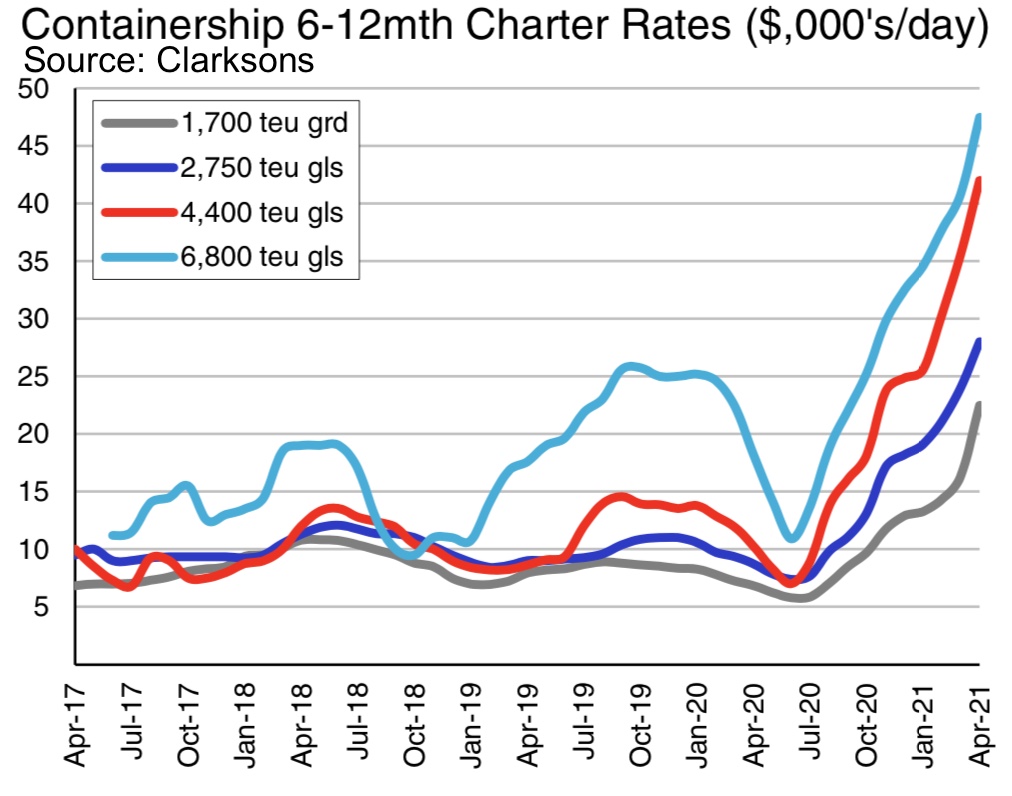

Boxship charter market smashing records across the board

Red-hot container charter deals are in unknown territory – sealing record high rates for unheard of lengths of time as operators pay top dollar to take any available tonnage.

Ships fixed this month are creating new milestones – as well as potential millstones if the markets turn sour anytime soon.

As an example, Israeli carrier ZIM has taken the 9,034 teu Seamax Niantic for a very long five year employment with Alphaliner suggesting the Eli Glickman-led liner is paying $50,000 a day for the ship.

ZIM, which relies on charters more than owning, is also reported to have fixed the 8,586 teu sisters Gulf Bridge and Mediterranean Bridge for an even longer period of six years at an unreported rate.

Ships fixed this month are creating new milestones – as well as potential millstones

“There is no end in sight to the current strong market, with the squeeze of supply showing no sign of easing in the medium term, while demand remains robust across all ship sizes,” Alphaliner noted in its most recent report, adding: “Charterers will, at least until the summer, continue to struggle to find the tonnage they need to cover their requirements, having no other choice but to accept the terms offered by owners to fix the few ships that become available for charter.”

The Alphaliner charter rate index is at its highest level since 2005 while freight rates are close to record levels and the prices for secondhand box tonnage have shot up in recent months.

Splash reported earlier this week how the overall containership secondhand price index, according to Clarksons, has increased by 47% since June last year. The price of a 10-year-old 6,600 teu unit has increased by 138% ($29m) to $50m over the same period, whilst the price of a 10-year-old 4,500 teu unit has risen by 268% ($25.5m) to $35m.

ZIM has taken the 9,034 teu Seamax Niantic for five years at $50,000 a day

The shortage of tonnage for charter has seen liners look far and wide for any ship to handle today’s extraordinary demand for containerised goods.

France’s CMA CGM has fixed six Chinese-flagged classic panamaxes ranging in size from 4,200 to 5,000 teu that would normally operate on the intra-China trades. The ships have been taken for two years at around $37,500 a day. CMA CGM has also just fixed the 4,957 teu Wieland for up to 40 months at $40,500 per day, a new high for wide beam tonnage, up by $5,000 from the previous benchmark set at the end of February.

US carrier Matson has fixed the 4,380 teu Dioryx for up to 30 months at $41,000 per day, also a new high for this ship size.

In the Atlantic, a geared 3,600 teu unit, the Chopin, secured a five-year charter extension, something Alphaliner noted was an unusually long duration for a ship of this size.

The latest Container Ship Time Charter Assessment Index (ConTex) published by the Hamburg and Bremen Shipbrokers’ Association last Friday shows that even ships in the 1,100 teu category are now being taken for two-year or longer durations.

“Activity is mainly dictated by tonnage availability as there are still several parties interested in every vessel that is potentially coming open,” the ConTex report stated.

Clarksons noted in its most recent weekly report, issued last Friday, that the containership charter market continues to tighten with longer fixture periods becoming increasingly prevalent. Clarksons’ boxship charter rate index is up 55% from the start of 2021, sitting like Alphaliner’s at a 16-year high.

“With very little prompt tonnage workable for sale or charter, operators are looking ever further forward for charter laycans in the larger sizes with rumours of 8,500 teu vessels under discussion for extension from Q1 2022, demonstrating the faith operators have in these rates remaining firm for quite some time,” rival broker Braemar ACM noted this week.

Very horny shipowners around here! they can do anything crazy! Caution is the key!