Coronavirus crude contango sees floating storage stage a comeback

Oil demand destruction from the coronavirus outbreak has sent prompt crude prices lower and flipped the crude market into contango, with researchers at Braemar ACM noting a subsequent pick up in demand for floating storage vessel hires for the first time since the middle of last year.

“A contango in crude prices supports long-haul crude trades and floating storage demand, which could alleviate some of the weakness in oil and tanker demand,” Braemar ACM explained in a note to clients.

Junjie Ting, a Singapore-based researcher with the brokerage, told Splash that a normal time charter at current rates of $25,000 to $30,000 a day would not be economical. However, it is likely workable if traders can find a cheap two-month time charter where the forward curve is steeper and buy distressed crude at a discount.

“This could be a start of further increase in floating storage, with several trading houses enquiring on short-term hire rates recently,” Ting said.

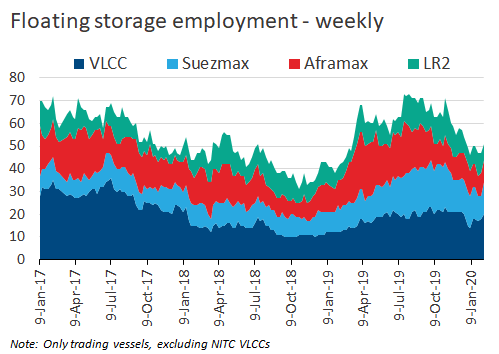

There has been an increase in floating storage activity from last week with two more VLCCs contracted taking the total to 20 VLCCs and four more suezmaxes booked for floating storage taking the total to 14.

Bloomberg reported earlier this month that three of the world’s largest oil traders – Vitol, Shell and Litasco – are seeking floating storage options in the wake of the huge turnaround in oil fortunes over the past 30 days.

The demand destruction caused by the coronavirus, coupled with the added supply from the US lifting sanctions on 26 COSCO VLCCs, has seen VLCC rates tumble by around $100,000 a day from highs experienced at the start of the year.

“Not surprisingly, we have seen a decline in oil prices and a rising contango in crude futures. Potentially, crude tanker floating storage could emerge, although a lot here depends on OPEC+ action, with the technical committee recommending a 600,000 b/d cut,” brokers Gibson noted in its most recent weekly report.

Oil giant BP has suggested that demand could decline by 300,000 to 500,000 barrels per day in 2020 and broadly similar views were expressed by other analysts.

A research report on the VLCC segment from researchers at US-based Charles R Weber noted: “Owners are showing a resistance to the lower levels on offer, but with limited inquiry, charterers are in no rush, putting the market at a standoff for the moment.

J Mintzmyer, shipping analyst at Value Investor’s Edge, said the past month had seen the worst slide in shipping stocks he had ever witnessed.

“Thus far, the average tanker stock decline has wiped out between two to three years of implied average profits. For instance, Euronav is off by more than $800m in the past month,” Mintzmyer wrote in a shipping coronavirus update yesterday, adding: “The market is saying that the current conditions have essentially destroyed the entire bull cycle.”