking process which heavily favours large shipowners could lead to inflationary pressures for consumers across much of the Americas.

The containerised and large gas carrier sectors can easily pass costs on, leaving dry bulk owners “hung out to dry”, said Thomas Zaidman, Sagitta Marine’s managing director.

“This is effectively sidelining the myriad of smaller ships carrying cargoes that keep the lights on, the local economy functioning and people fed in developing countries,” he said.

The inevitable upcoming vessel deviations will have inflationary effects on prices for food and other commodities that will most likely affect Panama’s neighbour countries, he predicted.