Covid-19 pushes PCTC demand to the curb

Declining sales of Light Vehicle and High and Heavy automotive segments spell trouble for carriers, but the supply side offers some hope, writes Niklas Carlen from Maritime Strategies International.

That the impact of the Coronavirus on developed and developing economies represents an upheaval has become a cliché. The impact extends beyond primary commodities and containerised goods to transporters of both passenger cars and industrial machinery which must devise strategies to deal with collapsing demand across consumer and enterprise demand.

Global Light Vehicle (LV) sales declined by almost 30% yoy during the first fourth months of 2020, as the impact of COVID-19 reverberated around the world. Asian markets collapsed first, with Chinese LV sales down an eye-watering 80% yoy in February alone. Although it is still soon to call the recovery, there were glimmers of hope in April as both Chinese and Korean sales showed signs of normalising. As the virus took hold of the rest of the world, the rout set in, with North American and European sales slumping by 50% and 74% yoy respectively in April, with the promise of more devastation to come in May.

Although the partial recovery in Asian sales offers some hope, MSI cautions against positing a similarly swift recovery for Europe and North America. The draconian measures implemented to limit the spread of the virus within China and Korea have certainly contributed to the earlier-than-expected reopening (albeit partial) of their respective economies, but the threat of a second infection wave continues to linger. In contrast, the overall response of governments in Europe and North America can best be characterised as unstructured, uncoordinated and too little, too late.

Overall, we expect global LV sales to decline by 26% yoy in 2020, with total sales dropping back to levels last witnessed 2009. Deepsea LV shipments are forecast to drop by 32% yoy over the same period, with the severity of the decline reflecting the greater impact of COVID-19 on sales in key importing regions.

In similar circumstances in 2008-09, the introduction of scrappage schemes and other sales incentives did much to support the global auto industry, and similar incentive schemes are being mooted today. However, it is important to remember that previous schemes did little to support trade, given that they favoured local assembly over imports as a means of supporting the domestic economy. It is difficult to envisage a scenario under which President Trump would introduce auto market incentives that weren’t exclusively geared towards the Detroit-3 and vehicles assembled in the US.

Even before the escalation of COVID-19, sentiment around sales in the high and heavy (H&H) market were pessimistic at best. The mining cycle had already peaked in 2018 with equipment shipments starting to slide in H1 2019, and construction and farm equipment sales also started tailing off in 2019.

The onset of COVID-19 has accelerated the decline in core H&H segments, with consolidated sales for leading H&H equipment manufacturers showing a 21% yoy slump in construction and mining equipment during Q1 2020, but farm equipment sales have performed better, declining by just 7% yoy. For the latter, we are more optimistic, with agri-related commodity prices and trades expected to stronger than other raw materials.

Slumping commodity prices will negatively impact the mining and energy sectors and undermine capex for years to come, slashing demand for machinery. Although consensus forecasts for mining capex are still positive for 2020, MSI’s own forecast points to a progressive slide in mining investment for some years to come. There may be some cause for optimism if government stimulus packages are implemented to boost construction activity, but we still expect deepsea H&H trade to decline by over 30% yoy in 2020.

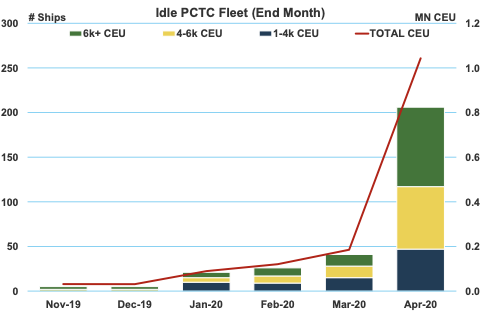

The impact of the slump in demand on the fleet has been dramatic. By the end of April 2020, approximately 25% of the total PCTC fleet was either laid up, anchored or drifting awaiting further orders, with a number of additional vessels sailing towards lay-up anchorages. During the financial crisis in 2008-09, approximately 145k CEU of capacity was laid up over a period of two years, and we expect that fleet capacity amounting to 150k CEU will be laid up this year before gradually being either reactivated or scrapped during 2021-22.

However, the current supply-side situation does provide some reason for optimism beyond 2020. The global PCTC fleet declined in size for the second time in four years in 2019, with the end-year fleet 1% smaller yoy. Limited newbuilding contracting over the last four years has resulted in a slow trickle of new ships into the fleet during 2018-19, whereas scrapping levels have been fairly robust.

We expect this lean period for PCTC newbuild contracting to continue out to 2022. The key factor underpinning this assumption is the continued reluctance of owners and operators to contract in the current low freight rate environment.

Although a number of newbuilding projects were under discussion prior to the ongoing collapse in demand, since 2018 contracting activity has been limited to shortsea vessels for Chinese coastal trade, LNG-fuelled vessels for European shortsea trade, and LNG-fuelled deepsea vessels for NYK and K Line as part of their commitment to Toyota.

In light of the weak fundamentals at present, which are likely to be compounded by the potential escalation of COVID-19 in the short-term, we expect operators will be unwilling to commit to new orders.

Other supply-side measures adopted to mitigate oversupply during the financial crisis included slow steaming, scrapping and deferral of newbuilding deliveries. Although average steaming speeds have fallen from 18 to less than 16 knots since 2009, operators are once again reducing speed in order to improve capacity management and we expect average speeds to drop to less than 14 knots in 2020.

A fundamental difference between supply side conditions today and those in 2009 is on the orderbook side. At the end of 2008, the orderbook was equal to over 30% of the existing fleet, and the oncoming tidal wave of newbuildings scheduled to hit the market necessitated a swift and aggressive supply-side response.

In contrast, at the end of 2019 the orderbook represented just over 3% of the existing fleet. On the demolition front, just under 600k CEU was removed from the fleet in 2009-10 at a time when over 30% of the fleet was older than 20 years of age (at the end of 2019 this ratio was 12%).

Although we expect scrapping of the PCTC fleet to increase during 2020-21, there are a number of constraining factors:

Scrapping in 2020 will prove challenging due to the impact of COVID-19 on the scrapping industry and the difficulties in swapping out crew, as well as competition for scrapping slots from other financially challenged shipping sectors.

Some of that scrapping will therefore be deferred to 2021, but those scrapping intentions may be dimmed if there is any sign of a significant rebound in trade.

The age profile of the fleet is much less favourable than it was in 2009-10.

Given the limited orderbook, we expect operators to adopt a wait-and-see approach and choose lay up over scrapping for younger vessels. In 2009, the scale of the orderbook was such that there were no concerns over future tonnage availability.