Shipping locks in Panama Canal diversion plans

The global seaborne trading map is in flux as shippers and shipowners reassess alternate routes to the parched Panama Canal, a waterway that accounts for 3% of all global maritime trade, which is in the process of slashing the amount daily transits in half as a drought prevention measure.

Analysis carried out for Splash by Sea, Oceanbolt and VesselsValue shows the scale of ongoing vessel diversions, with ships now taking far longer to get their destinations.

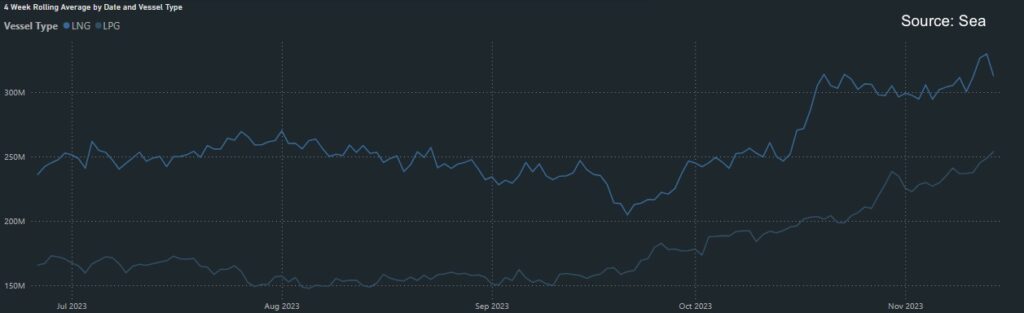

Sea data shows there has been a clear increase in the tonne days of global voyages for most sectors in the months since the Panama Canal Authority (ACP) started cutting daily transits as well as slashing draft limits on its larger locks.

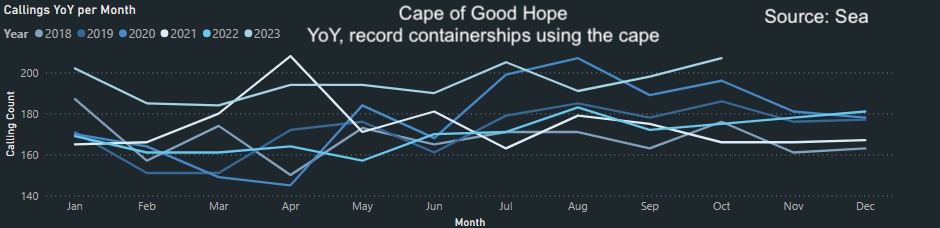

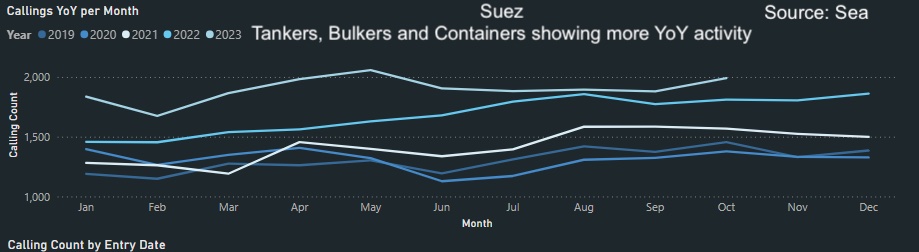

Looking at diversion routes, Sea analysis shows that several sectors are seeing the highest callings for this month since 2018. This includes containerships going via the Cape of Good Hope and the Suez Canal attracting far more tonnage than normal, while down south the Magellan Strait welcomed more than 30 extra ships last month compared to the same period last year.

At the Panama Canal itself, there has been a clear change in the composition of vessel types passing through with bulkers and tankers much lower year-on-year.

