Weekly Bunker: MGO differential narrows

What a crazy week. November Brent hit highs of $69 before ‘stabilising’ around $64.50. Unsurprisingly this caused huge swings in the bunker market, with delivered bunkers in Singapore hitting highs of over $580 on Tuesday. At this point MGO was at $616, meaning the cost to switch to MGO was only $33.

HSFO still remains incredibly strong with physical premiums +$143 over October Sing380 swaps (and approximately +$63 over the balance of September).

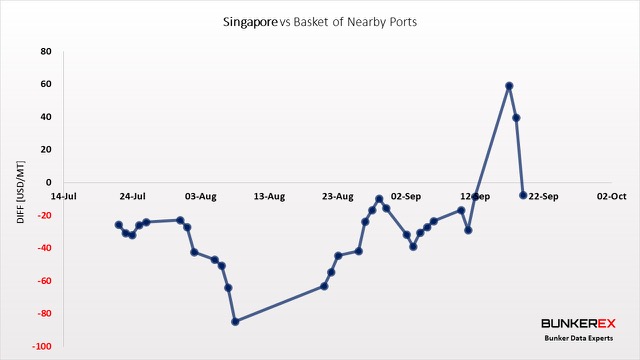

Singapore has been the exception of late, as shown in our ‘relative cost’ graph below. At one point it was one of the most expensive of the major ports East of Suez for bunkers.

As mentioned in last week’s column, volatility increases as volumes get thinner so we expect this trend to continue well into 2020 on HSFO. Import volumes continue to drop and as bunker demand stays strong, inventories have shrunk to eight-week lows.

The strength in HSFO meant LSFO was pricing right in the middle of HSFO and MGO, giving a theoretical blend margin of 50/50. As nice as that would be for non-scrubber vessels come 2020, we expect this to return to the levels published in the last few weeks of 20% HSFO and 80% MGO. That ‘normal’ level would give a Q1 LSFO value +$248 above HSFO and -$61 below MGO.

The crude markets remain delicately balanced as the world waits to see if Saudi can make up for the oil outage. Output levels are expected to return to normal within three weeks, but if news comes out to the contrary (as some analysts believe) prices will spike again. Watch this space.