THE Alliance members left with few options in wake of Hapag-Lloyd’s departure

The dramatic consolidation among container shipping’s global carriers over the past decade leaves the remaining liners of THE Alliance with few options in the wake of the departure of its largest member, bar perhaps one very tricky conversation to be had in Taiwan.

Hapag-Lloyd and Maersk this week have shaken up the global liner alliance structures on the main east-west trades, announcing the creation of the Gemini Cooperation from February next year.

Maersk’s existing partnership with Mediterranean Shipping Co (MSC), 2M, is due to expire in a year’s time and the Danish liner has been actively seeking a partner to plug capacity gaps.

The cleanest option would be for Evergreen to transfer to THE Alliance

The creation of the Gemini Cooperation leaves the remaining members of THE Alliance scrabbling to fill the gap left by the German carrier’s exit.

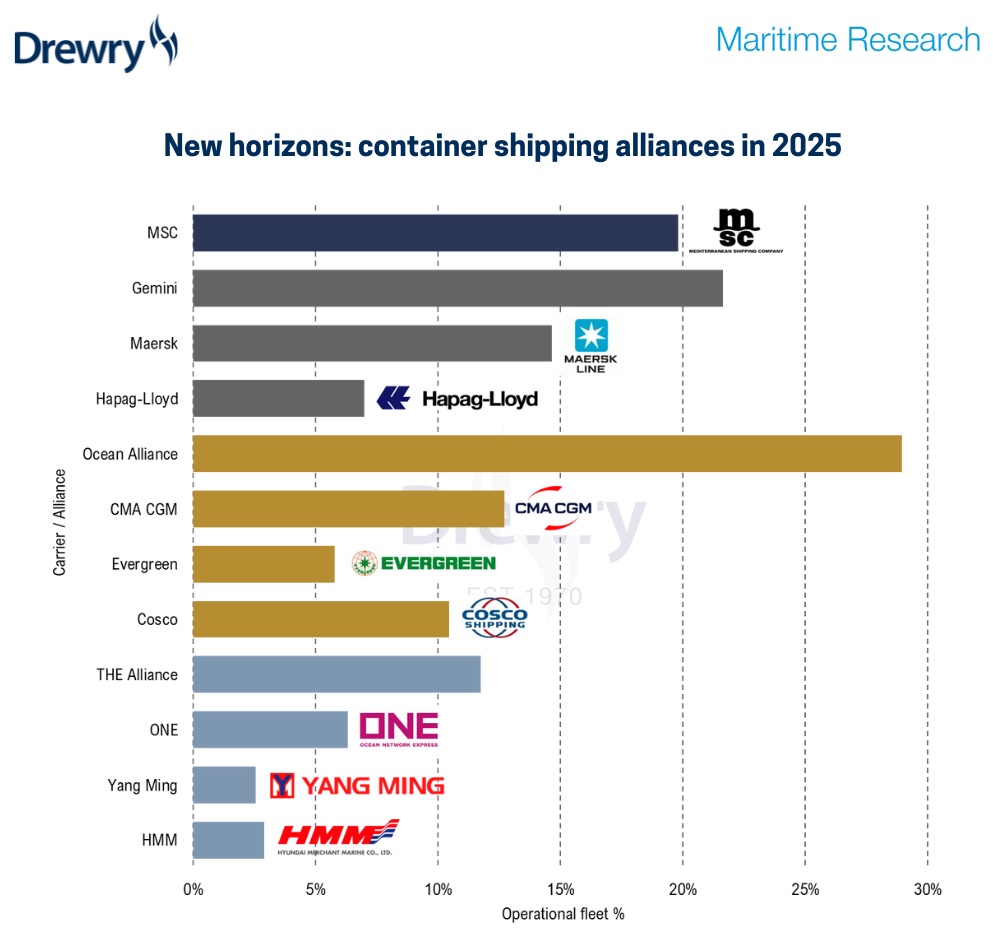

THE Alliance was founded in 2016. Its membership today is made up of Hapag-Lloyd, HMM, Ocean Network Express (ONE) and Yang Ming. THE Alliance is one of three global liner alliances along with 2M and the Ocean Alliance, whose members comprise CMA CGM, Evergreen, and COSCO.

“THE Alliance members are in a jam and will be desperate to fill the Hapag-Lloyd void,” commented Simon Heaney, senior manager of container research at UK consultancy Drewry.

Finding a suitable replacement and having zero leverage will prove challenging, he suggested.

ONE switching to the Ocean Alliance might be prohibitive from a size and regulatory standpoint, Heaney pointed out, adding that there are not any carriers just outside the top 10 that do enough work in the east-west trades.

“The cleanest option would be for Evergreen to transfer to THE Alliance, but they would need some heavy coaxing,” Heaney argued.

Evergreen is a historic foe of compatriot Yang Ming – a rivalry that goes back decades and is a very political one.

Peter Sand, head of research at Xeneta, a box freight rate platform, suggested the soon-to-be all-Asian THE Alliance might be a sign of the times.

“Partnerships are formed as per headquarters geography more than has been the case in past years,” Sand said.

Sand said the corporate marriage between Maersk and Hapag-Lloyd was a “fine cultural match”.

The new cooperation between Hapag-Lloyd and Maersk will comprise a fleet pool of around 290 vessels with a combined capacity of 3.4m teu; Maersk will deploy 60% and Hapag-Lloyd 40%.

The cooperation will comprise 26 mainline services, covering seven trades: Asia / US west coast, Asia / US east coast, Asia / Middle East, Asia / Mediterranean, Asia / North Europe, Middle East – India / Europe and the transatlantic.

Charles Moret, a partner at CTI Consultancy, maintained, via a post on LinkedIn, that the decision to put just 290 ships into the new alliance – from a combined pool of nearly 1,100 vessels – was a smart play from the two European liners.

“They are going for a hybrid solution to be more nimble operating a very reliable east-west network with a high focus on hub planning and execution to avoid disruption and ripple effects to the rest of their network, while keeping some flexibility to adapt to change on each of their own networks,” Moret suggested.

One of the clear losers from this week’s momentous liner alliance shake-up news is Germany’s largest port, where Hapag-Lloyd is headquartered and where Maersk bought a famous red-hulled brand, Hamburg Süd, seven years ago.

With rival MSC coming in to take a 49.9% stake of Hamburg’s top port operator, both Maersk and Hapag-Lloyd are loathe to pay the Swiss line to call at the city.

Gemini’s plans are to nominate two or three owned or controlled hub ports per region, and then deploy feeder networks. For North Europe, the three ports will be Wilhelmshaven, Bremerhaven and Rotterdam. Hamburg, where Hapag-Lloyd, has been the port’s largest customer for many years, is relegated to feeder status from the Gemini Cooperation.