Secondhand sales volumes set for highs not seen since 2007

Further evidence of the boom times shipping has entered – not seen since the bull-run of 2003 to 2008 – comes from the extraordinary volume of ships being bought and sold so far this year, which if it continues could see more than 7% of the deadweight fleet change hands in 2021, the highest level seen since 2007, new research from Clarkson Research Services suggests.

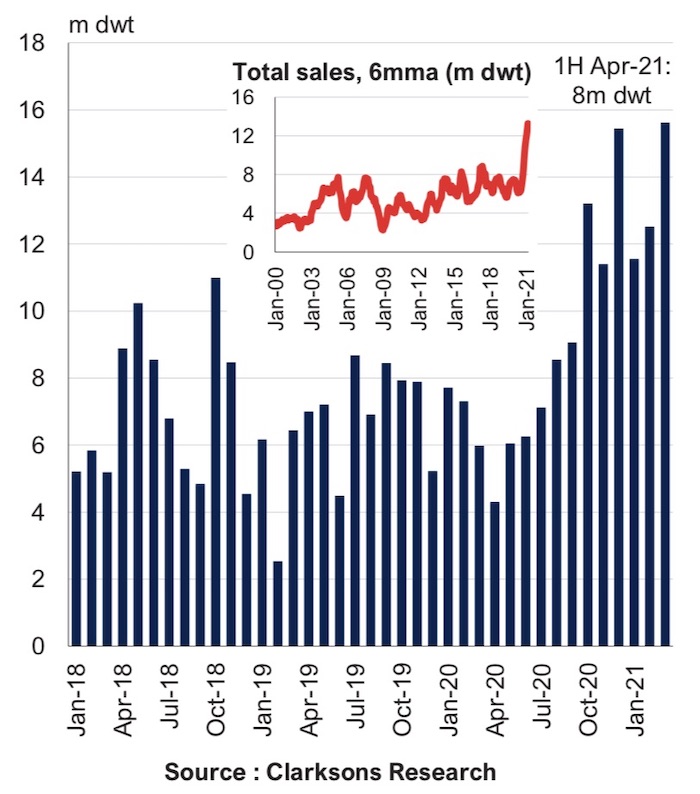

The secondhand sales surge first became evident in the final quarter last year. It ramped up this year with a record 590 ships – or 40m dwt – sold in Q1, according to Clarksons, and sales remain very firm throughout April.

Bulker sales reached a record 19m dwt in Q1 while boxship sales also surged with a record 122 ships of 0.4m teu sold, with charter owners accounting for 90% of capacity sold. Moreover, despite pressure on tanker market conditions, Q4 2020 and Q1 2021 have represented the two strongest ever quarters for tanker sales.

Overall, October to to March saw 50% more capacity sold than the previous most active six month period tracked by Clarksons.

“At the current pace, over 7% of fleet dwt would change hands in 2021, the highest level since 2007, compared to an average of 4% over the last decade (2004 peak: 9%),” the latest weekly report from Clarksons noted.

With the number of ships sold accelerating, prices have also headed north. Clarksons’ overall secondhand price index had risen by 33% since September last year to a seven-year high as of April 16.

The graph below from Clarkson Research Services shows the total monthly volume of reported secondhand vessel sales since start 2018, across all shipping sectors, in million dwt. For deeper historical context, the inset graph shows the six-month moving average of secondhand sales over the last 20 years.