Beijing rate cut adds to concerns about the health of shipping’s most important economy

Economic signals from China, the world’s most important shipping nation, continue to alarm shipowners.

The surprise financial news out of Beijing today was the decision by the People’s Bank of China to reduce the medium-term lending rate, through which it provides one-year loans to the banking system, by 10 basis points to 2.75%. The decision, along with a move to inject liquidity into the system, is seen by China watchers as clear evidence Beijing is worried about the state of the economy, where stimulus plans have failed to get the nation back on track after a brutal zero covid policy and bursting real estate bubbles hammered the world’s most populous nation this year.

Plenty of other economic data coming out of China today is cause for concern for many strands of international shipping.

Retail sales rose 2.7% year-on-year in July, far lower than the 5% expected, while industrial production was 3.8% higher, some way off the forecast 4.6%. Property investment tumbled 12.3% in July, the fastest rate this year, while the drop in new sales deepened to 28.9%.

Youth unemployment now stands at a record 19.9% and the government’s stated goal of 5.5% annual GDP growth for the full year looks in tatters.

New yuan loans tumbled by more than expected in July as companies and consumers stayed wary of taking on debt, data showed on Friday.

“We are now facing a typical liquidity trap problem. No matter how loose the credit supply is, companies and consumers are cautious in taking on more debt. Some of them are now even paying back their debt in advance. This may herald a recession,” commented Wang Jun, an economist at Zhongyuan Bank.

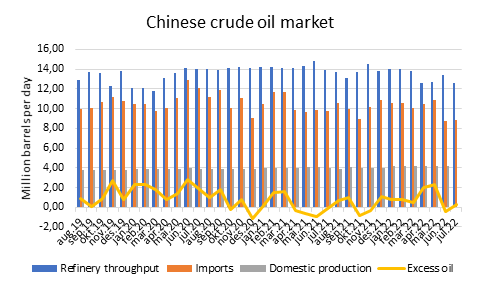

“For the oil market, the piece of information to look for is the refinery throughput, the main driving factor for the country’s oil imports,” a markets report from brokers Lorentzen & Co stated today, noting July runs were equivalent to 12.6m barrels per day, a 9.5% drop from the same month a year ago and the lowest point since March 2020 at the depths of the coronavirus outbreak.

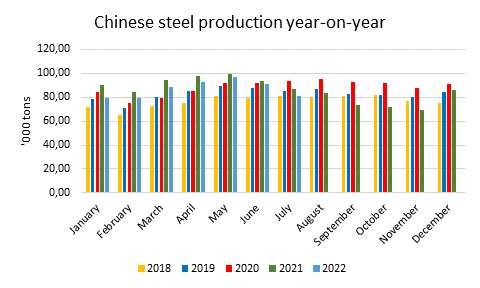

China’s National Bureau of Statistics today also had some frightening news for dry bulk owners. July’s steel production was at only 81.4m tons, the lowest for this month since 2018.

For container shipping, Peter Sand, chief analyst at rates platform Xeneta, said the data out of China ought not to be too alarming.

“Container shipping is more reliant on consumer demand from the US and Europe than retail sales in China,” Sand pointed out.

“Lower domestic demand in China is a particular concern for the dry bulk and crude tanker market as China accounts for respectively 35-40% and 25-30% of cargo demand,” Niels Rasmussen, chief shipping analyst at BIMCO, told Splash.

“Demand will likely remain weak in the short-term with the property sector acting as the main drag, with cooling exports further adding to the headwinds. This will put pressure on China’s commodity demand as a result,” commented Burak Cetinok, head of research at brokers Arrow Group. China’s imports will likely disappoint and that the anticipated recovery in imports in the second half of the year may be delayed further into 2023, Cetinok suggested.

“Things are clearly going in the wrong direction in China this year, with the economy hit by both the real estate crisis and the rolling covid lockdowns and restrictions,” commented Ralph Leszczynski, the head of research at broker Banchero Costa.

Industrial activity has been weak all year. In the first six months of 2022, steel production in China declined by 6% year-on-year, oil refining throughput was down 5.9% year-on-year, while total electricity generation was up by a modest 2.2% year-on-year. Electricity generation used to grow by at least 7% to 8% year-on-year in recent years.

This weakened industrial activity is directly reflected in commodity imports. Iron ore imports in the first half of 2022 were down by 4.5% year-on-year, thermal coal imports were down by 22% year-on-year, crude oil imports down by 3.1% year-on-year, and LNG imports were down 21.8% year-on-year.

“What is very worrying is that things appear to be deteriorating further rather than improving,” Leszczynski said.