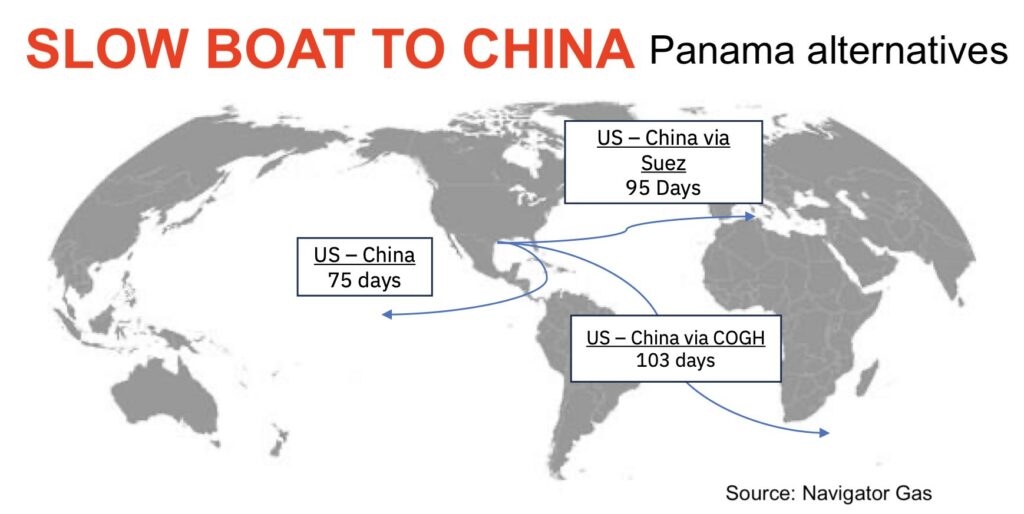

Charlotte Cook, trade analyst manager at Veson Nautical, a conglomerate that includes shipping data giants Oceanbolt and VesselsValue, told Splash that there had been a clear increase in the average hauls on the dry bulk US Gulf to China lane as well as for LNG and LPG trades on the same route, something that first started to manifest in July when the first transit cuts were instituted by the ACP, leading to more ships heading via the Suez.

There’s a real prospect no large tankers could be transiting the Panama Canal from the start of next year, with VLGCs also likely to be pushed out from the interoceanic waterway.

The canal’s administrators will whittle the number of transits down to just 18 in the coming three months, a figure that will stay until further notice.

At this point, slots for the newer, larger neopanamax locks with be down to eight per day, which will mostly be taken up by container vessels with the occasional gas carrier.

“Large oil tankers will not feature in this trade anymore. They will not be able to schedule in advance like container ships do and they can likely not compete for the auction slots,” a report from New York-based tanker brokers Poten & Partners suggested.

“The stark reduction in slots will push many of the tramp vessels (including tankers and dry cargo ships) away from the Canal. This will lead to more ton-mile demand and possibly changes in segment utilization as longer hauls may stimulate the use of larger vessels,” Poten predicted.

“Given the current booking system, it is possible that from early next year no VLGCs will be able to transit through the new locks, while transits through the old locks will be heavily reduced,” a report from Clarksons Research forecast, suggesting significant additional tonne-miles are likely to be seen as ships instead sail around the Cape of Good Hope or via the Suez.

“Rates have firmed as a result, both on the futures and spot market, though spot market liquidity has fallen as players assess the situation,” Clarksons noted in a gas ship market update.

The issue was brought up in an earnings call by Navigator Gas yesterday (see map below).

For dry bulk, there is growing consensus that more large ships will look to take alternate routes rather than waiting around at the canal.

“Despite the restrictions at the Panama Canal, the market may find an alternative and use larger ships going round the Cape Horn into the Pacific adding tonne-miles and supporting bigger vessels’ demand,” a recent report from Greece’s Xclusiv Shipbrokers suggested.

The restrictions at the canal have already seen a massive switch for dry bulk. Analysis carried by S&P Global shows the Suez Canal share of US Gulf to Asia shipments increased to 83% in October versus 23% a year ago.