Ship finance barometer shows first uptick for 11 years

The Petrofin Index for Global Ship Finance, a key barometer for the sector, showed its first uptick in 11 years, in an annual report issued from Athens this week.

The index, which commenced at 100 in 2008, was up by one point to 63 for results tallied for last year.

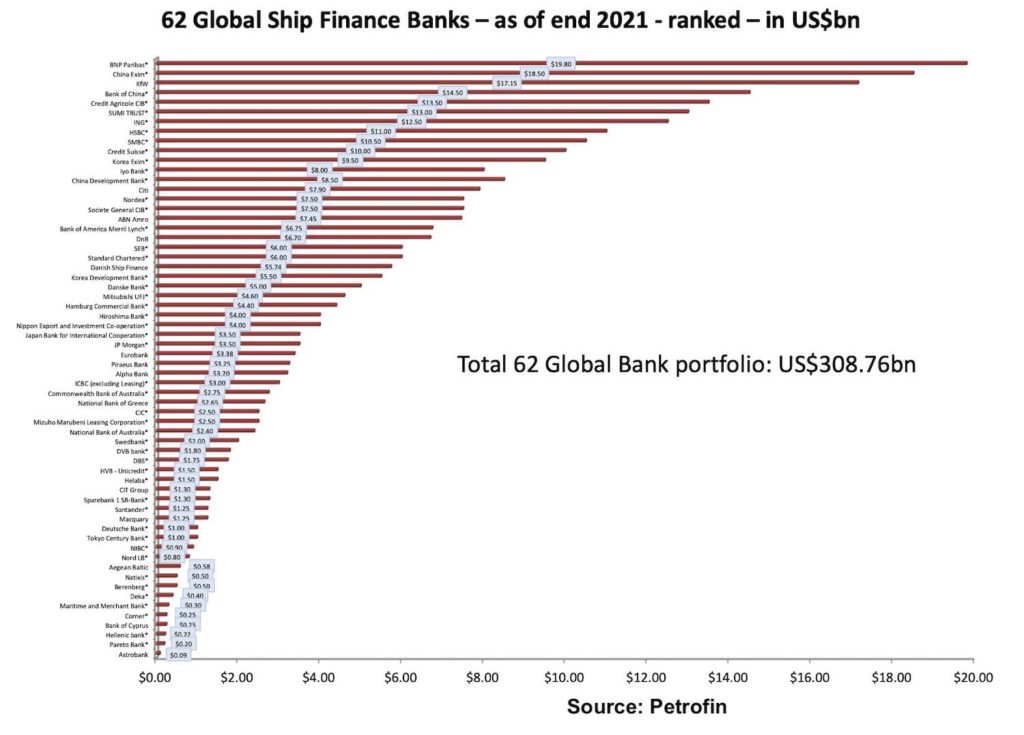

Moreover, the top 40 banks’ lending to shipping in 2021 was higher at $290.12bn from $286.9bn in 2020, thanks to the growth of Greek, Asian and Australian banks.

Bank lending in 2022 has been disrupted as caution prevails

According to Petrofin Research, global ship finance, including all forms of lending, leasing and alternative providers, totalled approximately $500bn. The total global bank lending of all banks, including local banks, amounts to approximately $340bn, roughly two-thirds of the global ship finance total.

On the banking podium there were no changes from last year’s annual report with BNP Paribas at the top of the rankings followed by China ExIm and KfW.

“There is increasing evidence that due to the Russian invasion of Ukraine, together with the high energy prices, geographical sanctions, higher interest rates, slowdown in global growth and concerns over an incoming recession, bank lending in 2022 has been disrupted as caution prevails amongst banks,” researchers behind the report warned on prospects for ship finance this year. “The Chinese selective lockdowns and economic slowdown has added to the above concerns and is having a temporary impact on Chinese leasing as well,” the report added.