‘Compelling’ tanker orderbook augurs well for rates through to 2026

The “compelling” tanker orderbook augurs well for freight rates for the coming couple of years, according to multiple researchers.

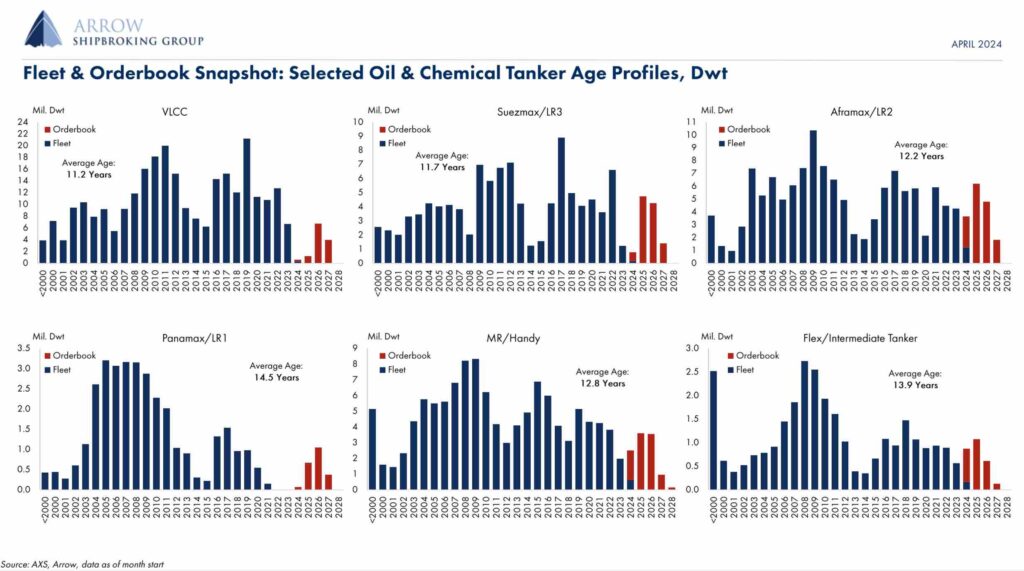

The tanker sector has one of the lowest extant fleet to orderbook ratios, and a minuscule delivery schedule.

According to data from Greece’s Xclusiv Shipbrokers tanker fleet growth will be just 0.02% in 2024, 1.7% next year and 1.8% in 2026.

“The de minimis tanker orderbook sure does look compelling for the coming years as there is no slack in those markets to deal with disruption, demand growth, or even seasonality,” states a new report penned by Jonathan Chappell, a shipping analyst at Evercore ISI, an investment bank.

“The fleet is hardly growing,” states a new tanker report from Oslo-based Arctic Securities, whose forecast for the overall tanker sector sees net fleet growth at 0.4%, 0.8% and 1.6% in 2024, 2025 and 2026, respectively.

Importantly, too, Arctic notes that the average age of the tanker sector has not been higher since 2003.

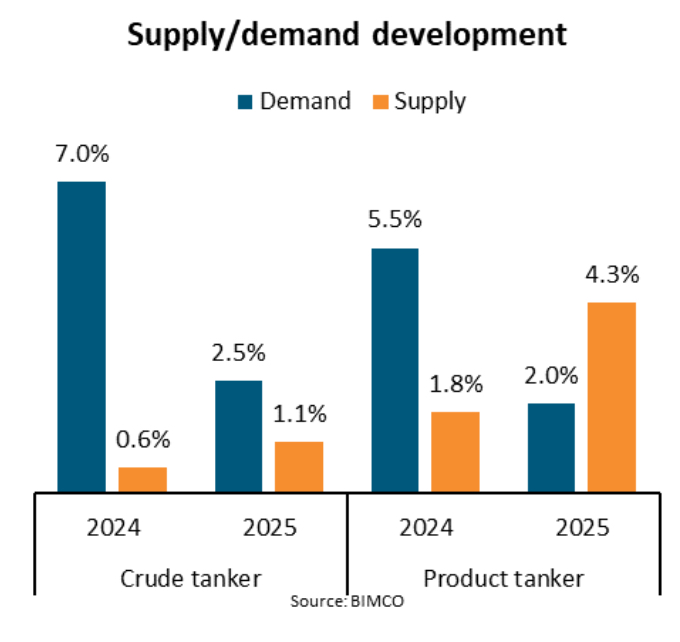

Another Greek broker, Intermodal, sees the crude tanker fleet capacity growing modestly by 0.6% in 2024 and 1.1% in 2025, with the aframax and suezmax segments leading this expansion. Product tanker fleet capacity is predicted by Intermodal to increase by 1.8% in 2024 and significantly by 4.3% in 2025, with the LR2s and MRs segments being the fastest growing.

Regarding the demand and supply dynamics, Intermodal sees the crude tanker market tightening across both 2024 and 2025, attributed to slow fleet growth and increased sailing distances. In contrast, the product tanker market is forecast by Intermodal to experience a tightening in 2024, followed by a weakening in 2025 as fleet growth outpaces demand.

UK consultants Drewry also cited the “strong fundamentals” in the tanker sector in a new report noting today’s “red-hot” asset prices, with secondhand values and newbuilding prices at their highest levels in the last 15 years.

The outlook for crude tankers remains “bright”, Drewry argued, as stunted supply and strong demand will favour shipowners at least until 2026.