Container spot rates duck below long-term rates on the transpacific

Business on the key transpacific box trade to the US west coast has hit a critical juncture with softening spot rates having now fallen below long-term contracted rates leading many shippers to start to look at the fine print of their contracts.

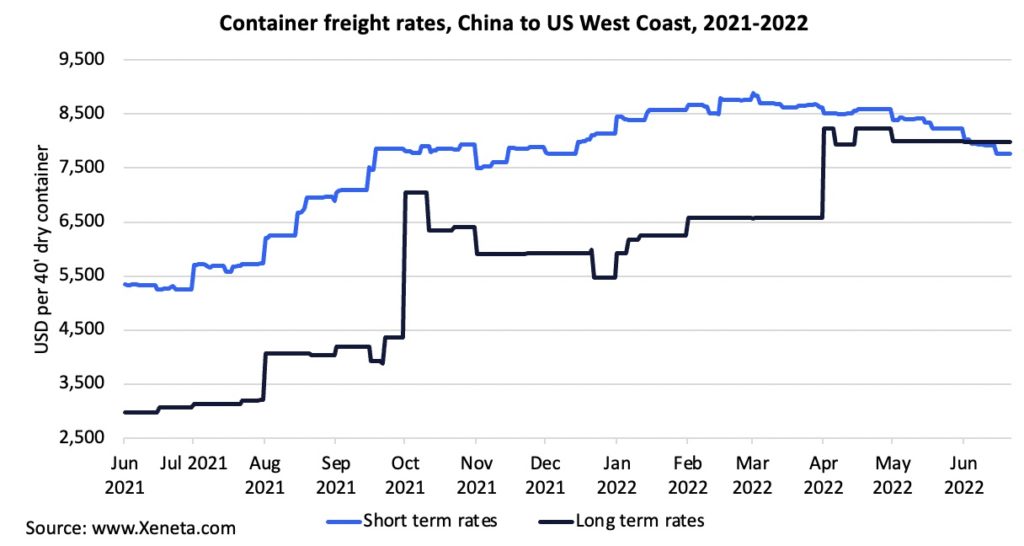

Data from Oslo-based platform Xeneta show that short-term rates are now 2.7% lower than contracted agreements, with the former sitting at $7,768 per feu and the long-term rates at $7,981, having shot up an incredible 159.9% year-on-year.

“What we’ve seen over the last year is strong growth for both sets of rates, but really spectacular gains for contracted agreements,” said Peter Sand, chief analyst at Xeneta. “That has led the gap between the two to diminish and, with supply chains bursting at the seams and shippers looking to manage risk as much as possible, the demand for spot deals has fallen slightly on this trade, bringing prices down. This creates opportunity for those with limber logistics strategies.”

Ocean contracts are notorious for not being honoured during market swings

The rapid closing of the gap between spot and contracted rates on the transpacific to the US west coast has caught many shippers by surprise, the gap hitting a peak of $4,000 as recently as September last year.

Meanwhile, a survey of small to medium importers on rival Freightos.com’s marketplace reflects recent reports of growing retail inventories and dipping demand.

More than half of respondents report they’ve placed peak season orders early in the hopes of building inventory.

Two-thirds said they are already experiencing a decrease in demand, with 84% of those attributing that dip to inflation.

Congestion continues to ease at Los Angeles and Long Beach, the main two ports on the US west coast, with China to US ocean transit times down 25% since the start of the year, and level with a year ago, according to Freightos.

“There were more signs this week of inventory surpluses and a resulting slowing in orders by major retailers suggesting a decrease in demand – at least for certain goods – as consumers shift spending to services or to the inflated costs of necessities, or both,” commented Judah Levine, head of research at Freightos, who also pointed out that there is minimal port congestion in Shanghai showing there’s still no sign of a surge of pent up demand many expected to follow the city’s reopening.

With rates for long term and spot rates heading in different directions, Levine pointed out: “Ocean contracts are notorious for not being honoured during market swings.”

Major retailers such as Walmart, Target, and Amazon have indicated lately inventory overstocking, which could see them cutting down their imports to improve inventory turnaround times.

“Consumer retail expenditure seems to be at a tipping point, inevitably reducing total volumes getting ashore. We expect this to push prices further down in the future,” said Shabsie Levy, the CEO and founder of Shifl, which also has an index covering freight rates on the transpacific.

Levy said that while long-term ocean freight prices remain higher than spot ocean freight prices, the situation may not last long.

“When shippers realise spot prices continue to cascade, they could look to renegotiate their contracts with containerlines,” Levy said, echoing comments made by Levine at Freightos.

Samsung, the seventh-largest importer into the US, has reduced its planned inventory order by half for July. The second-largest US importer, Target, announced its intentions to cut its inventory orders because of its ballooning inventory.

“Our data indicates that the hike in interest rates by the Fed is another blow to consumerism, as other industries, including services and real estate, see a hit in fortunes. Mortgage rates going up significantly from last year can result in slowing house construction starts, further reducing related retail spending,” said Levy.

For me, the obvious step here is for bigger established lines to allow spot rates to fall below costs for new entrants for a period, probably just long enough to put the smaller ones out of business, and to put anyone else off getting involved in the marketplace. This may sound like a conspiracy theorist talking, but i wouldn’t be in the slightest bit surprised if the established lines are very happy for this to happen?