Supercycle memories rekindled as dry bulk rates spike

The word supercycle is appearing in global business titles on a daily basis in recent weeks and dry bulk shipping numbers are increasingly backing up this bullish commodities stance – the Baltic Dry Index rocketing up this week and FFA traders reporting extraordinary business.

The derivative dry freight market recorded by London’s Freight Investor Services (FIS) posted a trade volume of $1bn notional value last week in the largest trading week of the 21st century, clearing over 75,000 lots across the cape, panamax and supramax vessel sizes.

John Banaszkiewicz, CEO of FIS, said: “2020 may have been the year of equities, but 2021 is gearing itself up to be the year of commodities – and nowhere is that truer that in the freight market. Last week we saw a mammoth 75,000 lots traded on freight, eclipsing the last dry shipping cycle boom in 2008.”

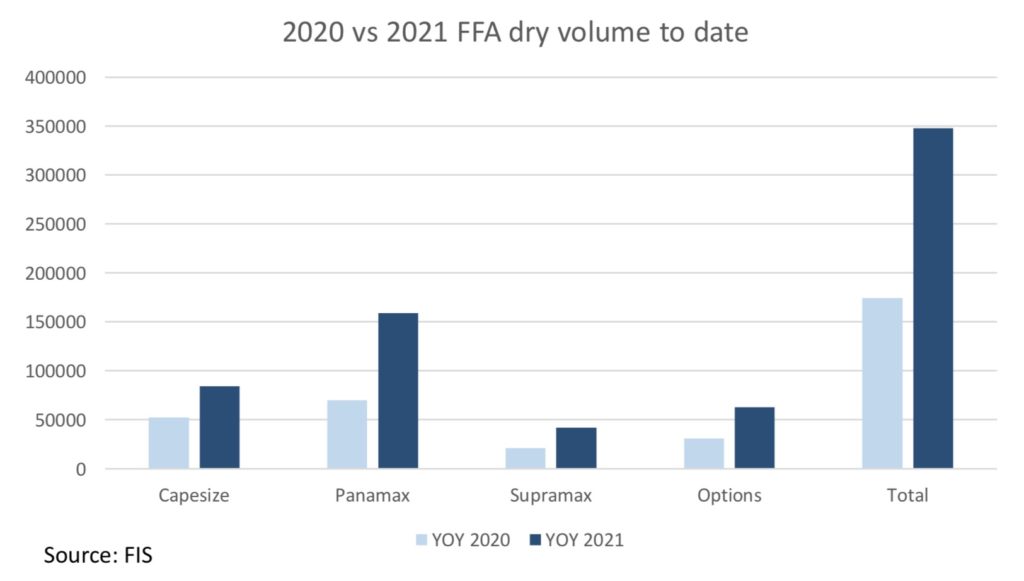

Current volumes year to date on average are double where they were in 2020, with the cape market trading up 61%, panamax up 126% and supramax up 99%. This increase has also extended to option trading which year to date versus 2020 up over 100%.

Banaszkiewicz added: “Dry shipping is one of the main indicators of a boom in commodities that has seen front month future iron ore 62% Fe rise to $162.80 to China, thermal coal to $65.55 and US Nola Urea to $335.”

You might remember 2008, and this week has really given us the same feeling

With the surge in commodity prices, many companies have been caught short on the rally, and therefore this has pushed volumes up in a short squeeze, especially in the panamax market.

Norwegian broker Fearnleys also had the supercycle vibe going on in its latest weekly report.

“You might remember 2008, and this week has really given us the same feeling,” Fearnleys said of the red-hot panamax market.

On kamsarmaxes, rival Norwegian broker Lorentzen & Stemoco noted in an update today: “A stellar market it is, with freight rates going from highs to highs.”

Fearnleys also discussed the “tremendous recovery” seen in the cape market over the past week where the two main routes with iron ore from Brazil and Australia to China are up by 23% and 46%, and the total time charter basket of all routes is up by 48%.

“This is backed by a very firm Panamax market and an increasingly strong belief amongst market participants in the Dry Bulk segment,” Fearnleys stated.