Plateau nears for soaring boxship charter rates

The spectacular, vertiginous ascent seen in boxship charter rates over the last year is approaching a plateau, according to leading analysts.

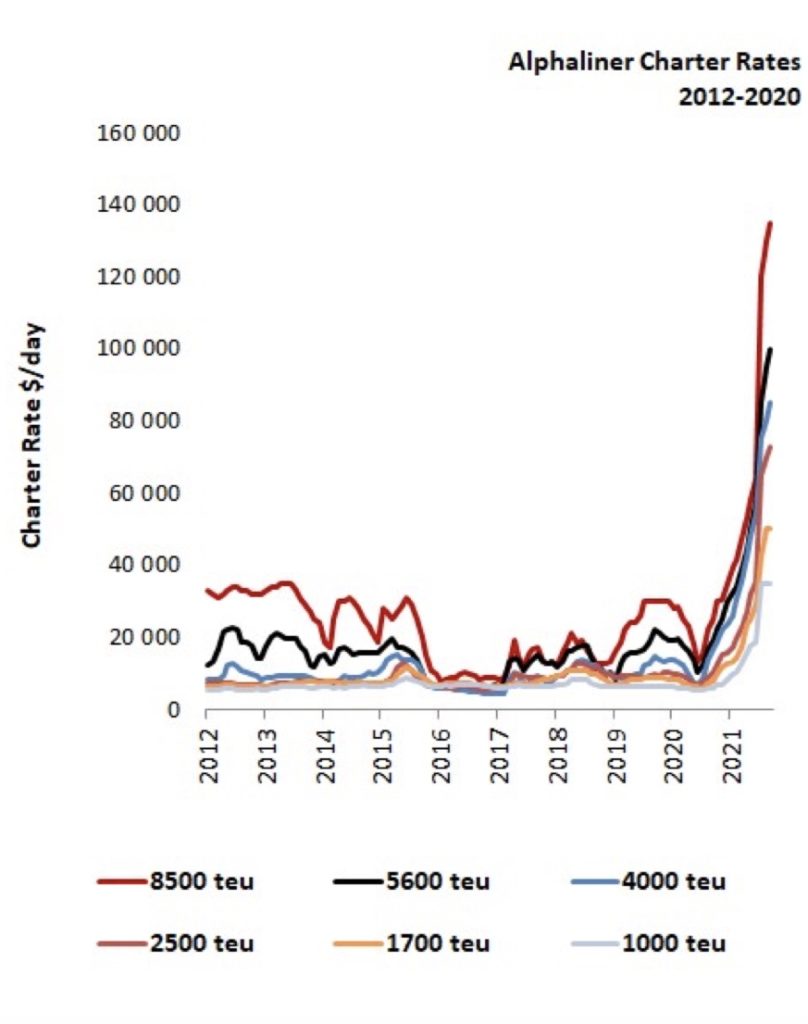

With ships of all shapes and sizes capable of carrying containers in red hot demand charter rates have leapt tenfold since the middle of last year, with desperate operators forking out up to $200,000 a day for ships in the 4,200 teu range. However, there are signs that the market is topping out in line with recent announcements by certain carriers that they are capping rises in spot freight rates.

Alphaliner suggested in its latest weekly report that charter rates are approaching their peak, with prices increasingly plateauing across the board, especially for long period charters.

Some large end users have a high motivation to pay top dollar for smaller vessels

“Standard tonnage in particular seems to be struggling to improve on last done deals, while higher specification units and smaller ships under 1,000 teu continue to record significant gains,” Alphaliner explained.

Alphaliner cited a slowing rise in container freight rates in the last weeks and a rebound in oil prices as reasons for the likely plateau.

However, charter rates on short charters up to six months continue to smash records.

While a plateau might be just around the corner, Alphaliner suggested there is no sign of a big drop in the charter market any time soon, since demand continues to far outstrip supply, with the situation unlikely to change until at least Q1 2022.

Commenting on charter rate patterns today, Simon Heaney, senior manager of container research at UK consultancy Drewry, told Splash there is a strong connection between freight rates and charter rates.

“With some carriers freezing prices – I expect more to follow – I think we are getting very close to peak spot rates, which in turn will limit further movement in the charter market,” Heaney said.

Drewry expects rates and charter prices to slow, but to still remain high, at least for the duration that supply chain disruption lasts.

“Charter rates might stay high for longer due to the longer fixture periods that have been locked in,” Heaney suggested.

Taking a different view was Alexander Geisler from the Hamburg and Bremen Shipbrokers’ Association, publishers of the weekly New Contex boxship chartering index. Geisler argued in conversation with Splash that so many new entrants into the sector would help prop up rates for some time yet.

“At the moment there is low activity across all segments due to the lack of supply, particularly for the larger sizes as there are hardly any vessels available above 4,000 teu in 2021,” Geisler pointed out, adding: “But unless we see a declining of container freight rates, some large end users have a high motivation to pay top dollar for smaller vessels and do everything alone.”

The New Contex short-term assessments for six months on 1,100 and 1,700 teu ships still has what Geisler described as “excessive upside potential” and are, compared to the freight rate market, heavily undervalued.