Bullish tone for next year’s SMM Hamburg

In what may be the most bullish meet-up of owners, yards and suppliers for more than a decade at Hamburg’s giant SMM exhibition next year, a new survey suggests shipowners are more willing to place orders for new ships than at any time for many years – the problem they face is finding an available slot.

Tanker newbuilds are especially in vogue, according to the just published Maritime Industry Report 2023, a survey carried by SMM, the world’s largest shipping exhibition, of more than 1,000 decision-makers from shipowning, shipbuilding and supply companies from 71 countries.

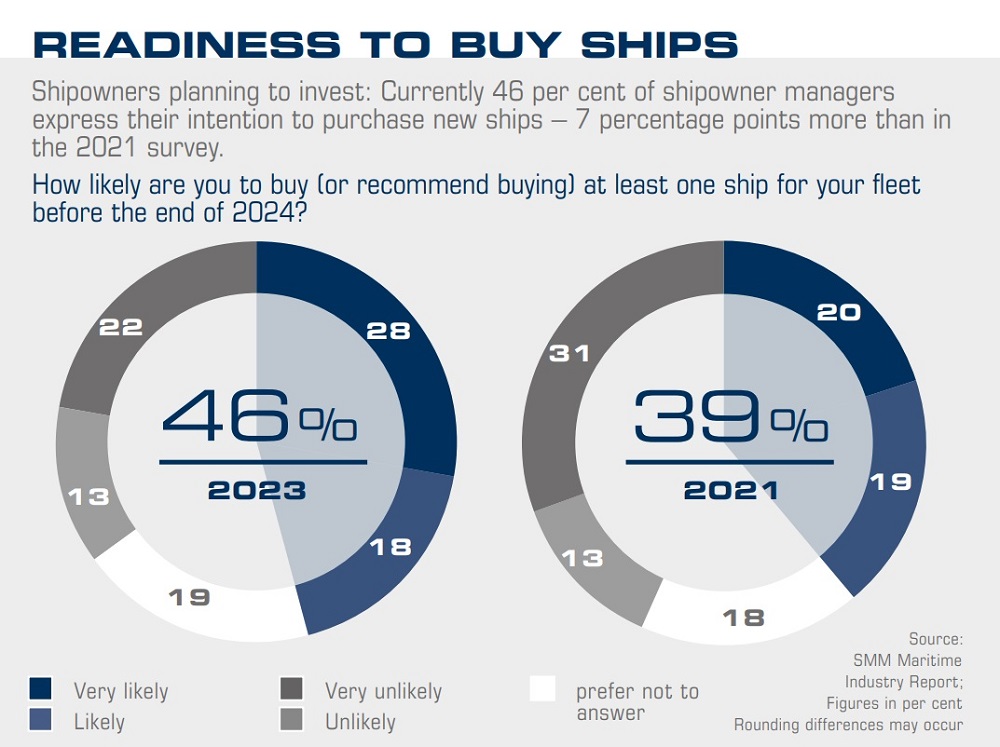

Shipowners indicated much stronger interest in investing in new ships – led by tankers – than in previous SMM surveys with 46% of decision-makers saying they are “likely” or “very likely” to order newbuilds before the end of 2024 – seven percentage points more than in 2021, and as many as 18 percentage points more than in 2019.

Looking at the results of the survey, Martin Johannsmann, chairman of the marine equipment and systems working group of the German Mechanical Engineering Industry Association (VDMA), commented: “Shipowners are investing significantly more again, driving a very positive development in the national and international markets.”

The issue at hand for owners looking to invest in newbuilds are two-fold – the full up nature of the yards, and the high prices.

After many years of contracting shipyard capacity, the global yard scene is finally expanding amidst record-long orderbooks, and a growing acceptance that much of today’s fleet will need to be replaced to meet new green regulations.

“Yards have got the longest backlog in history with 2026 soon full,” Dag Kilen, head of research at Norwegian broker Fearnleys, told Splash last month.

A new report from UK consultants Maritime Strategies International argues that 2023 will be the peak of the current newbuild price cycle and levels will fall over the next couple of years as the factors that supported prices, most notably the high steel prices and elevated forward cover at global shipyards, unwind.

However, forward cover will remain elevated and the forecast nadir in newbuild prices in 2026 will be significantly higher than pre-pandemic levels, MSI is predicting. A renewed surge in contracting volumes from 2025 will drive a further surge in newbuilding prices, which will remain at high levels through the rest of the decade.

The 126-page Review of Maritime Transport 2023 just published by the United Nations Conference on Trade and Development (UNCTAD) also covers the urgent need for a global fleet renewal and the tight situation at the world’s shipyards.

The average age of commercial ships at the start of 2023 was 22.2 years, two years older than a decade ago, according to UNCTAD data. Further, more than half of the world’s fleet is over 15 years old.

“Shipyard capacity is currently facing constraints. Tanker and dry bulk owners are anticipating long waiting times and high building prices. Increasing shipbuilding capacity is crucial to ensure that shipping meets global demand and its sustainability goals,” the UNCTAD report stated.

Taking place from September 3 to 6 next year, SMM is the world’s largest shipping exhibition set across some 100,000 sq m of exhibition floor space with Splash attending.