Financial case for scrubber retrofitting clouded by current narrow gap in fuel prices

A smaller gap than anticipated in the prices of low and high sulphur fuel at the start of the year has led some analysts to question the payback times for owners retrofitting scrubbers, although the financial case for scrubber-fitted newbuilds remains intact.

According to the latest weekly report from tanker brokers Gibson, earlier this month Taiwan refining giant CPC published its first general indication for 0.5% LSFO180, which has been priced at a premium of around $100 per tonne versus 180 cSt HSFO. Around the same time, Platts was quoted pricing 0.5% sulphur bunker fuel (barge assessment) at an even lower level – just a $40 per tonne premium in Singapore.

“The current spreads are notably below those expected by the market in 2020 but it is important to note that prompt demand for compliant fuels is yet to emerge,” Gibson observed.

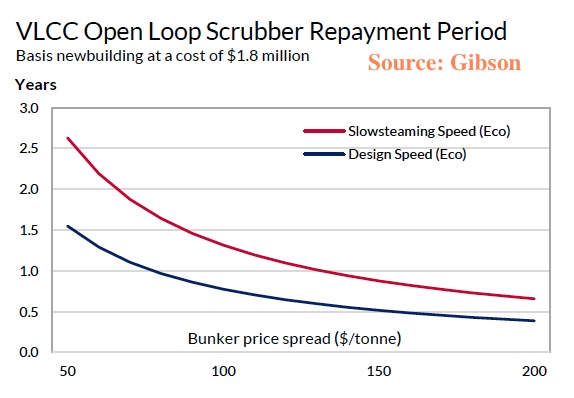

The report continued: “The economics of a scrubber retrofit will of course be impacted if the spread between 0.5% sulphur bunkers and HSFO turns to be much smaller than expected. With newbuilds, the picture is not as clear cut, as the cost of installation is much cheaper and without additional down time. As such, the open loop scrubber repayment period will still be fairly short, somewhere between 9 to 16 months, even if the spread in bunkers averages at $100/tonne and the ban on the discharge of scrubber washwater is introduced within coastal waters globally.”

Analysts at Gibson went on to stress that the risks remain that regulations may evolve further, open loop scrubbers might see a global ban, the spread may fall to negligible levels or HSFO availability might decline dramatically over time.

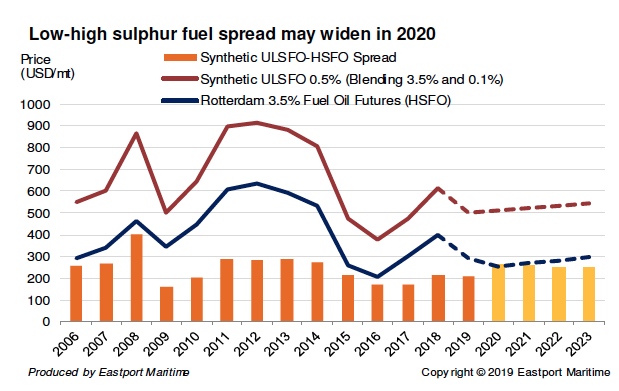

Meanwhile, Singapore-based Eastport Maritime carried its own fuel price projections (see graph below) in its latest market report in which it also discussed how oil storage market conditions are tightening in Singapore and other major Asian bunkering hubs. Oil majors and traders are taking on additional storage capacity to offer the full range of post-cap fuels, with Eastport predicting the storage market in Asian bunkering ports will get tighter as the year goes on.

Finally, according to the latest data from Clarkson Research, over a third of the global orderbook by tonnage has a scrubber ordered, although for the capesize orderbook this increases to around 50%, for VLCCs to over 70%, and for VLGC to 75%. Around 14% of the global orderbook tonnage is now LNG fuel capable, the majority of these are LNG vessels.

This is misleading. The pricing will be determined by the demand and supply scenario. It is not a surprise that the price difference is less now, when the demand is not high. What happens in 1.1.2020 when the demand for 0.5% S fuels will be in the range of 175 Million MT??