Boxship capacity growing at fastest pace on record

With nearly a container newbuilding scheduled to deliver daily for the rest of the year, brokers Braemar have warned this week it remains difficult to anticipate where the demand should be coming from to overcome the current supply situation.

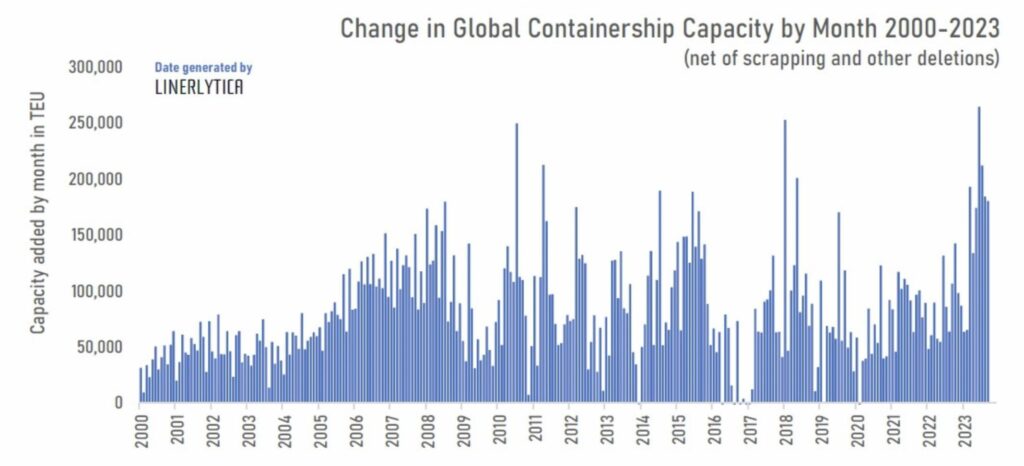

According to analysis from Asia-based consultancy Linerlytica, the pace of the growth of the box fleet at the moment is the fastest on record – and is set to continue for the next two years with the sight of newbuilds being forced to idle becoming commonplace.

Global containership capacity is growing at an average rate of over 190,000 teu a month since April, after accounting for new ship deliveries and capacity upgrades and deducting scrapped capacity and other deletions. In the past 30 days, 212,099 teu of newbuilds have been delivered.

“Compared to the growth spurt in 2006-2008 and 2014-2015, when the average monthly growth rate was just 120,000 teu per month, the current growth burst will pose a significant challenge to the carriers’ ability to manage the excess vessel supply,” Linerlytica warned in its latest weekly report. The pace of vessel scrapping remain at less than 10,000 teu a month.

Historically, the world container fleet grew by approximately 1m teu per year over the past decade. Full-year deliveries in 2023, however, are set to reach 2.2m teu, which will also be a new annual delivery record, beating the previous high of 1.7m teu delivered in 2015.

This new high mark for boxship deliveries will then be immediately broken in 2024 when a further 391 ships of almost 3m teu capacity is forecast by Alphaliner to enter service.

Giant newbuilds are now being forced to idle ahead of a maiden voyage for months on end.

Measuring 399.9 long, the giant 24,346 teu MSC Micol (pictured) was meant to begin her maiden voyage next month from Shanghai to Europe having been delivered from China’s Yangzijiang Shipbuilding, part of a record 1.5m teu orderbook delivering to Mediterranean Shipping Co (MSC) in the coming couple of years. Alphaliner reported earlier this month the ship will now depart on January 4.

“Overcapacity keeps worsening, due to an uninterrupted injection of newbuilding capacities of all sizes,” Alphaliner warned in a recent weekly report, adding: “Carriers have been trying to address these issues by closing services, downsizing fleets, slow steaming and blank sailings but this is not enough.”

Now is a good time for owners to start talking to shipbuilders about turning some of the boxships on order into bulkers and tankers. The sooner these conversations take place, the better!