Shipyard surprises in latest rankings: Samsung on top, Oshima above Imabari

The Geoje shipyard of Samsung Heavy Industries in the far southeast of South Korea has the largest orderbook backlog of all individual yards globally today at 11m cgt – about 9% of the global orderbook – and 17.9m dwt, according to the latest statistics from Clarksons Research.

In terms of individual yards – as opposed to shipbuilding groups – South Korea has the top four spots in the world today, with Hyundai Heavy’s Ulsan yard in second, Hanwha Ocean’s Geoje yard in third and Hyundai Samho in fourth. Hanwha Ocean is the name of the yard formerly known as Daewoo Shipbuilding & Marine Engineering.

Shanghai’s Hudong Zhonghua is the largest single yard in China, in terms of backlog, in fifth spot of the global rankings created by Clarksons Research, while lying down in 22nd spot Oshima Shipbuilding is currently ranked as the Japanese yard with the biggest orderbook. In 26th place, the Saint-Nazaire yard of Chantiers Atlantique is Europe’s largest yard by orderbook today.

When it comes to shipbuilding groups, state-controlled Chinese giant CSSC is the largest in the world – the umbrella organisation that controls big names such as Hudong Zhongua, Dalian Shipbuilding, Jiangnan Shipbuilding and Shanghai Waigaoqiao among many others. HD Hyundai is in second spot with the top two groups controlling 34% of the global orderbook by cgt.

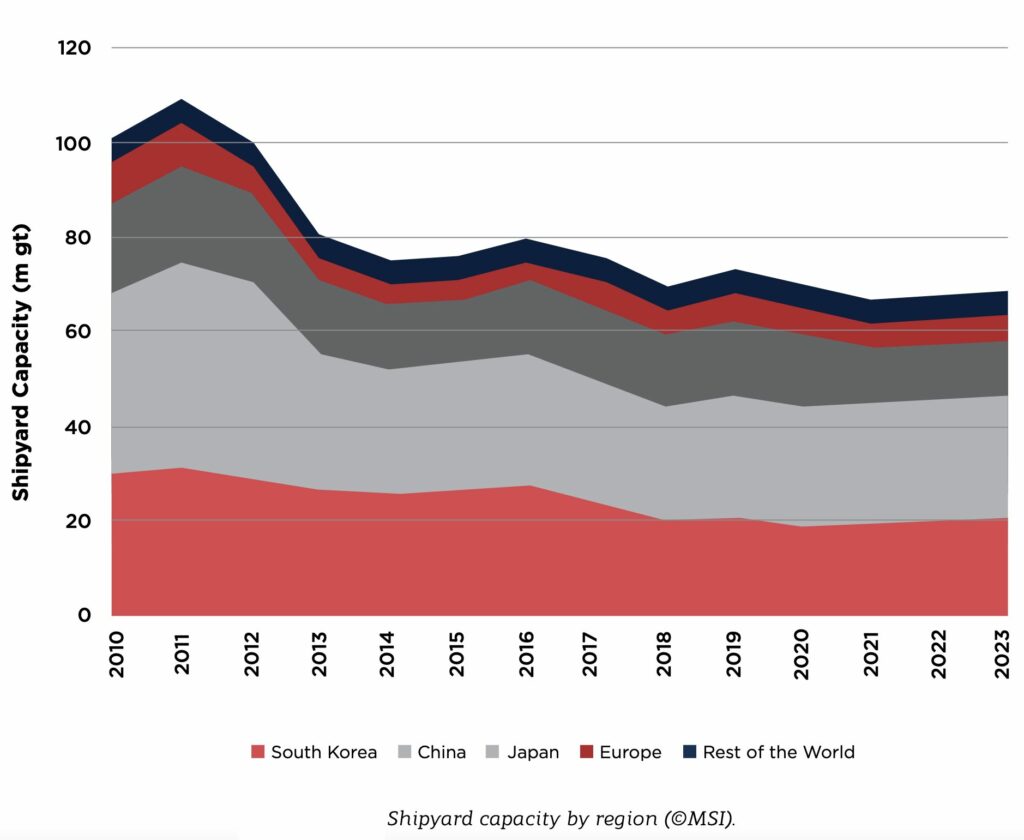

Highlighting how consolidated the shipbuilding space has become in the past 15 years, Clarksons data shows that 71% of the global orderbook is at the top 10 shipyard groups.

After many years of contracting shipyard capacity, the global yard scene is finally expanding amidst record-long orderbooks, and a growing acceptance that much of today’s fleet will need to be replaced to meet new green regulations.

“Yards have got the longest backlog in history with 2026 soon full,” Dag Kilen, head of research at Norwegian broker Fearnleys told Splash earlier this week.

According to data from Maritime Strategies International (MSI) carried in class society ABS’s recently published 2023 Outlook, shipyard capacity grew 1.8% to 67.1m gt last year with MSI forecasting this figure will rise to 69m gt by 2025, and will peak at 81m gt in 2030. While this is significantly above current levels, it remains 26% below the 2011 peak.