Chinese property scene remains cause for concern for capesize owners

Persistent gloomy headlines about the Chinese property sector continue to give otherwise bullish capesize owners pause for thought.

In late January, a Hong Kong court ordered the liquidation of the Evergrande Group, bringing an end to two years of financial instability during which the company struggled to meet its debt obligations.

Dry bulk owners might have hoped that the court ruling would bring an end to the doom and gloom headlines surrounding the Chinese property sector which represents about 25-30% of the nation’s GDP and approximately a third of the country’s domestic steel demand. The bad news has continued to roll in, however.

Cape rates have been remarkably strong in Q1, but have struggled this week. The capesize index on the Baltic Exchange lost one point to 2,637 yesterday and has slipped over 24% for the week.

Iron ore futures fell on Friday for a fourth straight session, as concerns over China’s property sector weighed on demand and port inventories rose.

The “wild” swings in iron ore prices and rising stockpiles have got some owners feeling a “bit jittery” conceded analysts at brokers Arrow in a recent research report.

On Thursday, ratings agency Fitch cut its forecast for China’s housing market and said it now expects a 5%-10% fall in new home sales in 2024.

Country Garden, the country’s largest private property developer, on Thursday delayed the publication of its 2023 financial results. Vanke, another major developer, reported a 50.6% drop in 2023 core profits.

Total stocks of imported iron ore at China’s major ports rose for a fourteenth consecutive week to reach a two-year high of 144.3m tons yesterday, data from industry consultancy Mysteel showed.

“Iron ore demand could see some pressure due to China’s sluggish property market,” HSBC warned this week. The bank sees China’s iron ore demand declining at a compound annual growth rate of 1.4% over 2024-28 and global demand remaining flat over the period.

“The pick-up in Chinese steel demand remains slower than expected this year, continuing to weigh on steel profit margins and iron ore prices,” stated a report from another bank, ING, this week, noting how inventories are increasing as the pick-up in steel consumption from end-users is weaker than expected at this time of the year.

Citi analysts, noting the slow start to the Chinese construction season, said in a research note published earlier this week that they expect China steel production to lift from current levels.

“China steel consumption growth will likely remain weak but with industry profits up, we expect steel producers to lift output with steel exports to remain high,” Citi argued.

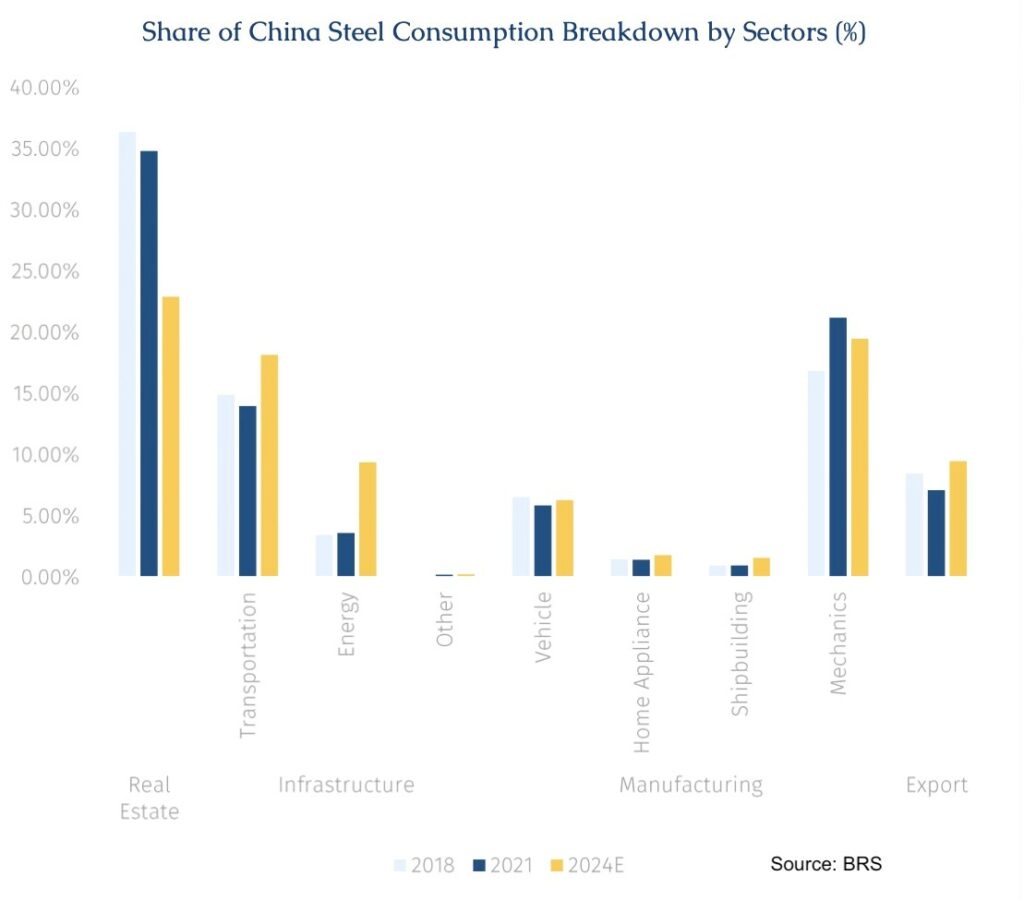

Broker SSY remains constructive on the Chinese steel complex. In its annual forecast, published last month, it noted that the property market correction in China has now been ongoing for nearly four years, which means that the sector is smaller relative to the other sectors driving steel demand – from approximately 40% share of domestic steel demand in 2020 to an estimated 33% in 2023. Secondly, the other sectors — notably auto manufacturing, shipbuilding, infrastructure and manufacturing — showed strong growth throughout 2023 and have the continued support of Chinese policymakers for 2024.

In related news, there is now a new way to keep track of iron ore stockpiles – from space.

US-headquartered Ursa Space has unveiled a new weekly dataset providing volumetric measurements of iron ore stockpiles across critical global locations. Using satellite imagery, this subscription-based service offers data on strategic stockpile locations including Port Hedland in Australia, Saldanha Bay in South Africa, Brazil’s Ponta da Madeira, and Chinese import hubs Qingdao and Caofeidian. The company also offers similar services for coal and oil, and can provide stockpile data on cobalt and copper on request.

Insightful article! Never heard about the space based assessments of iron ore stockpiles. Could be a worthwhile subscription if you own or operate Cape size tonnage!