The Broker Badger: penny-pinching in the S&P market

It’s August so, generally speaking, shipping markets are pretty dead right now. “Everybody’s on bloody holiday,” one beleagured broker (who isn’t) told me this week. Probably not the best time of year to launch our new weekly market round-up, The Broker Badger*, but let’s have a go anyway, shall we?

I almost fell off my executive-style swivel chair yesterday when both Euroseas and Navios Partners reported having sold vessels. Granted, both sales happened sometime in the past quarter, rather than the past week, but it was still the most excitement the sale and purchase (S&P) market has seen in a while.

I’m exaggerating, but the records of recent S&P transactions are pretty dull. We’ve seen the handymax bulk carrier NewLead Castellano sold at auction; a sale-and-leaseback deal by Navig8 Product Tankers and quite a few different Japanese firms offloading small-ish bulk carriers. Oh and MOL sold a 13-year-old VLCC to Eurotankers for $28.3m, that was fun.

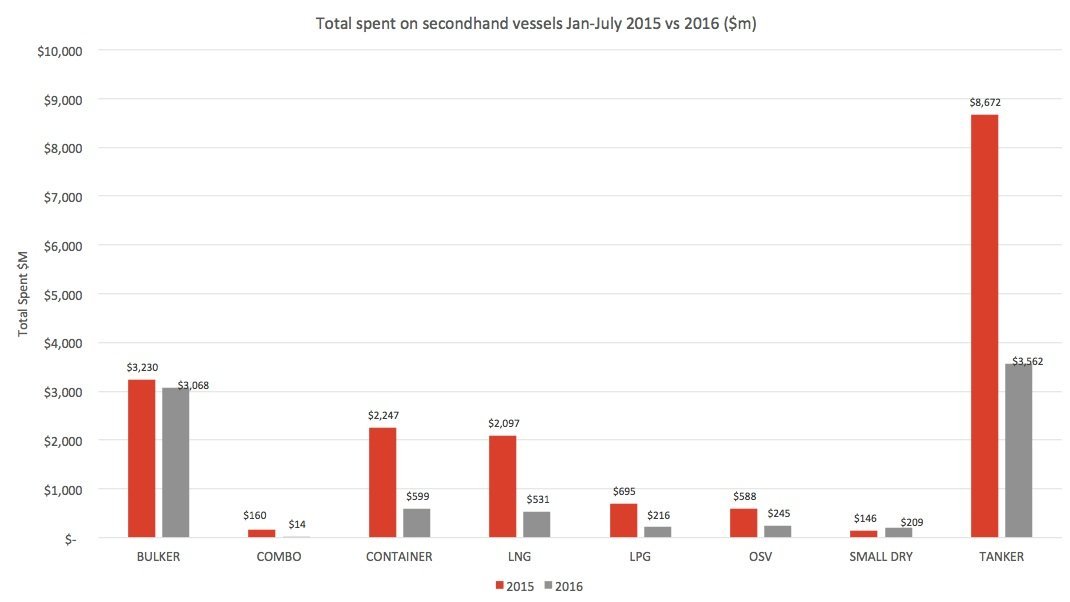

Data provided for Splash by online platform VesselsValue.com (VV) shows that spending in the S&P market has declined by around 25% between January and the end of July 2016, compared with the same period in 2015.

Some 729 vessels have changed hands so far this year for a combined sum of $37.86bn, compared with 798 between in the first seven months of 2015 for $50.58bn in total.

Bulk carriers are still the vessel type most commonly bought and sold, and appetite for the vessels has gathered pace this year compared to last. Some 332 vessels have changed hands since January 1, compared to 251 in the same period 2015.

However, the VV data shows that the collective value of the bulkers bought and sold this year ($3.07bn) is lower than the collective value of those sold last year ($3.23m).

If we look at the Baltic Exchange’s S&P valuations of its benchmark five-year-old vessels, bulk carriers have been appreciating in price since around the beginning of April. Meanwhile, the Baltic’s valuations of tankers has been declining since February.

The VV data echoes this and shows that spending on secondhand tankers this year – some $3.56bn in total – has declined by 59% compared to the $8.67bn spent first seven months of 2015. Some 263 tankers changed hands in the first seven months of last year, compared to just 172 this year.

VV’s Adrian Economakis told Splash the waning enthusiasm of tanker buyers is something of a delayed cyclical effect in the recent buoyant tanker market.

“Tanker rates, until recently, have been very strong, but positive long term sentiment has been lacking. Values have stayed low and newbuilding ordering was limited. In other words, people were not expecting a sustained good market for tankers, so the earnings market stayed healthy for quite long and looks like a more conventional shipping cycle,” he said

“However, with the recent downward trend in rates and continued fall in tanker values, we may be seeing another stage in a different cycle.”

Data and graph: VesselsValue.com

* Working title. I might change it (I think that’s what they mean when they say “a woman’s right to choose”).