Record Chinese covid cases spark concern

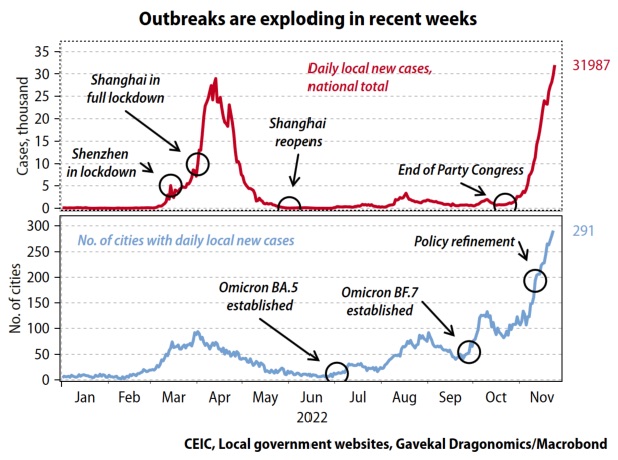

The number of covid cases in China has spiked to record highs this week as officials ordered lockdown measures in major cities, including Zhengzhou, where protests were staged at the largest iPhone factory in the world.

More than one-fifth of China’s total gross domestic product (GDP) is currently under lockdown, according to a report issued yesterday by finance group Nomura. Hotspots include Guangzhou, Beijing and Chongqing. The report also projected the amount of GDP affected by lockdowns would continue to rise in the coming weeks as China deals with its biggest covid case surge since the start of the pandemic. Bearish Nomura is forecasting Chinese GDP growth of just 4.3% next year.

Many headlines have been made from Zhengzhou where workers for Foxconn have battled police this week in covid riots. Exports from there are slipping. Henan province, which is home to Foxconn’s mega iPhone factory, assembled and exported 8.4m smartphones in October, down by 16.9% from 10.2m in the previous month, according to Chinese customs data.

A longer-than-expected covid reopening may shave almost one percentage point off China’s GDP growth next year, according to Oxford Economics.

If China pushes back its economic reopening to the first half of 2024, an anticipated recovery in private consumption will be delayed, Oxford Economics’ senior economist Louise Loo wrote in a Friday report. That may knock almost a full percentage point off the firm’s projected growth forecast of 4.2% for 2023.

“Disruptions to household spending and industrial activity may put the brakes on growth and dampen appetite for petrochemical imports,” researchers at Singapore-based Eastport Maritime stated in a daily update today.

China’s zero covid policy has created an industrial slowdown across the nation, the world’s most important country for shipping demand. This has been reflected in China’s dry bulk commodity import demand, which has declined by 4.7% year-on-year to 1.6bn tonnes across the first 10 months of the year.

“Given the worsening impact of the lockdowns and the strong rise in Covid cases this month in particular, we expect to see more stimulus measures put in place before the new year as sentiment in the country’s real estate market continues on a downward trajectory,” analysts at Braemar suggested in a new dry bulk report.

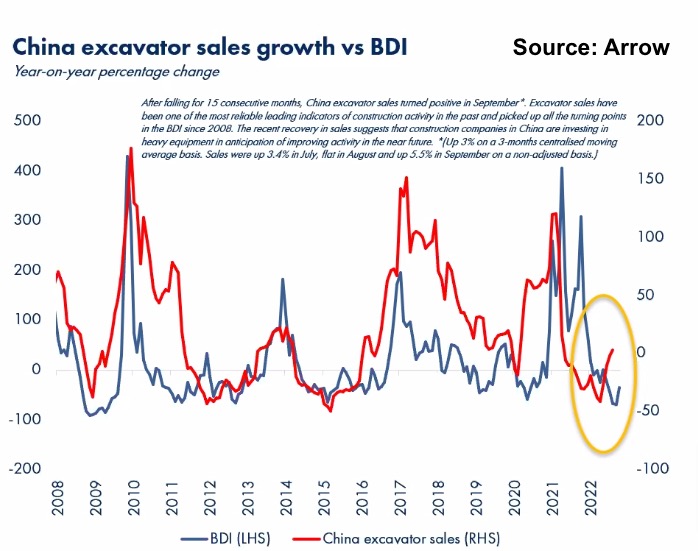

One positive spin for dry bulk can be found in the local sales of excavators, something that has shown a remarkable correlation with the Baltic Dry Index over the past decade. A presentation from brokers Arrow earlier this week showed how excavator sales recently turned positive for the first time in 15 months.

Construction companies invest in heavy equipment, only if they anticipate a demand recovery, Burak Cetinok, Arrow’s head of research said, pointing out that despite all the depressing covid headlines infrastructure investments are up strongly this year, something that could be bolstered by the 16 measures Beijing has announced this month to help deal with the moribund property sector.