Maersk hands the baton to MSC at top of the liner rankings

The changing of the guard at the top of the liner rankings is underway. Alphaliner data shows there’s just 10,817 slots – essentially a single neopanamax purchase – separating Maersk and Mediterranean Shipping Co (MSC) at the top of the liner rankings with the Danish carrier in the process of relinquishing top spot for the first time in more than a quarter of a century before the year closes.

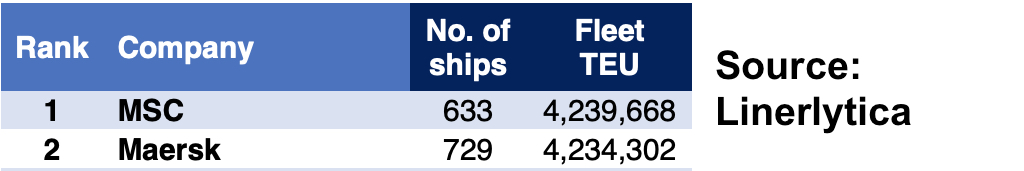

Data from rival liner data provider Linerlytica shows that MSC has actually just passed its Danish peer. According to Linerlytica, MSC took the top spot on November 24 when the Susan Maersk boxship became the MSC Fie.

MSC has been on a dramatic expansion charge since August 2020, hoovering up an unprecedented 125 secondhand ships over the past 16 months as well as signing for more container newbuilds than any other carrier in the world. Both carriers now command a 16.9% market share, according to data compiled by Alphaliner. If MSC’s orderbook is included, then its fleet already surpasses that of its 2M alliance partner by a considerable distance.

MSC is tipped to have just signed a letter of intent with South Korea’s Hyundai Heavy Industries (HHI) for the construction of six LNG-powered 15,000 teu ships worth a total of $1bn adding to its record-breaking 1m teu orderbook.

The big gap between MSC and Maersk’s fleet make-up is in the difference between owned and chartered fleets with Maersk owning far more of its tonnage while MSC still relies on charterers for a majority of its fleet despite its changed tactics during the pandemic.

Maersk has been the world’s largest containerline since the mid-1990s. In recent years it has repeatedly stated its intention be a logistics integrator with a fleet no larger than 4m to 4.4m teu.

MSC, founded by Gianluigi Aponte in 1970, became the world’s second largest carrier in 2004, and since then it and Maersk have continued to top the global ranking table.

Soren Toft, former Maersk COO, today celebrates his first year work anniversary since joining MSC as CEO.

Looking at how the liner rankings have changed during the pandemic, analysts at Sea-Intelligence observed over the weekend that the biggest shifts have been lower down the order, with most of the global carriers staying in their current line-up.

The biggest leaps up the rankings during the pandemic have come from China. China United Lines (CU Lines), for instance, was not even in the top 100 at the outset of the pandemic, but now operates a fleet of 82,000 teu and ranks as the world’s 22nd largest carrier.

“They are one of the very clear beneficiaries of the extremely strong container market of 2021,” Sea-Intelligence stated in its latest weekly report.

BAL Container Line has been another beneficiary of the extremely strong 2021 market conditions. It was also outside top 100 at the outset of the pandemic, but now operates 33,000 teu and is the world’s 37th largest carrier.

For now