Car carrier orderbook surges by 30% in opening three months of 2023

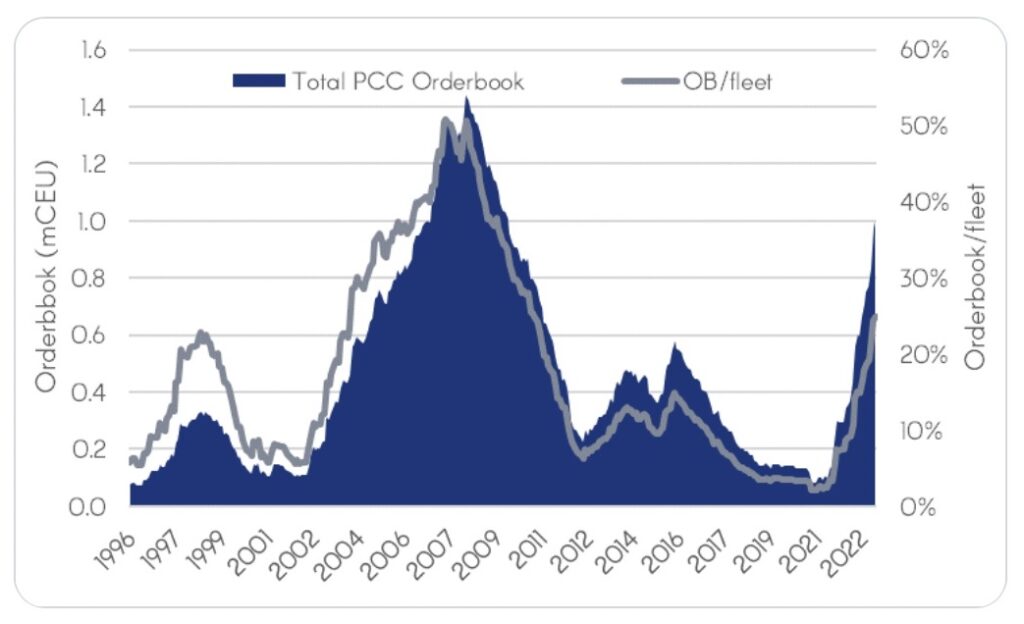

The car carrier orderbook is surging, up by 30% in the year-to-date, and now represents 25% of the fleet on the water, according to data from Gersemi Asset Management. Another notable trend in this booming sector is the reentry of global container carriers.

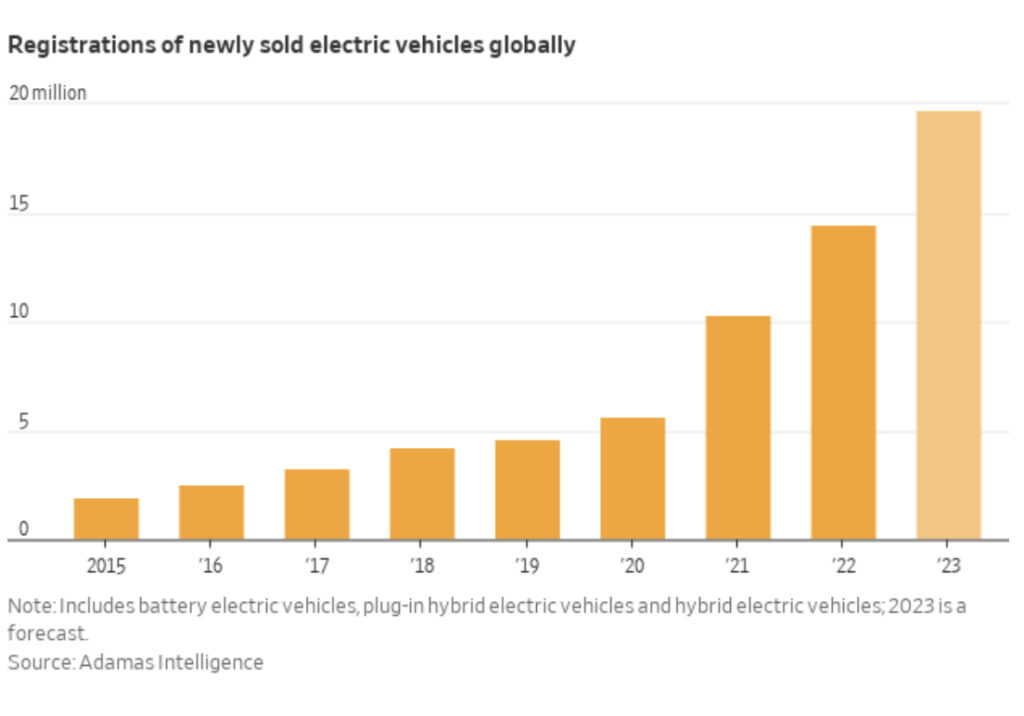

After a decade of limited orders, car carriers have become hot shipping property over the past year with rates hitting record levels, and ton-miles increasing significantly, thanks in part to the growth of China’s electric vehicle (EV) exports.

With rates still highly elevated, experts believe there is little chance for the sector to cool off this year. Just 12 vehicle carriers are scheduled for delivery in 2023 compared to ultra-low demolition activity predicted at three vessel removals, marginally improving the net fleet balance by 1.8% by total ceu, according to data from VesselsValue.

“This niche sector remains comfortably short on shipping supply through 2023. This is ominous for OEMs desperately seeking additional car capacity for their EV seaborne exports – but highly positive for shipowners and their shareholders enjoying record returns for another 12+ months,” Dan Nash, head of ferry, vehicle carrier and roro at VesselsValue, told Splash.

However, 46 vessels are scheduled for delivery in 2024, followed by 52 vessel deliveries in 2025, compared to forecasted vessel removals at less than half the delivery rate for both years based on the latest data. This will add 0.6m ceu capacity to the global fleet by the end of 2025, something Nash warned could go higher if Chinese OEMs exercise current options.

Chinese automotive manufacturers have piled into the car carrier scene in recent months, responsible for most of the new orders.

Global container carriers have also sought to get in on the act with VesselsValue noting COSCO, CMA CGM and HMM have ordered and chartered vehicle carriers over the past year.

That graph looks a bit worrying. The previous major economic meltdown had the PCC’s on their peak, similar to what some analysts predict today. The major driver seems to be China with it’s EV exports but that does not seem a healthy enough support. Any implication of the Chinese in the RUS-UK conflict, economic struggles or any other geopolitical destabilization will send the PCC demand back to normal levels.

Who knows? May be soon Chinese cars will be more modern and affordable than… any I don’t know. US cars are sht already. European industry is going down to toilet. Japanese time has already passed.

It would be interesting to know the Flags / Owners of these vessels which have enormous strategic value in time of war to move heavy equipment and materiel.

See the re-positioning of this class of vessels (incl. Ferries) in and around mainland Chinese ports during Pelosi’s visit to Taiwan